China is accelerating plans to replace US and foreign technology, quietly empowering a secretive government-backed organization to vet and approve local suppliers in sensitive areas from cloud to semiconductors, people familiar with the matter said.

Formed in 2016 to advise Beijing’s leadership, the Chinese Information Technology Application Innovation Working Committee has been entrusted to help set industry standards and train personnel to operate trusted software. The quasi-government body is to devise and execute the so-called “IT Application Innovation” plan, better known as xinchuang (新創) in Chinese. It has been given a selection of suppliers vetted under the plan to provide technology for sensitive sectors from banking to data centers storing Chinese government information, a market that could be worth US$125 billion by 2025.

So far, 1,800 Chinese suppliers of PCs, chips, networking and software have been invited to join the committee, the people said, asking not to be identified as the information is private.

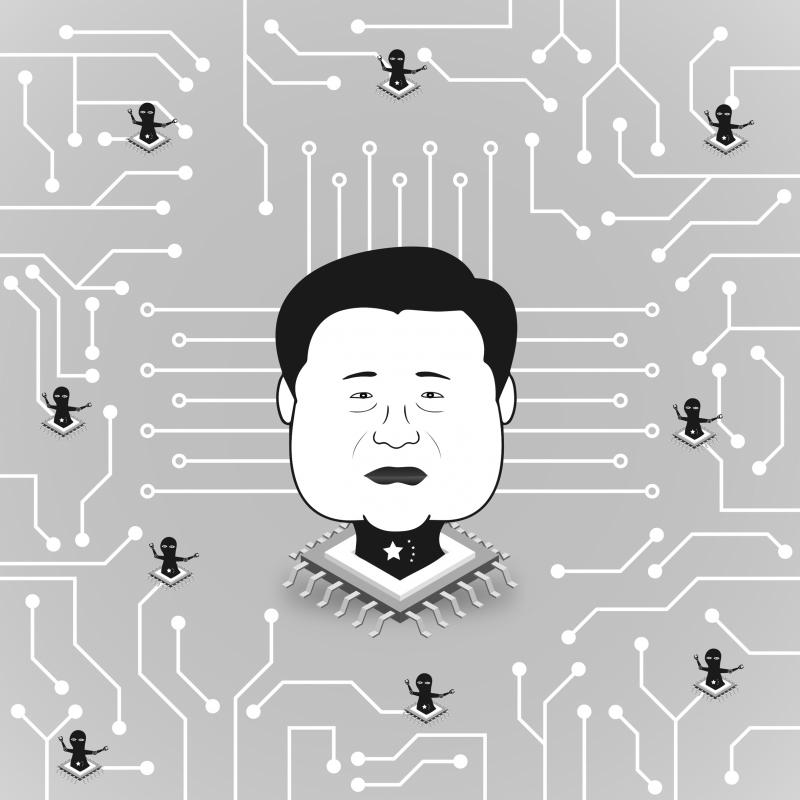

Illustration: June Hsu

The organization has certified hundreds of local companies this year as committee members, the fastest pace in years, one of the people said.

The existence of a xinchuang white-list, whose members and over-arching goals have not been previously reported, is likely to inflame tensions just as US President Joe Biden and Chinese President Xi Jinping (習近平) wrapped up their first face-to-face virtual summit. It gives Beijing more leverage to replace foreign tech firms in sensitive sectors, and quickens a push to help local champions achieve technology self-sufficiency and overcome sanctions first imposed by the administration of former US president Donald Trump, in fields such as networking and chips.

“China is trying to develop homegrown technologies,” Gavekal Dragonomics technology analyst Dan Wang (王丹) said. “This effort is more serious now that many more domestic firms now share that political goal, since no one can be sure that US technologies can avoid US export controls.”

The push to replace foreign suppliers is part of a broader effort by Beijing to exert control over its sprawling technology industry, including data security.

The government has forced overseas cloud providers such as Amazon Web Services and Microsoft to set up joint ventures to operate in China. Apple has also yielded its user data storage business to a government-backed operator in Guizhou Province.

The grip is set to tighten, as the Chinese Ministry of Industry and Information Technology gains more oversight of industrial and telecom data and has proposed new rules that require crucial data to be stored inside the country.

While few details have been revealed about the committee or its members, any companies that are more than 25 percent foreign-owned would be excluded from the panel, shutting out overseas suppliers including Intel and Microsoft. Chinese tech start-ups that are primarily funded by foreign investment would also face a higher bar, although Alibaba Group Holding and Tencent Holdings, the country’s two largest providers of cloud services, have circumvented the rules by applying for membership through locally incorporated subsidiaries, the people said.

“US choke-hold policies, exemplified by the Entity List, were the direct catalyst that pushed China to build the xinchuang sector,” Shanghai-based research firm iResearch said in a report in July. “The blacklisting underlined the urgency for China to invest more in technology innovation and have the key technologies made in China.”

The ministry and the China Electronics Standardization Association, which oversees the committee, did not respond to requests for comment.

Alibaba representatives did not immediately respond to a written request for comment, and a Tencent spokesperson declined to comment.

The committee had 1,160 members in July last year, said Netis, a cloud company that said it has passed the complex review process. Other prominent companies include Beijing-based CPU maker Loongson, server maker Inspur and operating systems developer Standard Software. Westone, an information security company that could potentially be tasked by Beijing to take over Didi Global’s data management, is also a member.

Membership on the panel could give local suppliers a key advantage in having their technology approved under the xinchuang plan, thus unlocking a billion-dollar market. Xinchuang-related business generated 162 billion yuan (US$25.36 billion) in sales last year and is on track to reach nearly 800 billion yuan by 2025, a report coauthored by the China Software Industry Association said.

“In every sector of the Xinchuang industry, there’s a significant imbalance between supply and demand,” it said. “Suppliers need to press the gas pedal to the floor in order to meet the demand.”

In September, the Xinhua news agency-backed Economic Information Daily listed 40 top performers of the project, which included Huawei Technologies, Alibaba’s cloud unit and network security company Qi An Xin Technology Group. In an April list of 70 model cases in the xinchuang industry, the ministry praised Alibaba’s “100 percent self-developed” cloud platform for “providing a safe, trustworthy digital infrastructure for all levels of governments.”

Chinese Communist Party entities, the government and military are to be the first to adopt xinchuang products, followed by financial and state-owned companies, iResearch Consulting Group said.

“Xinchuang can’t be built in one day. It’s a long-term strategy that helps China grow its own IT technologies,” the report said.

We are used to hearing that whenever something happens, it means Taiwan is about to fall to China. Chinese President Xi Jinping (習近平) cannot change the color of his socks without China experts claiming it means an invasion is imminent. So, it is no surprise that what happened in Venezuela over the weekend triggered the knee-jerk reaction of saying that Taiwan is next. That is not an opinion on whether US President Donald Trump was right to remove Venezuelan President Nicolas Maduro the way he did or if it is good for Venezuela and the world. There are other, more qualified

The immediate response in Taiwan to the extraction of Venezuelan President Nicolas Maduro by the US over the weekend was to say that it was an example of violence by a major power against a smaller nation and that, as such, it gave Chinese President Xi Jinping (習近平) carte blanche to invade Taiwan. That assessment is vastly oversimplistic and, on more sober reflection, likely incorrect. Generally speaking, there are three basic interpretations from commentators in Taiwan. The first is that the US is no longer interested in what is happening beyond its own backyard, and no longer preoccupied with regions in other

As technological change sweeps across the world, the focus of education has undergone an inevitable shift toward artificial intelligence (AI) and digital learning. However, the HundrED Global Collection 2026 report has a message that Taiwanese society and education policymakers would do well to reflect on. In the age of AI, the scarcest resource in education is not advanced computing power, but people; and the most urgent global educational crisis is not technological backwardness, but teacher well-being and retention. Covering 52 countries, the report from HundrED, a Finnish nonprofit that reviews and compiles innovative solutions in education from around the world, highlights a

A recent piece of international news has drawn surprisingly little attention, yet it deserves far closer scrutiny. German industrial heavyweight Siemens Mobility has reportedly outmaneuvered long-entrenched Chinese competitors in Southeast Asian infrastructure to secure a strategic partnership with Vietnam’s largest private conglomerate, Vingroup. The agreement positions Siemens to participate in the construction of a high-speed rail link between Hanoi and Ha Long Bay. German media were blunt in their assessment: This was not merely a commercial win, but has symbolic significance in “reshaping geopolitical influence.” At first glance, this might look like a routine outcome of corporate bidding. However, placed in