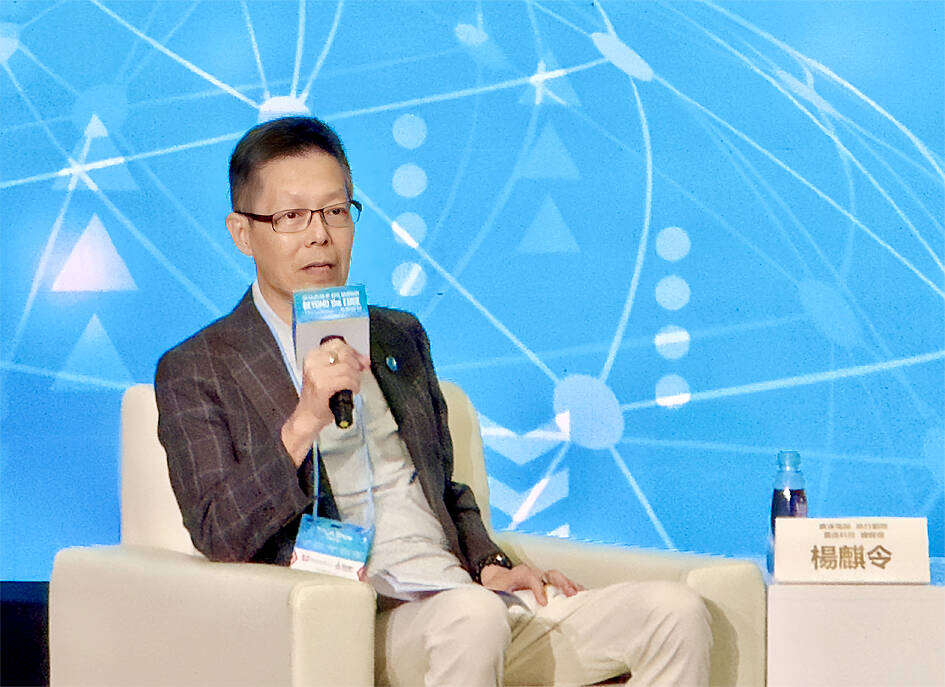

Quanta Computer Inc’s (廣達) artificial intelligence (AI)-related business is expected to grow by at least a triple-digit percentage this year, prompting the company to consider hiking its capital expenditure, mostly in the US and Thailand, company executive vice president Mike Yang (楊麒令) said on Thursday.

Quanta’s order visibility extends into next year on the back of strong AI demand, said Yang, who is also the president of the firm’s server manufacturing arm Quanta Cloud Technology Inc (雲達).

‘NO AI BUBBLE’

Photo: Fang Wei-chieh, Taipei Times

“It is clear that there is no such thing as an AI bubble,” Yang said.

The construction of data centers is continuing and server manufacturers are still expanding capacity to meet rising demand, Yang said.

Over the next one to three years, AI would not only continue to grow rapidly, but enter a “blooming era,” Quanta chairman Barry Lam (林百里) said, adding that Quanta has secured a competitive edge by successfully transitioning from air-cooled AI servers to liquid-cooled supercomputers.

Quanta expects to begin shipping servers powered by Nvidia’s latest Rubin platform in August, with revenue contribution this year likely to be limited, as it is still in its early rollout phase, he said.

As the system design is largely carried over from the GB200 and GB300 platforms, overall production schedules and deployment efficiency are expected to improve over time, he added.

Quanta is focusing on Level 11 orders, with some projects extending to Level 12, while only a small portion of general-purpose servers remain in standalone configurations, Yang said.

AI server revenue is on track to post triple-digit growth this year, while general-purpose servers should post a solid performance, he said.

The company aims to double capacity this year, primarily for the production of Level 11 servers after reviewing expansion plans and execution schedules over the past two to three years, he said.

Overall this year, AI servers are expected to account for about 80 percent of the company’s total server revenue, Yang said.

Regarding overseas deployment, Quanta is cautious about expanding capacity in Tennessee due to power supply constraints, he said.

In Mexico, Quanta’s server node factory has entered volume production this quarter, he said.

ASUSTEK

Separately, Asustek Computer Inc (華碩) chairman Jonney Shih (施崇棠) yesterday said that the company would continue providing services to its smartphone users, responding to a reporter’s question about whether the company is halting its money-losing smartphone business.

Asustek must reallocate resources quickly to brace for an important paradigm shift ahead and allocate more resources to develop commercial PCs and a wide range of AI-related devices, Shih said.

With memorychip prices surging, Asustek on Jan. 5 raised distribution prices for some computer models, as chip supply constraints are expected to continue, with semiconductor makers prioritizing high-bandwidth chips for AI servers over PC chips.

Addressing concerns that the AI boom has crowded out resources, such as high-bandwidth memory and other components, for non-AI businesses, Shih said the situation has indeed put pressure on non-AI products, but Asustek has long believed that challenges also present opportunities.

Regarding the newly announced US tariffs on Taiwan, Shih said the overall impact on Asustek’s operations is positive, and the company has a flexible global manufacturing footprint to respond to unexpected changes and shifts in the global supply chain.

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,