China suspended an export ban to the US that had targeted gallium, germanium and antimony, metals crucial for modern technology, the Chinese Ministry of Commerce announced yesterday in a de-escalation of the trade war with Washington.

The restrictions banned the export of dual-use goods, materials that can have both civilian and military applications.

Imposed December last year, the ban is suspended until November next year, the ministry said in a statement.

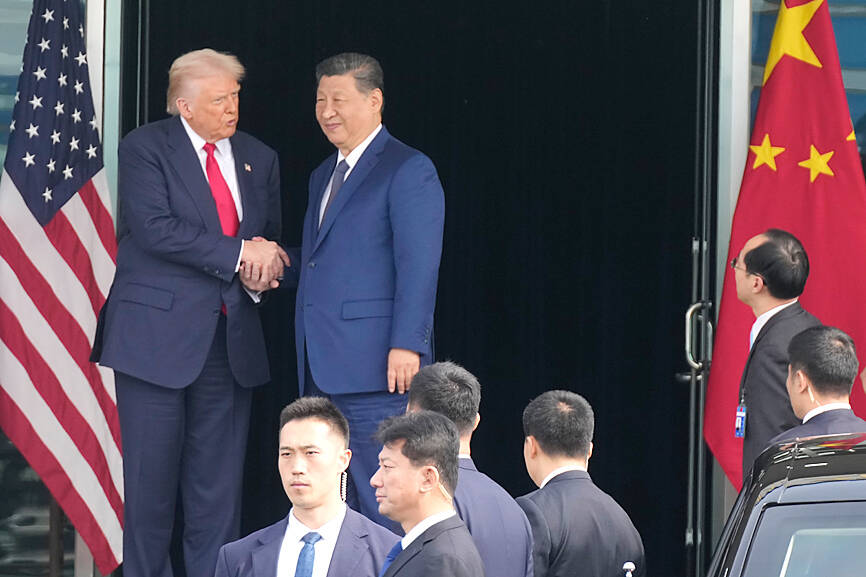

Photo: AP

The announcement comes after Chinese President Xi Jinping (習近平) and US President Donald Trump met on Oct. 30 in South Korea and agreed to walk back some punitive measures imposed during their tit-for-tat tariff escalation.

At one point, duties on both sides had reached prohibitive triple-digit levels, hampering trade between the world’s two largest economies and snarling global supply chains.

Throughout the trade war, China has sought to leverage its chokehold over the critical minerals underpinning everything from smartphones to advanced military technology. Gallium, germanium and antimony are not classed as rare earth elements but are crucial for entire sectors of the economy.

China accounts for 94 percent of the world’s production of gallium — used in integrated circuits, LEDs and photovoltaic panels — according to a report by the EU published last year.

For germanium, essential for fiber optics and infrared sensors, China makes up 83 percent of production.

Antimony is used both in battery technology and by the arms industry to reinforce armor plating and ammunition.

In its brief statement, the ministry also announced the easing of restrictions on exports of graphite-related products, which had likewise been banned under the controls on dual-use goods.

These are the latest de-escalation measures taken by Beijing since the Xi-Trump meeting.

Last week, China announced that it would extend the suspension of additional tariffs on US goods for one year, keeping them at 10 percent.

The commerce ministry said it would cease applying additional tariffs imposed since March on soybeans and a number of other US agricultural products. These measures severely impacted a key source of Trump’s political support, farmers.

Trump announced at the end of last month that China had agreed to suspend the restrictions imposed on Oct. 9 on the export of rare earths technology for one year.

Rare earths are a field dominated by China and are essential for manufacturing in many areas.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), the world’s leading advanced chipmaker, officially began volume production of its 2-nanometer chips in the fourth quarter of this year, according to a recent update on the company’s Web site. The low-key announcement confirms that TSMC, the go-to chipmaker for artificial intelligence (AI) hardware providers Nvidia Corp and iPhone maker Apple Inc, met its original roadmap for the next-generation technology. Production is currently centered at Fab 22 in Kaohsiung, utilizing the company’s first-generation nanosheet transistor technology. The new architecture achieves “full-node strides in performance and power consumption,” TSMC said. The company described the 2nm process as

Even as the US is embarked on a bitter rivalry with China over the deployment of artificial intelligence (AI), Chinese technology is quietly making inroads into the US market. Despite considerable geopolitical tensions, Chinese open-source AI models are winning over a growing number of programmers and companies in the US. These are different from the closed generative AI models that have become household names — ChatGPT-maker OpenAI or Google’s Gemini — whose inner workings are fiercely protected. In contrast, “open” models offered by many Chinese rivals, from Alibaba (阿里巴巴) to DeepSeek (深度求索), allow programmers to customize parts of the software to suit their