China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok.

China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp.

The ministry also announced an anti-discrimination probe into US measures against China’s chip sector.

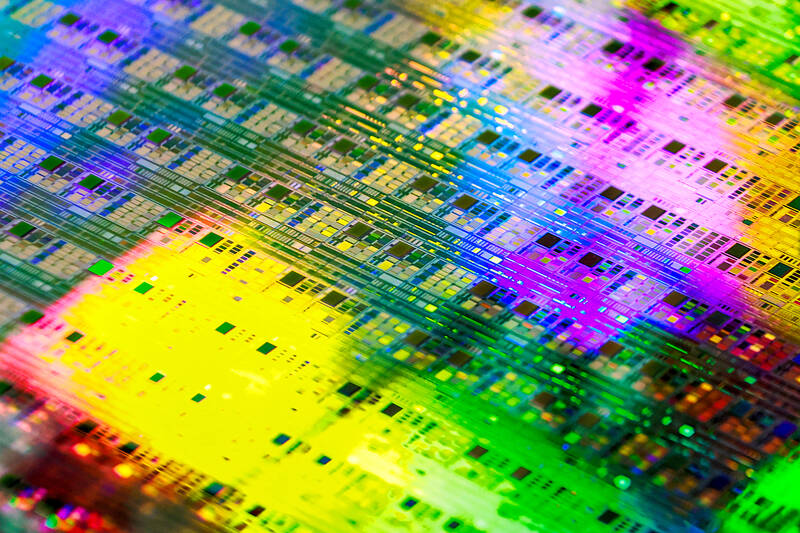

Photo: Ritchie B. Tongo, EPA

US measures such as export curbs and tariffs “constitute the containment and suppression of China’s development of high-tech industries” such as advanced computer chips and artificial intelligence, a ministry spokesperson said.

US President Donald Trump and former US president Joe Biden placed curbs on China’s access to advanced semiconductors, including restrictions on the sale of chipmaking equipment to the country. While Washington cited national security concerns, Beijing said the curbs are part of a US strategy to contain its growth.

US Secretary of the Treasury Scott Bessent was set to meet Chinese Vice Premier He Lifeng (何立峰) in Madrid from yesterday until Wednesday, He’s office said.

The meetings between Bessent and He would be the latest in a series of negotiations aimed at reducing trade tensions and postponing the enactment of higher tariffs on each other’s goods.

US and Chinese counterparts previously held discussions in Geneva in May, London in June and Stockholm in July. The two governments have agreed to several 90-day pauses on a series of increasing reciprocal tariffs, staving off an all-out trade war.

Trade experts said there was little likelihood of a substantial breakthrough in the Madrid talks. The most likely result would be another extension of the deadline for TikTok’s Chinese owner, ByteDance Ltd (字節跳動), to divest its US operations by Wednesday or face a US shutdown.

A source familiar with the Trump administration’s discussions on TikTok’s future said that a deal was not expected, but that the deadline would be extended for a fourth time since Trump took office in January, which might annoy Republicans and Democrats in the US Congress who mandated TikTok’s sale to a US entity to reduce national security risks.

Wendy Cutler, a former trade negotiator at the Office of the US Trade Representative and head of the Asia Society Policy Institute in Washington, said that she expected more substantial “deliverables” to be saved for a potential meeting between Trump and Chinese President Xi Jinping (習近平) later this year, perhaps at an APEC summit in Seoul at the end of next month.

These might include a final deal to resolve US national security concerns over TikTok, a lifting of restrictions on Chinese purchases of US soybeans and a reduction of fentanyl-related tariffs on Chinese goods, Cutler said, adding that the Madrid discussions might help lay groundwork for such a meeting.

However, resolving core US economic complaints about China, including its demands that Beijing shift its economic model toward more domestic consumption and rely less on state-subsidized exports, could take years, Cutler added.

Additional reporting by Reuters

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.