Gasoline and diesel prices are to remain unchanged this week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) said yesterday, despite crude oil import costs rising.

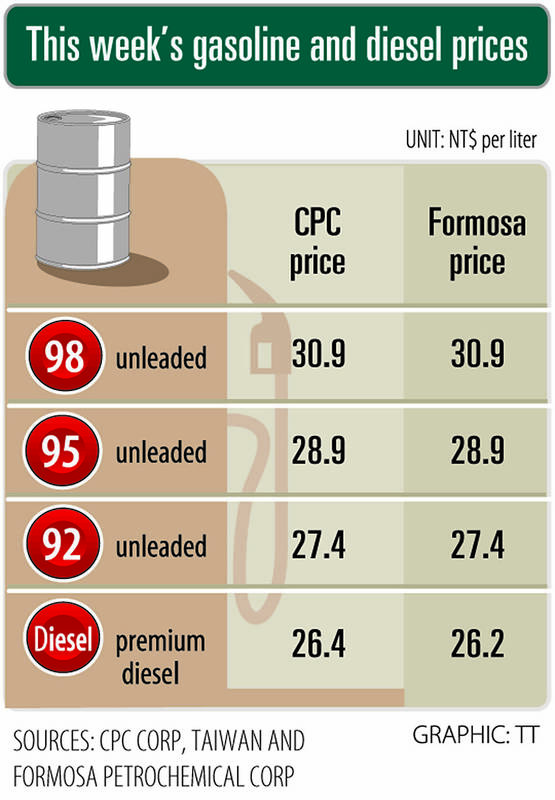

Gasoline prices at CPC and Formosa stations are to stay at NT$27.4, NT$28.9 and NT$30.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said.

The price of premium diesel is to remain at NT$26.4 per liter at CPC stations and NT$26.2 at Formosa pumps, they added.

CPC said that based on its weighted oil price formula of 70 percent Dubai crude and 30 percent Brent, its gasoline and diesel prices should have increased by NT$0.7 and NT$0.2 per liter this week respectively, as summer is the peak oil consumption season in Asia, which pushes the price of oil higher.

However, CPC said it would absorb the costs to comply with the government’s policy of keeping domestic fuel prices lower than in major neighboring markets.

Formosa set its prices in line with CPC after accounting for trends in the global oil market, the New Taiwan dollar exchange rate and fierce competition in the domestic market.

The companies’ announcements came after international crude oil prices last week snapped a two-week streak of gains.

Front-month Brent crude oil futures — the international oil benchmark — last week fell 2.93 percent to settle at US$65.5 per barrel on the Intercontinental Exchange, while West Texas Intermediate crude oil futures — the US oil gauge — lost 3.34 percent to US$61.87 per barrel on the New York Mercantile Exchange.

Shiina Ito has had fewer Chinese customers at her Tokyo jewelry shop since Beijing issued a travel warning in the wake of a diplomatic spat, but she said she was not concerned. A souring of Tokyo-Beijing relations this month, following remarks by Japanese Prime Minister Sanae Takaichi about Taiwan, has fueled concerns about the impact on the ritzy boutiques, noodle joints and hotels where holidaymakers spend their cash. However, businesses in Tokyo largely shrugged off any anxiety. “Since there are fewer Chinese customers, it’s become a bit easier for Japanese shoppers to visit, so our sales haven’t really dropped,” Ito

The number of Taiwanese working in the US rose to a record high of 137,000 last year, driven largely by Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) rapid overseas expansion, according to government data released yesterday. A total of 666,000 Taiwanese nationals were employed abroad last year, an increase of 45,000 from 2023 and the highest level since the COVID-19 pandemic, data from the Directorate-General of Budget, Accounting and Statistics (DGBAS) showed. Overseas employment had steadily increased between 2009 and 2019, peaking at 739,000, before plunging to 319,000 in 2021 amid US-China trade tensions, global supply chain shifts, reshoring by Taiwanese companies and

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) received about NT$147 billion (US$4.71 billion) in subsidies from the US, Japanese, German and Chinese governments over the past two years for its global expansion. Financial data compiled by the world’s largest contract chipmaker showed the company secured NT$4.77 billion in subsidies from the governments in the third quarter, bringing the total for the first three quarters of the year to about NT$71.9 billion. Along with the NT$75.16 billion in financial aid TSMC received last year, the chipmaker obtained NT$147 billion in subsidies in almost two years, the data showed. The subsidies received by its subsidiaries —

Taiwan Semiconductor Manufacturing Co (TSMC) Chairman C.C. Wei (魏哲家) and the company’s former chairman, Mark Liu (劉德音), both received the Robert N. Noyce Award -- the semiconductor industry’s highest honor -- in San Jose, California, on Thursday (local time). Speaking at the award event, Liu, who retired last year, expressed gratitude to his wife, his dissertation advisor at the University of California, Berkeley, his supervisors at AT&T Bell Laboratories -- where he worked on optical fiber communication systems before joining TSMC, TSMC partners, and industry colleagues. Liu said that working alongside TSMC