Several Taiwanese semiconductor suppliers are taking a cautious view of the third quarter — typically a peak season for the industry — citing uncertainty over US tariffs and the stronger New Taiwan dollar.

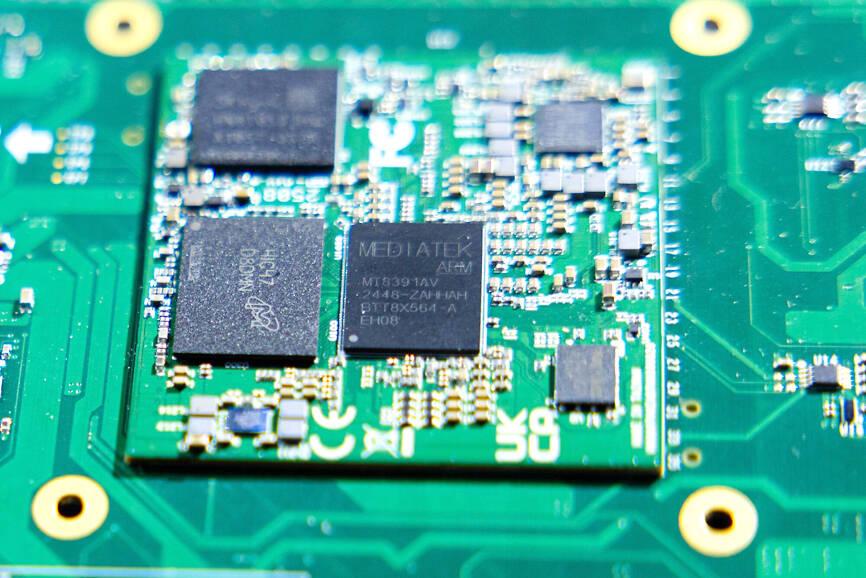

Smartphone chip designer MediaTek Inc (聯發科技) said that customers accelerated orders in the first half of the year to avoid potential tariffs threatened by US President Donald Trump’s administration. As a result, it anticipates weaker-than-usual peak-season demand in the third quarter.

The US tariff plan, announced on April 2, initially proposed a 32 percent duty on Taiwanese goods. Its implementation was postponed by 90 days to July 9, then further delayed to Aug. 1 to allow for negotiations. Taiwan’s tariff rate was ultimately set at 20 percent, effective on Friday last week.

Photo: Annabelle Chih, Bloomberg

In April, the US also launched an investigation into potential tariffs on semiconductor imports. On Wednesday, Trump said a tariff of about 100 percent could be imposed on imported semiconductors, with exemptions for manufacturers building plants in the US.

Echoing MediaTek’s outlook, sensor chip designer PixArt Imaging Inc (原相科技) said customers producing computer mice front-loaded large orders in the first half, but demand is likely to slow in the third quarter.

Display driver chip designer Novatek Microelectronics Corp (聯詠科技) also said that customers have become cautious about new orders after aggressive purchases earlier this year.

The appreciation of the NT dollar is another headwind. The local currency rose 10.97 percent against the US dollar in the second quarter, ending June at NT$29.902, which led to foreign exchange losses for several firms.

For example, application-specific chip designer Progate Group Corp (巨有科技) posted a second-quarter net loss of NT$0.06 per share.

Although the NT dollar has weakened slightly since the start of the third quarter, the industry still expects the average exchange rate to remain stronger than in the previous quarter, which could continue to weigh on operations.

MediaTek forecasts third-quarter revenue to fall 7 to 13 percent from the previous quarter, to between NT$130.1 billion and NT$140 billion (US$4.36 billion and US$4.68 billion).

By contrast, contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) expects strong demand for artificial intelligence applications to drive an 8 percent quarter-on-quarter revenue increase in US dollar terms, based on an exchange rate of NT$29 to the greenback.

For the full year, TSMC projects revenue growth of 30 percent in US dollar terms, outpacing the global semiconductor industry’s estimated 15.4 percent expansion.

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)