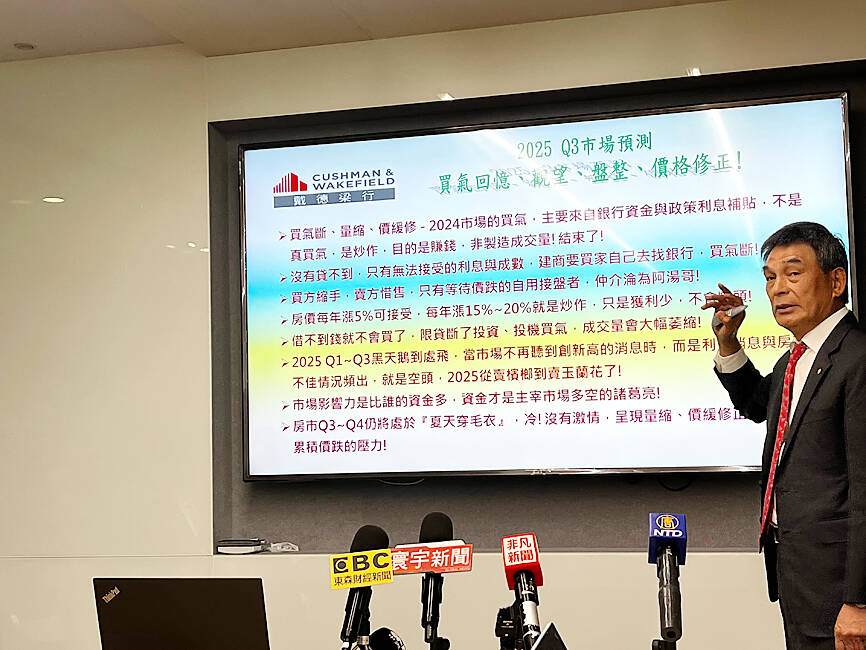

Taiwan’s property market would remain weak through the second half of the year, with transactions retreating and home prices facing mild downward pressure, Cushman & Wakefield Taiwan said yesterday.

“The market is cold — very cold,” Cushman & Wakefield Taiwan managing director Billy Yen (顏炳立) said at a news conference in Taipei. “The investment cycle is over, and what lies ahead is a phase of contraction, modest price corrections, and accelerated efforts by developers to clear inventory.”

The firm trimmed its full-year housing transaction forecast to between 265,000 and 270,000 units, down from 280,000 units projected three months ago. Monthly transactions have averaged 22,000 units — signaling a marked slowdown from the boom years that saw volumes exceed 30,000, he said.

Photo: Hsu Yi-ping, Taipei Times

The absence of stimulus policies — such as last year’s first-time buyer incentives — cautious consumer sentiment, higher borrowing costs, and a persistent pricing gap between sellers and buyers have taken a toll on the market, he said.

While transactions are sliding, a sharp correction in home prices remains unlikely, he said.

“There’s no chance of a 50 percent price correction,” he said. “The days of NT$600,000 [US$20,676] to NT$700,000 per ping [3.31m2] are long gone.”

Yen also criticized discounting claims by developers as little more than “marketing theater.”

“Marking up prices and then offering a 20 percent discount is just optics,” he said. “No developer is selling at a loss. It’s all about preserving cash flow.”

On the commercial front, Cushman & Wakefield lowered its land transaction forecast for the year to NT$160 billion, following NT$74.1 billion in deals in the first half. Owner-occupiers accounted for more than 80 percent of the activity, reflecting long-term confidence among corporates despite broader market caution, Yen said.

The commercial office market still holds promise, particularly for old buildings near MRT stations, he said, adding that investors can buy with confidence properties aged 20 to 30 years and priced below NT$900,000 per ping.

Asked whether Nvidia Corp’s expansion in Taipei could catalyze a market rebound, Yen was skeptical.

“It may offer a short-term jolt, but it’s not going to revive the entire property market,” he said.

The sharp drop in dealmaking has left brokers struggling to bridge the growing divide between seller expectations and buyer demands. At the same time, banks are pulling back on real-estate lending, adding to the headwinds, Yen said.

Still, the downtrend does not pose a systemic risk, he said.

“This is a market coming off an overheated phase. What we are seeing is a return to fundamentals, with speculative demand retreating and the market finding a new, more stable equilibrium,” he added.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.