Hon Hai Precision Industry Co (鴻海精密) has agreed to produce a new electric vehicle (EV) model for Mitsubishi Motors Corp of Japan, a source within the industry said on Sunday.

Hon Hai, also known as Foxconn Technology Group (富士康科技集團), would start initial production of the new EV model at a plant in Miaoli County owned by its partner Yulon Motor Co (裕隆汽車), said the source, who spoke on condition of anonymity.

The vehicle would be a modified version of Hon Hai’s Model B prototype, first unveiled in 2022, the source said, without giving a date for the expected start of production.

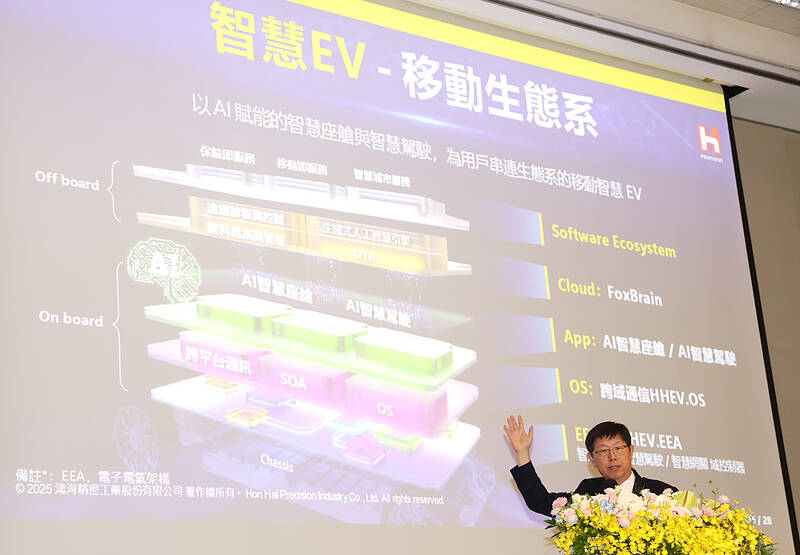

Photo: CNA

The new urban EVs are expected to launch in Australia and New Zealand next year, with potential rollouts in Taiwan and Japan to follow, the source said.

Hon Hai chairman Young Liu (劉揚偉) oversees the company’s EV development, while chief strategy officer Jun Seki, who previously spent 33 years at Nissan Motor Co, manages operations related to the Japanese market, the source added.

Hon Hai declined to comment on the reported partnership with Mitsubishi Motors.

At an earnings conference last month, Hon Hai said it planned to sign contract design and manufacturing agreements with Japanese clients as part of its EV development strategy.

Foxtron Vehicle Technologies Co (鴻華先進), a joint venture between Hon Hai and Yulon Motor, is expected to unveil a new EV model codenamed “n5” later this year, which is also based on the Model B prototype, the source said.

The n5 is being assembled at Yulon Motor’s plant in Sanyi Township (三義), Miaoli County, the source added.

Meanwhile, demand has been steadily increasing for the n7 EV model, which is based on Hon Hai’s SUV Model C design, the source said, adding that deliveries for the first three months of this year reached 1,120 units, following total sales of 7,121 units last year.

EVs based on the Model C design are set to enter mass production in North America in the fourth quarter of this year, Hon Hai said.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

Taiwan’s long-term economic competitiveness will hinge not only on national champions like Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) but also on the widespread adoption of artificial intelligence (AI) and other emerging technologies, a US-based scholar has said. At a lecture in Taipei on Tuesday, Jeffrey Ding, assistant professor of political science at the George Washington University and author of "Technology and the Rise of Great Powers," argued that historical experience shows that general-purpose technologies (GPTs) — such as electricity, computers and now AI — shape long-term economic advantages through their diffusion across the broader economy. "What really matters is not who pioneers

BUBBLE? Only a handful of companies are seeing rapid revenue growth and higher valuations, and it is not enough to call the AI trend a transformation, an analyst said Artificial intelligence (AI) is entering a more challenging phase next year as companies move beyond experimentation and begin demanding clear financial returns from a technology that has delivered big gains to only a small group of early adopters, PricewaterhouseCoopers (PwC) Taiwan said yesterday. Most organizations have been able to justify AI investments through cost recovery or modest efficiency gains, but few have achieved meaningful revenue growth or long-term competitive advantage, the consultancy said in its 2026 AI Business Predictions report. This growing performance gap is forcing executives to reconsider how AI is deployed across their organizations, it said. “Many companies

China Vanke Co (萬科), China’s last major developer to have so far avoided default amid an unprecedented property crisis, has been left with little time to keep debt failure at bay after creditors spurned its proposal to push back a looming bond payment. Once China’s biggest homebuilder by sales, Vanke failed to obtain sufficient support for its plan to delay paying the 2 billion yuan (US$283.51 million) note due today, a filing to the National Association of Financial Market Institutional Investors showed late on Saturday. The proposal, along with two others on the ballot, would have allowed a one-year extension. All three