Taiwan’s official manufacturing purchasing managers’ index (PMI) last month lost 0.6 points to 50.8, as some firms saw an increase in rush orders, but overall visibility remained foggy, the Chung-Hua Institution for Economic Research (CIER, 中華經濟研究院) said yesterday.

“The end-market demand proved murky though December is usually the high sales season for technology products,” CIER president Lien Hsien-ming (連賢明) said.

Firms generally stood by a wait-and-see attitude before US president-elect Donald Trump is inaugurated on Jan. 20 and makes clear his trade policy, Lien said.

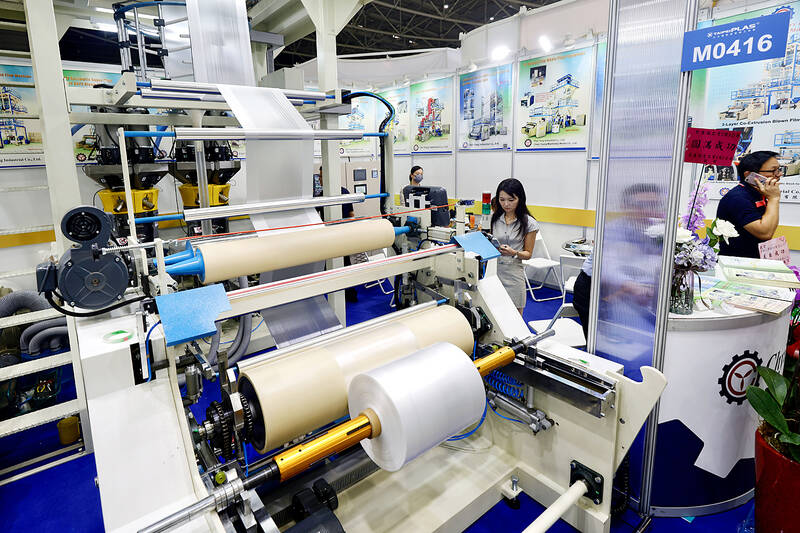

Photo: RITCHIE B. TONGO, EPA-EFE

PMI data seek to capture the health of the manufacturing industry with points of more than 50 indicate expansion and values below 50 suggest contraction.

The reading on new orders shed 4.6 points to 50.9, as business picked up at most sectors except firms that provide chemical and biotechnology products as well as raw materials, the institute said.

CIER researcher Chen Shin-hui (陳馨蕙) said suppliers of consumer electronics benefitted from rush orders, but noted that rush orders were not broad-based — limited mostly to laptop manufacturers for the US market.

Orders for transportation tools also elevated, but the advance likely had to do with seasonal inventory replenishment rather than a market recovery, Chen said.

Despite the advent of the Lunar New Year, firms remained cautious on concerns of Trump’s tariff policy and China’s stimulus measures, she said.

The measure on inventories fell 1.2 points to 47.4, and the reading on customer inventory held unchanged at 44.5, suggesting conservative practices, the institute said. The gauge on industrial output dropped 2.4 points to 52.1, but the sub-index on employment gained 1.2 points to 51.1, it said.

Firms are also dejected about their business prospects, given that the six-month outlook printed 46.1, down 1.8 points from one month earlier, the institute said.

“Jitters about tariff hikes prevail though the artificial intelligence boom would sustain and benefit Taiwanese firms,” Lien said.

In related developments, the non-manufacturing index last month grew 1.9 points to 56.5, as the gaming industry saw sales improve on the beginning of the winter vacation for universities and colleges, the hospitality facilities received support from year-end parties thrown by companies, and shipping firms benefited from higher freight rates on the back of rerouting needs, the institute said.

Most service providers expect business to thrive over the next six months, although retailers and real-estate brokers disagreed, as the holiday season would soon be over and Taiwanese like to spend money abroad, it said.

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

Sweeping policy changes under US Secretary of Health and Human Services Robert F. Kennedy Jr are having a chilling effect on vaccine makers as anti-vaccine rhetoric has turned into concrete changes in inoculation schedules and recommendations, investors and executives said. The administration of US President Donald Trump has in the past year upended vaccine recommendations, with the country last month ending its longstanding guidance that all children receive inoculations against flu, hepatitis A and other diseases. The unprecedented changes have led to diminished vaccine usage, hurt the investment case for some biotechs, and created a drag that would likely dent revenues and