Super Micro Computer Inc on Tuesday gave a sales forecast that fell short of analysts’ estimates while saying it couldn’t predict when it would file official financial statements for its previous fiscal year. The company’s shares dropped about 20 percent in premarket trading yesterday.

The embattled server maker missed an August deadline to file its annual financial report and last week its auditor, Ernst & Young LLP, resigned, citing concerns about the company’s governance and transparency.

An investigation of the accounting issues by a special board committee found “no evidence of fraud or misconduct on the part of management or the board of directors,” Super Micro said on Tuesday in a statement.

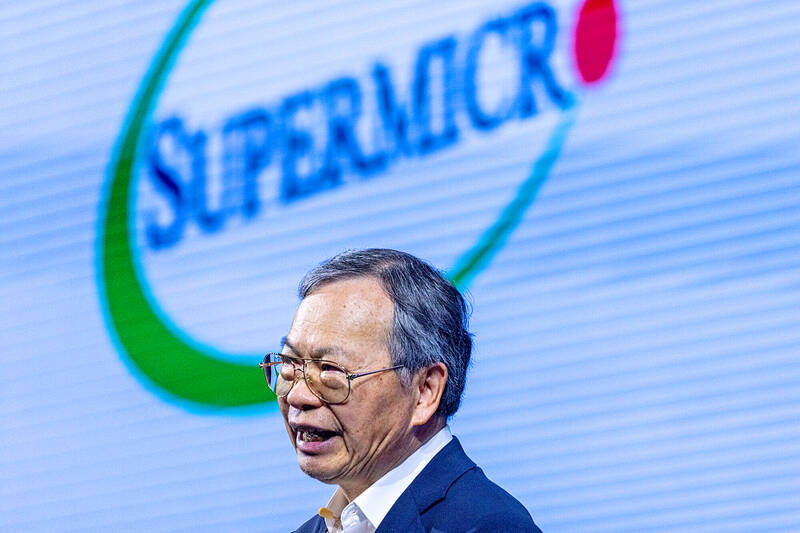

Photo: Annabelle Chih, Bloomberg

Revenue will be US$5.5 billion to US$6.1 billion in the quarter ending in December, the company said. Analysts, on average, projected sales of US$6.79 billion, according to data compiled by Bloomberg. Profit, excluding some items, is expected to be US$0.56 to US$0.65 per share, compared with US$0.80 anticipated by analysts.

Sales were hurt in the fiscal first quarter by the availability of semiconductors, Super Micro chief executive officer Charles Liang (梁見後) said. When asked on a conference call whether the company’s accounting issues had affected its relationship with Nvidia Corp, which is the top producer of powerful processors for artificial intelligence (AI), executives said the chipmaker hasn’t made any changes to Super Micro’s supply allocations.

“At this moment — according to our relationship, according to our communication — things are very positive,” Liang said of the relationship with Nvidia.

Super Micro has had a tumultuous year. Shares were rising at the start of this year, with Wall Street enthusiastic about AI-fueled demand for the company’s high-powered machines, and the company winning inclusion in the S&P 500.

But scrutiny intensified after a former employee alleged earlier this year in federal court that Super Micro had sought to overstate its revenue. Short seller Hindenburg Research referenced those claims in a research report, alleging “glaring accounting red flags, evidence of undisclosed related party transactions, sanctions and export control failures, and customer issues.”

Recently, the failure to file its 10-K financial disclosure and the departure of E&Y has put the San Jose, California-based company at a risk of being delisted by Nasdaq Inc and booted from the index. The shares have slipped 44 percent since the auditor’s resignation last week and are down more than 75 percent from a March peak. The shares fell to a low of US$22.52 after closing at US$27.70 in New York on Tuesday.

Super Micro said it “continues to work diligently” on the financial filing delays and continues to stand by previously issued disclosures, but can’t predict when the delayed form will be filed. The board’s special committee said it would recommend improvements to internal governance or controls in addition to “other work that is ongoing.”

Nasdaq rules give the company until mid-November to submit a plan to restore it to compliance. If Super Micro’s plan is approved, the company could get extra time to file its disclosures — pushing the deadline to February next year. “The company intends to take all necessary steps to achieve compliance with the Nasdaq continued listing requirements as soon as possible,” Super Micro said.

For the quarter that ended in September, Super Micro said preliminary results show sales of US$5.9 billion to US$6 billion. Analysts, on average, estimated US$6.47 billion. Profit, excluding some items, was about US$0.76 per share, the company said. Wall Street expected US$0.74. The results could change upon review by a new accounting firm, Super Micro chief financial officer David E. Weigand said on the conference call.

At the start of the call, executives said they wouldn’t answer questions about E&Y’s departure or the financial filing delays. That didn’t stop multiple analysts from trying.

“We’re diligently looking to replace the auditor as quickly as possible,” Weigand said when asked whether the company was comfortable with its ability to meet the deadline. “We will be filing a plan with Nasdaq regarding an extension.”

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Power supply and electronic components maker Delta Electronics Inc (台達電) yesterday said second-quarter revenue is expected to surpass the first quarter, which rose 30 percent year-on-year to NT$118.92 billion (US$3.71 billion). Revenue this quarter is likely to grow, as US clients have front-loaded orders ahead of US President Donald Trump’s planned tariffs on Taiwanese goods, Delta chairman Ping Cheng (鄭平) said at an earnings conference in Taipei, referring to the 90-day pause in tariff implementation Trump announced on April 9. While situations in the third and fourth quarters remain unclear, “We will not halt our long-term deployments and do not plan to

TikTok abounds with viral videos accusing prestigious brands of secretly manufacturing luxury goods in China so they can be sold at cut prices. However, while these “revelations” are spurious, behind them lurks a well-oiled machine for selling counterfeit goods that is making the most of the confusion surrounding trade tariffs. Chinese content creators who portray themselves as workers or subcontractors in the luxury goods business claim that Beijing has lifted confidentiality clauses on local subcontractors as a way to respond to the huge hike in customs duties imposed on China by US President Donald Trump. They say this Chinese decision, of which Agence