China’s economy softened last month, extending a slowdown in industrial activity and real estate prices as Beijing faces pressure to ramp up spending to stimulate demand.

Data published by the Chinese National Bureau of Statistics (NBS) on Saturday showed weakening activity across industrial production, retail sales and real estate last month compared with July.

“We should be aware that the adverse impacts arising from the changes in the external environment are increasing,” NBS chief economist Liu Aihua (劉愛華) said in a news conference.

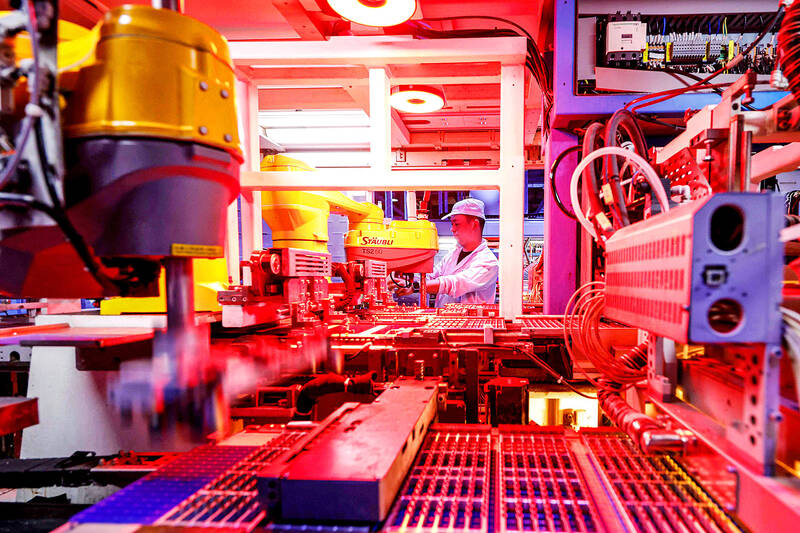

Photo: AFP

Liu said that demand remained insufficient at home, and the sustained economic recovery still confronts multiple difficulties and challenges.

While industrial production rose 4.5 percent last month compared with a year earlier, it declined from July’s 5.1 percent growth, according to the bureau’s data.

Retail sales grew 2.1 percent from the same time last year, slower than the 2.7 percent increase last month.

Fixed asset investment rose 3.4 percent from January to last month, down from 3.6 percent in the first seven months.

Meanwhile, investment in real estate in the first eight months declined 10.2 percent from a year earlier.

Trade data for last month saw imports grow just 0.5 percent compared with a year earlier.

The consumer price index (CPI) rose 0.6 percent last month, missing forecasts according to data released on Monday, while the core CPI, which excludes food and energy prices, rose just 0.3 percent, the slowest in more than three years.

“The momentum is slowing down… The bottleneck remains domestic demand,” Australia and New Zealand Banking Group Ltd senior China strategist Xing Zhaopeng (邢兆鵬) said.

The one bright spot has been exports, but analysts are not sure for how long the trend of rising exports would continue, given the increasing trade tensions with some countries and regions.

“As we are already toward the tail-end of the third quarter, time is running low for policymakers to introduce measures to buoy the economy amid numerous headwinds,” ING Bank NV chief China economist Lynn Song (宋林) said.

Additional reporting by Reuters

“The Q3 GDP is likely to be lower than Q2 based on current data flows. We expect large-scale stimulus to come soon,” Xing said.

Some other economic indicators released on Saturday too were unflattering. China’s nationwide survey-based jobless rate climbed to 5.3 percent last month from 5.2 percent in the previous month, the NBS said, adding that more college graduates entered the job market to hunt offers.

Shiina Ito has had fewer Chinese customers at her Tokyo jewelry shop since Beijing issued a travel warning in the wake of a diplomatic spat, but she said she was not concerned. A souring of Tokyo-Beijing relations this month, following remarks by Japanese Prime Minister Sanae Takaichi about Taiwan, has fueled concerns about the impact on the ritzy boutiques, noodle joints and hotels where holidaymakers spend their cash. However, businesses in Tokyo largely shrugged off any anxiety. “Since there are fewer Chinese customers, it’s become a bit easier for Japanese shoppers to visit, so our sales haven’t really dropped,” Ito

The number of Taiwanese working in the US rose to a record high of 137,000 last year, driven largely by Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) rapid overseas expansion, according to government data released yesterday. A total of 666,000 Taiwanese nationals were employed abroad last year, an increase of 45,000 from 2023 and the highest level since the COVID-19 pandemic, data from the Directorate-General of Budget, Accounting and Statistics (DGBAS) showed. Overseas employment had steadily increased between 2009 and 2019, peaking at 739,000, before plunging to 319,000 in 2021 amid US-China trade tensions, global supply chain shifts, reshoring by Taiwanese companies and

Taiwan Semiconductor Manufacturing Co (TSMC) Chairman C.C. Wei (魏哲家) and the company’s former chairman, Mark Liu (劉德音), both received the Robert N. Noyce Award -- the semiconductor industry’s highest honor -- in San Jose, California, on Thursday (local time). Speaking at the award event, Liu, who retired last year, expressed gratitude to his wife, his dissertation advisor at the University of California, Berkeley, his supervisors at AT&T Bell Laboratories -- where he worked on optical fiber communication systems before joining TSMC, TSMC partners, and industry colleagues. Liu said that working alongside TSMC

TECHNOLOGY DAY: The Taiwanese firm is also setting up a joint venture with Alphabet Inc on robots and plans to establish a firm in Japan to produce Model A EVs Manufacturing giant Hon Hai Precision Industry Co (鴻海精密) yesterday announced a collaboration with ChatGPT developer OpenAI to build next-generation artificial intelligence (AI) infrastructure and strengthen its local supply chain in the US to accelerate the deployment of advanced AI systems. Building such an infrastructure in the US is crucial for strengthening local supply chains and supporting the US in maintaining its leading position in the AI domain, Hon Hai said in a statement. Through the collaboration, OpenAI would share its insights into emerging hardware needs in the AI industry with Hon Hai to support the company’s design and development work, as well