Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) on Saturday said that it has again chosen Kikuyo in Kumamoto Prefecture to host its second fab in Japan.

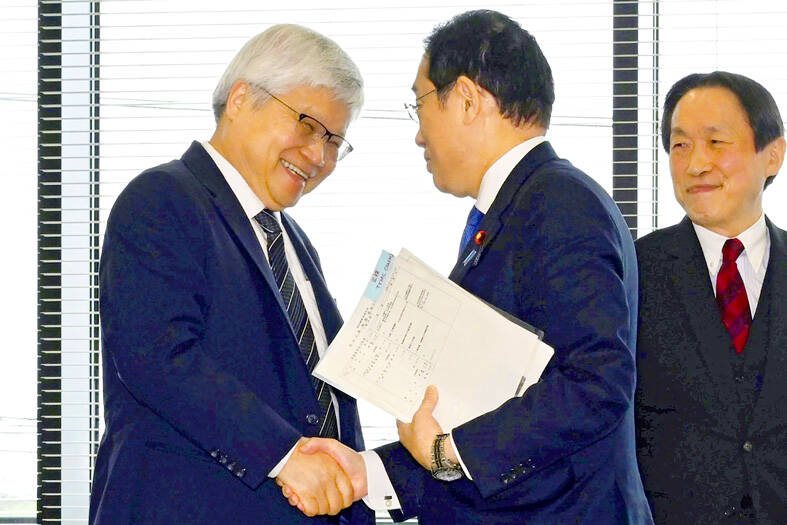

TSMC chief executive C.C. Wei (魏哲家) made the announcement during a visit by Japanese Prime Minister Fumio Kishida to TSMC’s first fab in Kikuyo earlier in the day, Japanese media reported.

The chipmaker later confirmed the news, adding that in addition to Kishida, Wei met with local business representatives, including those from the fab’s operator, Japan Advanced Semiconductor Manufacturing Inc (JASM), to discuss its progress.

Photo: Kyodo News via AP

JASM — a TSMC, Sony Semiconductor Solutions Corp and Denso Corp joint venture — announced in February that it would start building a second fab at the end of this year, but did not say where.

At Saturday’s meeting, Wei also expressed optimism about future cooperation between Taiwan and Japan in the semiconductor industry, TSMC said.

Wei also said that about 60 percent of the indirect materials required to begin manufacturing at the first Kumamoto fab are expected to be sourced locally in Japan by the end of 2030.

TSMC inaugurated its first Kumamoto fab on Feb. 24, with mass production scheduled to begin in the fourth quarter of this year.

After the two fabs are completed, JASM is expected to produce more than 100,000 12-inch wafers per month under maximum capacity, using the mature 40-nanometer, 28-nanometer, 22-nanometer, 16-nanometer and 12-nanometer processes, as well as advanced 7-nanometer and 6-nanometer technologies, TSMC said.

JASM’s chips would be used in the production of automotive, industrial, consumer and high-performance computing-related applications, it said.

Separately, TSMC on Friday maintained its sales guidance for this year, although its production lines in Taiwan were disrupted by a major earthquake that hit the country on Wednesday morning.

The quake measured 7.2 on the Richter scale and magnitude 7.4 on the moment magnitude scale.

In mid-January, the company projected a 21 to 26 percent annual increase in revenue this year in US dollar terms, higher than the 20 percent growth expected in the global pure-play wafer foundry industry.

TSMC said most of the equipment at its fabs in Taiwan was up and running again as of Friday, after operations were temporarily suspended when the earthquake struck.

The chipmaker plans to hold an investors’ conference on Thursday next week to share its first-quarter results.

Investors are also waiting for TSMC’s reports on its efforts to expand capacity of the sophisticated chip-on-wafer-on-substrate (CoWoS) technology being used at its IC packaging plants.

Industrial sources said that TSMC’s CoWoS capacity has been fully booked by clients, with Nvidia Corp accounting for more than 50 percent of orders the chipmaker has received.

Shiina Ito has had fewer Chinese customers at her Tokyo jewelry shop since Beijing issued a travel warning in the wake of a diplomatic spat, but she said she was not concerned. A souring of Tokyo-Beijing relations this month, following remarks by Japanese Prime Minister Sanae Takaichi about Taiwan, has fueled concerns about the impact on the ritzy boutiques, noodle joints and hotels where holidaymakers spend their cash. However, businesses in Tokyo largely shrugged off any anxiety. “Since there are fewer Chinese customers, it’s become a bit easier for Japanese shoppers to visit, so our sales haven’t really dropped,” Ito

The number of Taiwanese working in the US rose to a record high of 137,000 last year, driven largely by Taiwan Semiconductor Manufacturing Co’s (TSMC, 台積電) rapid overseas expansion, according to government data released yesterday. A total of 666,000 Taiwanese nationals were employed abroad last year, an increase of 45,000 from 2023 and the highest level since the COVID-19 pandemic, data from the Directorate-General of Budget, Accounting and Statistics (DGBAS) showed. Overseas employment had steadily increased between 2009 and 2019, peaking at 739,000, before plunging to 319,000 in 2021 amid US-China trade tensions, global supply chain shifts, reshoring by Taiwanese companies and

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) received about NT$147 billion (US$4.71 billion) in subsidies from the US, Japanese, German and Chinese governments over the past two years for its global expansion. Financial data compiled by the world’s largest contract chipmaker showed the company secured NT$4.77 billion in subsidies from the governments in the third quarter, bringing the total for the first three quarters of the year to about NT$71.9 billion. Along with the NT$75.16 billion in financial aid TSMC received last year, the chipmaker obtained NT$147 billion in subsidies in almost two years, the data showed. The subsidies received by its subsidiaries —

Taiwan Semiconductor Manufacturing Co (TSMC) Chairman C.C. Wei (魏哲家) and the company’s former chairman, Mark Liu (劉德音), both received the Robert N. Noyce Award -- the semiconductor industry’s highest honor -- in San Jose, California, on Thursday (local time). Speaking at the award event, Liu, who retired last year, expressed gratitude to his wife, his dissertation advisor at the University of California, Berkeley, his supervisors at AT&T Bell Laboratories -- where he worked on optical fiber communication systems before joining TSMC, TSMC partners, and industry colleagues. Liu said that working alongside TSMC