Housing transactions in the six special municipalities totaled 63,226 units in the first quarter, rising 28.3 percent from the same period last year, as the market emerged from unfavorable policy measures and continued to benefit from government interest subsidies for first-home purchases, analysts said on Monday.

The results also came as concerns over a ban on transfers of presale project purchase agreements faded and rallies in the TAIEX boosted sentiment, Sinyi Realty Inc (信義房屋) research manager Tseng Ching-der (曾敬德) said.

The subsidies for first-home purchases drove one-third of overall transactions in the first quarter, Tseng said.

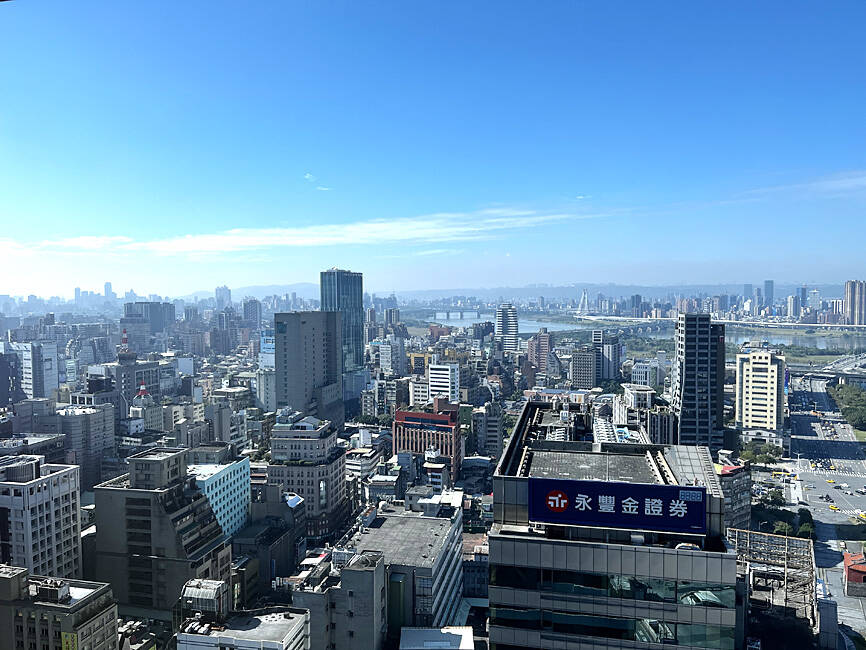

Photo: Hsu Yi-ping, Taipei Times

The subsidy program has expedited transactions since its launch in August last year by providing ultra-low interest rates of 1.775 percent, a five-year grace period and mortgage durations capped at 40 years, he said.

Tseng said that the boom is expected to continue through the first half, despite the central bank’s rate hike last month of 0.125 percentage points to curb inflation expectations ahead of an average 11 percent increase in electricity rates from this month.

The interest rate hike would not affect the program, as the Ministry of Finance has said it would absorb extra borrowing costs to help stabilize prices.

Tainan reported the steepest hike in housing deals of 39.2 percent to a record 6,865 units in the first quarter, as the city continued to benefit from relative home affordability and capacity expansions by major local tech firms, Sinyi Realty said.

Transactions in Kaohsiung soared 30 percent to 10,435 units for similar reasons after Taiwan Semiconductor Manufacturing Co (台積電) said it plans to set up new plants in the city.

The pickup in confidence also has to do with Taiwan’s improving economy and exports, Evertrust Rehouse Co (永慶房屋) said.

The government’s business climate monitor flashed “green” in the past two months, indicating steady economic growth, Evertrust Rehouse deputy research head Chen Chin-ping (陳金萍) said.

The signal came after exports rebounded to expansion mode and would give local firms confidence to invest and upgrade, boding well for consumer spending, Chen said.

Housing transactions in Taipei rose 35 percent to 7,641 units and were up 21 percent to 15,092 units in New Taipei City, while Taoyuan had a 35 percent increase to 8,190 units and Taichung posted a 22 percent gain to 12,130 units, government data showed.

The latest transaction data indicated that first-quarter growth momentum in the housing market was even and broad-based, H&B Realty Co (住商不動產) said.

However, the central bank’s recent rate hike was aimed to tell the market that it remains watchful, Chinatrust Real Estate Co (中信房屋) said.

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to

Nvidia Corp’s GB300 platform is expected to account for 70 to 80 percent of global artificial intelligence (AI) server rack shipments this year, while adoption of its next-generation Vera Rubin 200 platform is to gradually gain momentum after the third quarter of the year, TrendForce Corp (集邦科技) said. Servers based on Nvidia’s GB300 chips entered mass production last quarter and they are expected to become the mainstay models for Taiwanese server manufacturers this year, Trendforce analyst Frank Kung (龔明德) said in an interview. This year is expected to be a breakout year for AI servers based on a variety of chips, as

Global semiconductor stocks advanced yesterday, as comments by Nvidia Corp chief executive officer Jensen Huang (黃仁勳) at Davos, Switzerland, helped reinforce investor enthusiasm for artificial intelligence (AI). Samsung Electronics Co gained as much as 5 percent to an all-time high, helping drive South Korea’s benchmark KOSPI above 5,000 for the first time. That came after the Philadelphia Semiconductor Index rose more than 3 percent to a fresh record on Wednesday, with a boost from Nvidia. The gains came amid broad risk-on trade after US President Donald Trump withdrew his threat of tariffs on some European nations over backing for Greenland. Huang further

HSBC Bank Taiwan Ltd (匯豐台灣商銀) and the Taiwan High Prosecutors Office recently signed a memorandum of understanding (MOU) to enhance cooperation on the suspicious transaction analysis mechanism. This landmark agreement makes HSBC the first foreign bank in Taiwan to establish such a partnership with the High Prosecutors Office, underscoring its commitment to active anti-fraud initiatives, financial inclusion, and the “Treating Customers Fairly” principle. Through this deep public-private collaboration, both parties aim to co-create a secure financial ecosystem via early warning detection and precise fraud prevention technologies. At the signing ceremony, HSBC Taiwan CEO and head of banking Adam Chen (陳志堅)