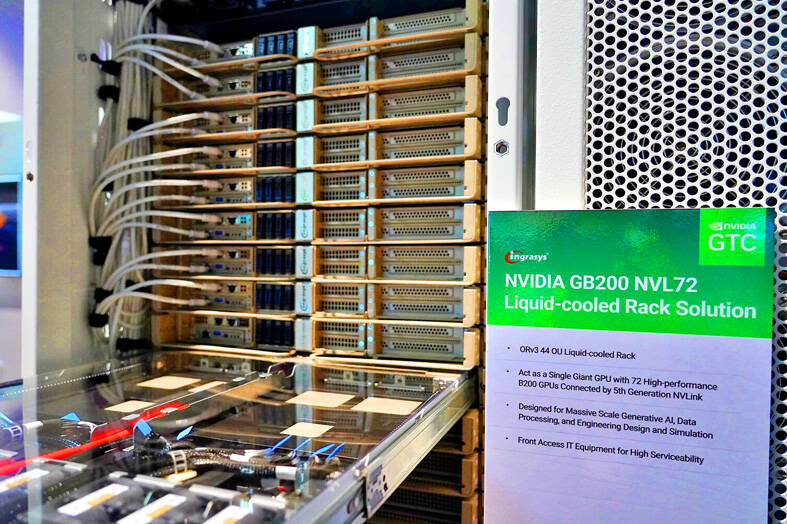

Hon Hai Technology Group (鴻海科技集團) yesterday showcased its latest liquid-cooled server racks at Nvidia Corp’s developers’ conference in San Jose, California, with the products aimed at helping customers build artificial intelligence (AI) data centers.

The racks are developed by Hon Hai subsidiary Ingrasys Technology Inc (鴻佰科技) and support Nvidia’s new GB200 flagship chip, Hon Hai said in a statement.

To fuel a new wave of generative AI applications, Ingrasys is leveraging the Nvidia GB200 NVL72, a next-generation AI liquid-cooled rack solution, Hon Hai said.

Photo courtesy of Hon Hai Technology Group via CNA

“Our collaboration with Nvidia helps us deliver the latest accelerated computing technologies to our customers so they can build AI-powered data centers to suit a wide range of applications,” Ingrasys president Benjamin Ting (丁肇邦) said.

Complementing Ingrasys’ rack solution is an advanced liquid-cooling technology, which Hon Hai has been working on for at least five years to address heat management issues for server or data center operators.

Liquid cooling and high-speed switch manufacturing are keys to enhancing graphics processing unit performance, as they help improve the performance of AI servers and optimize power consumption, eventually reducing operational costs for customers, Hon Hai chairman Young Liu (劉揚偉) said last week.

Wiwynn Corp (緯穎), a supplier of cloud infrastructure for data centers, also displayed its latest AI server racks based on the Nvidia GB200 NVL72 system, along with its rack-level liquid-cooling management system, at the developers conference.

The company would continue collaborating with Nvidia to develop optimized and sustainable solutions for data centers in the generative AI era, Wiwynn chief executive officer Sunlai Chang (張順來) said in a separate statement.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two