Taiwanese hold a neutral view of the property market next quarter, as cautious sentiment lingers amid economic uncertainty, but housing prices have found support in inflation, an Evertrust Rehouse Co (永慶房屋) survey released yesterday showed.

Almost 60 percent of respondents thought it would be unwise to join the market in the next six months, while nearly 40 percent said it would be better to wait until 2025, suggesting an extended slowdown in transactions, Evertrust research manager Daniel Chen (陳賜傑) said, citing the company’s quarterly survey.

Thirty-four percent said house prices would increase, while 31 percent expected price corrections, with high inflation believed to become a new norm, Chen said.

Photo: Hsu Yi-ping, Taipei Times

Respondents were conservative even though 79 percent said that the recent introduction of favorable lending terms for first-home buyers was helpful in bolstering people’s interest in buying property, he said.

“People by-and-large need more time to digest economic signals at home and abroad,” Chen said, referring to poor exports, capital flight, monetary tightening in advanced economies and international oil price increases.

Evertrust general manager Yeh Ling-chi (葉凌棋) said that while it is difficult to make projections at this point, things could grow more fluid next quarter before Taiwan elects a new president and lawmakers in January.

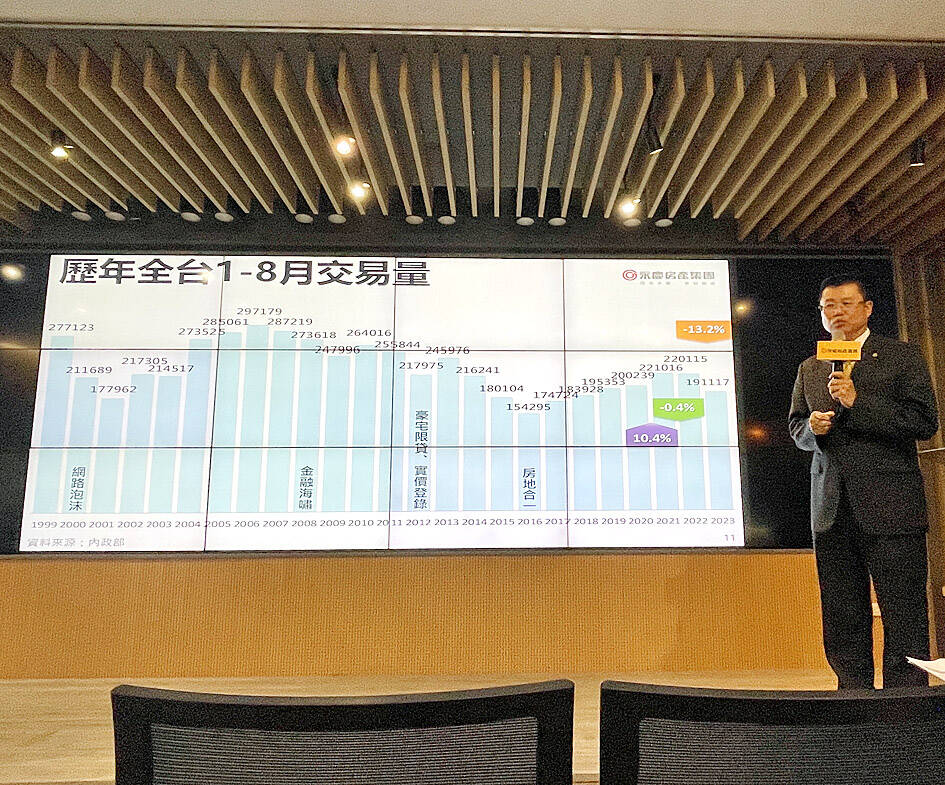

“Political uncertainty always warrants caution,” Yeh said, adding that Evertrust Rehouse, Taiwan’s largest broker by number of offices, stood by its earlier forecast that housing deals this year would shrink 8 to 11 percent to 283,000 to 293,000 units, despite a better-than-expected third quarter.

A low base accounts for the improvement in comparison values this quarter, Yeh added.

House prices grew a moderate 2 to 4.9 percent in major cities this quarter, as the mentality that real estate is the best defense against inflation supported prices, he said.

Expectations of price declines have not been realized and some buyers decided not to stay on the sidelines any longer, Yeh added.

Of the survey’s respondents, 83 percent said they supported the government’s plan to raise house taxes for people who own multiple homes next year, but they were concerned that it would prompt landlords to pass their extra tax burden on to their tenants.

Small and open, Taiwan’s economy is vulnerable to external influences, and the US’ dim economic outlook for next year would inevitably weigh on Taiwan’s exports, the nation’s main growth driver, Yeh said.

That explains why the public is generally not confident that the nation’s economy will recover next quarter, he said.

Nvidia Corp chief executive officer Jensen Huang (黃仁勳) on Monday introduced the company’s latest supercomputer platform, featuring six new chips made by Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), saying that it is now “in full production.” “If Vera Rubin is going to be in time for this year, it must be in production by now, and so, today I can tell you that Vera Rubin is in full production,” Huang said during his keynote speech at CES in Las Vegas. The rollout of six concurrent chips for Vera Rubin — the company’s next-generation artificial intelligence (AI) computing platform — marks a strategic

Enhanced tax credits that have helped reduce the cost of health insurance for the vast majority of US Affordable Care Act enrollees expired on Jan.1, cementing higher health costs for millions of Americans at the start of the new year. Democrats forced a 43-day US government shutdown over the issue. Moderate Republicans called for a solution to save their political aspirations this year. US President Donald Trump floated a way out, only to back off after conservative backlash. In the end, no one’s efforts were enough to save the subsidies before their expiration date. A US House of Representatives vote

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

US President Donald Trump on Friday blocked US photonics firm HieFo Corp’s US$3 million acquisition of assets in New Jersey-based aerospace and defense specialist Emcore Corp, citing national security and China-related concerns. In an order released by the White House, Trump said HieFo was “controlled by a citizen of the People’s Republic of China” and that its 2024 acquisition of Emcore’s businesses led the US president to believe that it might “take action that threatens to impair the national security of the United States.” The order did not name the person or detail Trump’s concerns. “The Transaction is hereby prohibited,”