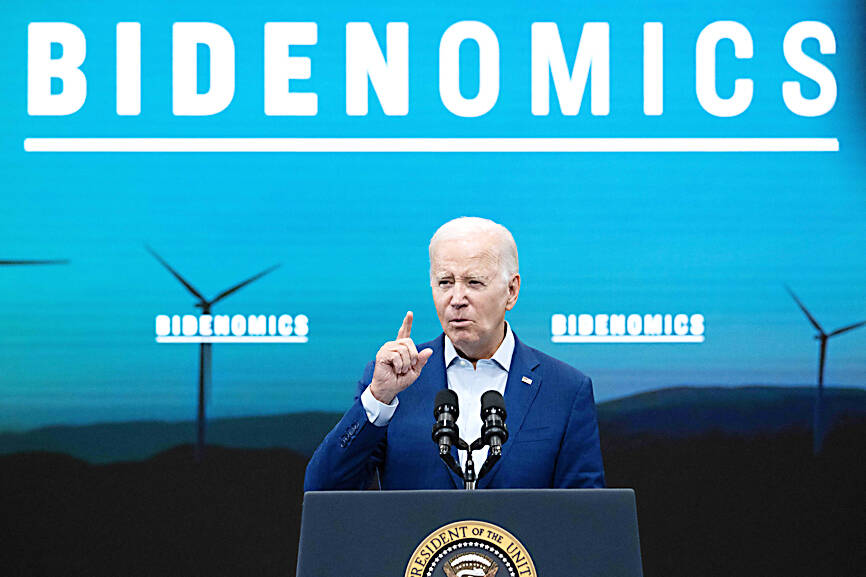

US President Joe Biden on Wednesday issued an executive order aimed at restricting certain US investments in sensitive high-tech areas in China — a move Beijing criticized as being “anti-globalization.”

The long-anticipated rules, expected to be implemented next year, target sectors such as semiconductors and artificial intelligence, as Washington seeks to limit access to key technologies.

“The commitment of the United States to open investment is a cornerstone of our economic policy and provides the United States with substantial benefits,” Biden said in a letter to Congressional leaders announcing the executive order. “However, certain United States investments may accelerate and increase the success of the development of sensitive technologies and products in countries that develop them to counter United States and allied capabilities.”

Photo: AFP

The program is set to prohibit new private equity, venture capital and joint venture investments in advanced semiconductors and some quantum information technologies in China, the US Department of the Treasury said.

“The outbound investment program will fill a critical gap in the United States’ national security toolkit,” a senior US government official said on condition of anonymity. “What we’re talking about is a narrow and thoughtful approach as we seek to prevent [China] from obtaining and using the most advanced technologies to promote military modernization and undermining US national security.”

The treasury department is considering a notification requirement for US investments in Chinese entities involved in less advanced semiconductors and activities relating to certain types of artificial intelligence.

China could exploit US investments to further its ability to produce sensitive technologies critical to military modernization, it said.

However, it anticipates creating an exception for certain US investments into publicly traded securities and transfers from US parents to subsidiaries.

The Chinese Ministry of Foreign Affairs blasted the move as an attempt to “engage in anti-globalization and desinicization,” warning that China would “resolutely safeguard its own rights and interests.”

“Beijing is strongly dissatisfied and firmly opposes the United States’ insistence on introducing restrictions on investment in China, and has lodged solemn representations with the United States,” the ministry said in a statement.

While the volume of US dollars or numbers of transactions covered by a ban or notification regime are likely to be quite small, it does not necessarily mean the overall impact would be limited, said Emily Benson, director of the project on trade and technology at the Center for Strategic and International Studies.

“It’s possible that while they’re not directly subject to bans, companies will rethink the nature of their investments and that could have a chilling effect on bilateral investment over time,” Benson said.

Nicholas Lardy, nonresident senior fellow at the Peterson Institute for International Economics, said that “the share of investment in China that’s been financed by foreign capital in recent years is about 1 to 2 percent.”

“If you want to have an impact, you’ve got to get other countries that are making these kinds of investments in China to have a similar regime,” he said.

A senior US government official said that key allies and partners have recognized the importance of this issue and “some are seeking to align” their policy approaches.

The UK yesterday said that it was weighing how to respond to Biden’s executive order as it continued to assess potential national security risks, while the European Commission said it would analyze the US move and was in close contact with the Biden administration.

Additional reporting by Reuters

SEMICONDUCTORS: The German laser and plasma generator company will expand its local services as its specialized offerings support Taiwan’s semiconductor industries Trumpf SE + Co KG, a global leader in supplying laser technology and plasma generators used in chip production, is expanding its investments in Taiwan in an effort to deeply integrate into the global semiconductor supply chain in the pursuit of growth. The company, headquartered in Ditzingen, Germany, has invested significantly in a newly inaugurated regional technical center for plasma generators in Taoyuan, its latest expansion in Taiwan after being engaged in various industries for more than 25 years. The center, the first of its kind Trumpf built outside Germany, aims to serve customers from Taiwan, Japan, Southeast Asia and South Korea,

Gasoline and diesel prices at domestic fuel stations are to fall NT$0.2 per liter this week, down for a second consecutive week, CPC Corp, Taiwan (台灣中油) and Formosa Petrochemical Corp (台塑石化) announced yesterday. Effective today, gasoline prices at CPC and Formosa stations are to drop to NT$26.4, NT$27.9 and NT$29.9 per liter for 92, 95 and 98-octane unleaded gasoline respectively, the companies said in separate statements. The price of premium diesel is to fall to NT$24.8 per liter at CPC stations and NT$24.6 at Formosa pumps, they said. The price adjustments came even as international crude oil prices rose last week, as traders

SIZE MATTERS: TSMC started phasing out 8-inch wafer production last year, while Samsung is more aggressively retiring 8-inch capacity, TrendForce said Chipmakers are expected to raise prices of 8-inch wafers by up to 20 percent this year on concern over supply constraints as major contract chipmakers Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Samsung Electronics Co gradually retire less advanced wafer capacity, TrendForce Corp (集邦科技) said yesterday. It is the first significant across-the-board price hike since a global semiconductor correction in 2023, the Taipei-based market researcher said in a report. Global 8-inch wafer capacity slid 0.3 percent year-on-year last year, although 8-inch wafer prices still hovered at relatively stable levels throughout the year, TrendForce said. The downward trend is expected to continue this year,

POWERING UP: PSUs for AI servers made up about 50% of Delta’s total server PSU revenue during the first three quarters of last year, the company said Power supply and electronic components maker Delta Electronics Inc (台達電) reported record-high revenue of NT$161.61 billion (US$5.11 billion) for last quarter and said it remains positive about this quarter. Last quarter’s figure was up 7.6 percent from the previous quarter and 41.51 percent higher than a year earlier, and largely in line with Yuanta Securities Investment Consulting Co’s (元大投顧) forecast of NT$160 billion. Delta’s annual revenue last year rose 31.76 percent year-on-year to NT$554.89 billion, also a record high for the company. Its strong performance reflected continued demand for high-performance power solutions and advanced liquid-cooling products used in artificial intelligence (AI) data centers,