South Korean start-up Rebellions Inc yesterday launched an artificial intelligence (AI) chip, racing to win government contracts as Seoul seeks a place for local companies in the exploding industry.

The company’s Atom chip is the latest South Korean attempt to challenge global leader Nvidia Corp in the hardware that powers the potentially revolutionary AI technology.

AI is the talk of the tech world, as ChatGPT — a chatbot from Microsoft Corp-backed OpenAI that generates articles, essays, jokes and even poetry — has become the fastest-growing consumer app in history just two months after launch.

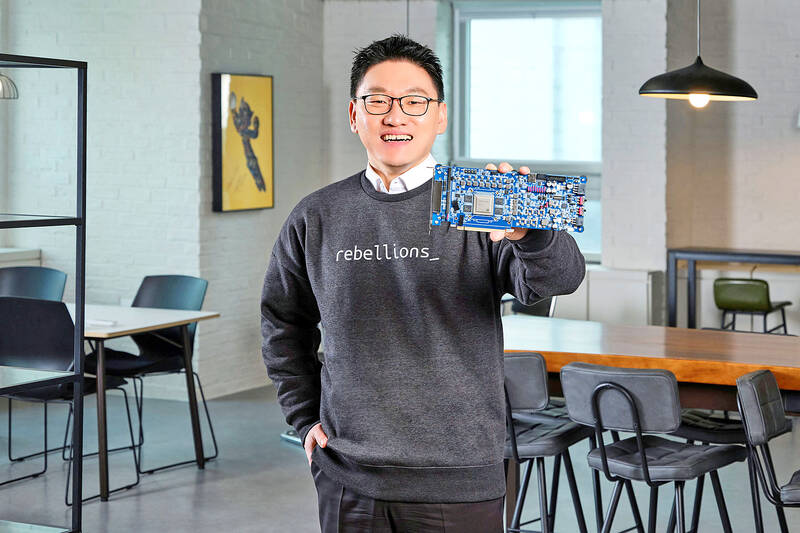

Photo: Courtesy of Rebellions Inc via Reuters

Nvidia, a US chip designer, has a commanding share of high-end AI chips, making up about 86 percent of the computing power of the world’s six biggest cloud services as of December last year, Jefferies Group LLC chip analyst Mark Lipacis said.

The South Korean government wants to foster a domestic industry, investing more than US$800 million over the next five years for research and development in a bid to lift the market share of South Korean AI chips in domestic data centers from essentially zero to 80 percent by 2030.

“It’s hard to catch up to Nvidia, which is so far ahead in general-purpose AI chips,” Korea Institute for Industrial Economics and Trade senior researcher Kim Yang-paeng said. “But it’s not set in stone, because AI chips can carry out different functions and there aren’t set boundaries or metrics.”

Rebellions’ Atom is designed to excel at running computer vision and chatbot AI applications.

Because it targets specific tasks rather than doing a wide range, the chip consumes only about 20 percent of the power of an Nvidia A100 chip on those tasks, Rebellions cofounder and chief executive Park Sung-hyun said.

A100 is the most popular chip for AI workloads, powerful enough to create — in industry lingo, “train” — the AI models. Atom, designed by Rebellions and manufactured by South Korean giant Samsung Electronics Co, does not do training.

While countries such as Taiwan, China, France, Germany and the US have extensive plans to support their semiconductor companies, the South Korean government is rare in singling out AI chips for a concentrated push.

Seoul is to put out a notice this month for two data centers, called neural processing unit farms, with only domestic chipmakers allowed to bid, an official at the South Korean Ministry of Science and Information Communications Technology said.

In a country whose firms supply half the world’s memory chips, the authorities want to create a market that can be a test bed for AI chipmakers, aiming to foster global competitors.

“The government is twisting the arm of the data centers and telling them: ‘Hey, use these chips,’” said Park, a former Morgan Stanley engineer.

Without such support, data centers and their customers would likely stick with Nvidia chips, he said.

Sapeon Korea Inc also plans to participate in the project, the SK Telecom Co subsidiary said.

FuriosaAI, backed by South Korea’s top search engine Naver Corp and state-run Korea Development Bank, said it would also bid.

“There’s a lot of momentum behind Nvidia’s developments. These start-ups have got to build momentum, so that will take time,” Gartner Inc analyst Alan Priestley said. “But government incentives such as what’s happening in Korea could well affect the market share within Korea.”

Rebellions would seek to participate in the government project in a consortium with KT Corp — a big South Korean telecom, cloud and data center operator — in the hopes of weaning Nvidia customers off the US supplier.

“Amid high dependence on foreign GPUs [graphics processing units] globally, the cooperation between KT and Rebellions will allow us to have an ‘AI full stack’ that encompasses software and hardware based on domestic technology,” KT vice president Bae Han-chul said.

Rebellions declined to give a forecast for its AI chip venture. It has raised 122 billion won (US$95.47 million), including 30 billion won from KT in a funding round joined by Singapore’s Temasek Pavilion Capital and a 10 billion won grant from the South Korean government.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

Nanya Technology Corp (南亞科技) yesterday said the DRAM supply crunch could extend through 2028, as the artificial intelligence (AI) boom has led the world’s major memory makers to dramatically reduce production of standard DRAM and allocate a significant portion of their capacity for high-bandwidth memory (HBM) chips. The most severe supply constraints would stretch to the first half of next year due to “very limited” increases in new DRAM capacity worldwide, Nanya Technology president Lee Pei-ing (李培瑛) told a news briefing. The company plans to increase monthly 12-inch wafer capacity to 20,000 in the first half of 2028 after a

Property transactions in the nation’s six special municipalities plunged last month, as a lengthy Lunar New Year holiday combined with ongoing credit tightening dampened housing market activity, data compiled by local land administration offices released on Monday showed. The six cities recorded a total of 10,480 property transfers last month, down 42.5 percent from January and marking the second-lowest monthly level on record, the data showed. “The sharp drop largely reflected seasonal factors and tighter credit conditions,” Evertrust Rehouse Co (永慶房屋) deputy research manager Chen Chin-ping (陳金萍) said. The nine-day Lunar New Year holiday fell in February this year, reducing

New vehicle sales in Taiwan plunged about 37 percent sequentially last month as the long Lunar New Year holiday and 228 Peace Memorial Day holiday cut short the number of working days, along with the lingering uncertainty over import tax cuts on US vehicles, market researcher U-Car said in a report yesterday. New car sales last month totaled 22,043, slumping from 35,073 units in January and down 19.89 percent from 37,515 in February last year, U-Car data showed. Sales of imported luxury cars, led by Mercedes-Benz, plummeted about 45 percent to 3,109 units last month from 5,663 units in the previous month,