The technology sector’s research and development (R&D) spending reached a record NT$820.6 billion (US$26.72 billion) in 2021, up 14.2 percent from the previous year, the National Science and Technology Council said on Friday.

The R&D spending accounted for 3.77 percent of Taiwan’s GDP in 2021, also setting a new high and rising from 3.61 percent in 2020, the council said in a report on its Web site.

The private sector accounted for 84.9 percent of tech R&D spending in 2021 with NT$696.3 billion, up 16.4 percent from a year earlier, while the public sector spent NT$124.3 billion, up 3.1 percent annually, the council said.

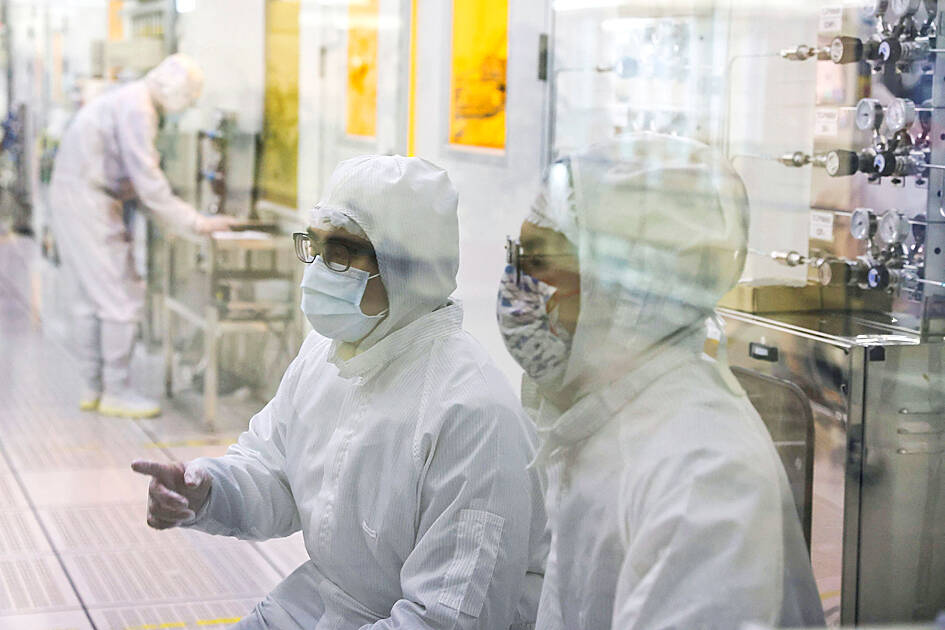

Photo: Ann Wang, Reuters

Enterprises, particularly those in the semiconductor industry, served as the major growth driver for tech R&D spending, due to solid global demand for chips made with high-end processes used in emerging technologies such as 5G applications and artificial intelligence of things, as well as online learning and remote work, which were prevalent during the COVID-19 pandemic, the council said.

R&D spending by enterprises totaled NT$691.59 billion in 2021, up 16.6 percent from a year earlier, it added.

As many tech giants are based in the Hsinchu Science Park (新竹科學園區), the Central Taiwan Science Park (中部科學園區) and the Southern Taiwan Science Park (南部科學園區), which are supervised by the council, these accounted for 45.4 percent of enterprises’ total R&D spending, up from 42.3 percent in 2020.

In addition to semiconductor suppliers, the science parks also house manufacturers from the computer and peripherals, communications, optoelectronics, precision machinery and biotech industries, which also spent considerably on R&D, the council said.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

It is challenging to build infrastructure in much of Europe. Constrained budgets and polarized politics tend to undermine long-term projects, forcing officials to react to emergencies rather than plan for the future. Not in Austria. Today, the country is to officially open its Koralmbahn tunnel, the 5.9 billion euro (US$6.9 billion) centerpiece of a groundbreaking new railway that will eventually run from Poland’s Baltic coast to the Adriatic Sea, transforming travel within Austria and positioning the Alpine nation at the forefront of logistics in Europe. “It is Austria’s biggest socio-economic experiment in over a century,” said Eric Kirschner, an economist at Graz-based Joanneum

OPTION: Uber said it could provide higher pay for batch trips, if incentives for batching is not removed entirely, as the latter would force it to pass on the costs to consumers Uber Technologies Inc yesterday warned that proposed restrictions on batching orders and minimum wages could prompt a NT$20 delivery fee increase in Taiwan, as lower efficiency would drive up costs. Uber CEO Dara Khosrowshahi made the remarks yesterday during his visit to Taiwan. He is on a multileg trip to the region, which includes stops in South Korea and Japan. His visit coincided the release last month of the Ministry of Labor’s draft bill on the delivery sector, which aims to safeguard delivery workers’ rights and improve their welfare. The ministry set the minimum pay for local food delivery drivers at