The local housing market might experience a soft landing in the first half of next year, after months of declining transactions caused by unfavorable policy measures and economic changes, central bank Governor Yang Chin-long (楊金龍) said yesterday.

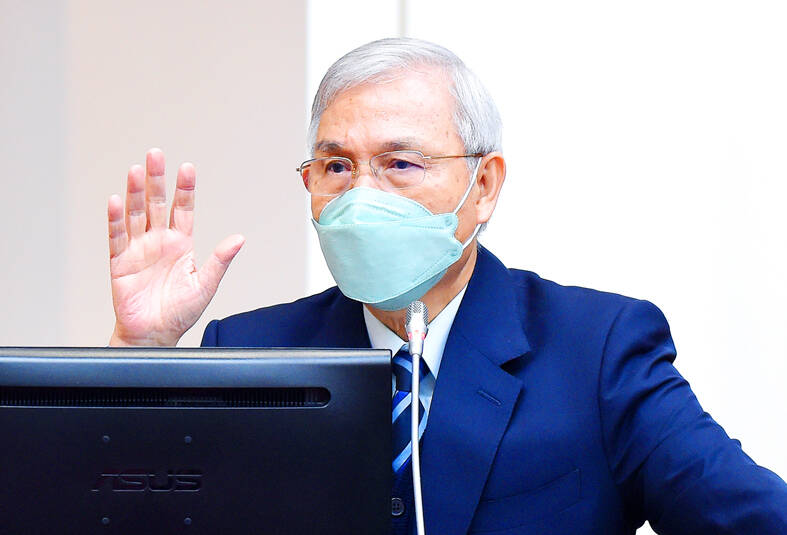

Yang made the remarks while responding to lawmakers’ questions about the property market, monetary policy and inflation at a meeting of the legislature’s Finance Committee.

“The property market might need more time to assimilate the previous three rate hikes, which were intended to tame inflation but help cool property transactions,” Yang said.

Photo: Liao Chen-hui, Taipei Times

A drop in transactions usually precedes price corrections, he said.

Unaffordable housing is the public’s biggest complaint, especially among young people, surveys have shown.

The number of housing transfers in the nation’s six special municipalities shrunk by double-digit percentage points in the second half of this year, with the pace of retreat accelerating each month, government statistics showed.

Yang has favored a moderate approach to tackling inflation and housing price hikes, while other central bank board directors have pushed for more drastic monetary tightening.

The governor refused to comment on whether interest rates would be raised again on Thursday, saying that all central bank board members are required to say nothing 10 days ahead of a board meeting.

Inflation and the economic outlook would dominate policy discussions, Yang said, adding that consumer price increases of within 2 percent would be acceptable in his opinion.

Research organizations have said that Taiwan’s inflation rate is expected be below target for next year, thanks to tax cuts on imported raw materials and the absence of supply chain disruptions that have plagued the US and Europe.

The central bank must also weigh how seriously the worsening global economic slowdown would affect Taiwan’s GDP growth, Yang said.

Taiwan’s GDP is expected to expand a slight 2.5 percent next year, driven mainly by government and consumer expenditure, as exports slip into contraction this quarter and in the coming six months.

There is no need for Taiwan to copy advanced economies’ monetary policies, and the central bank would deal with the matter based on the nation’s best interests, Yang said.

Analysts generally expect another 0.125 percentage rate hike to narrow Taiwan’s rate gap with the US, as the US Federal Reserve could raise the interest rate by 0.5 percentage points later this week.

Yang said he has reservations about Taiwan Semiconductor Manufacturing Co ( 台積電) founder Morris Chang’s (張忠謀) statement that globalization is dead.

“I don’t agree that globalization is dead, although its content has shifted... That is an extreme statement,” Yang said.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the