The Financial Supervisory Commission (FSC) plans to tighten its oversight over local investment brokerages to hold company board members accountable if fund managers are found to be involved in fraud or malpractice, the commission said on Thursday.

The FSC would stipulate in the Regulations Governing Responsible Persons and Associated Persons of Securities Investment Trust Enterprises (證券投資信託事業負責人與業務人員管理規則) that board members are responsible for supervising fund managers, it told a news videoconference.

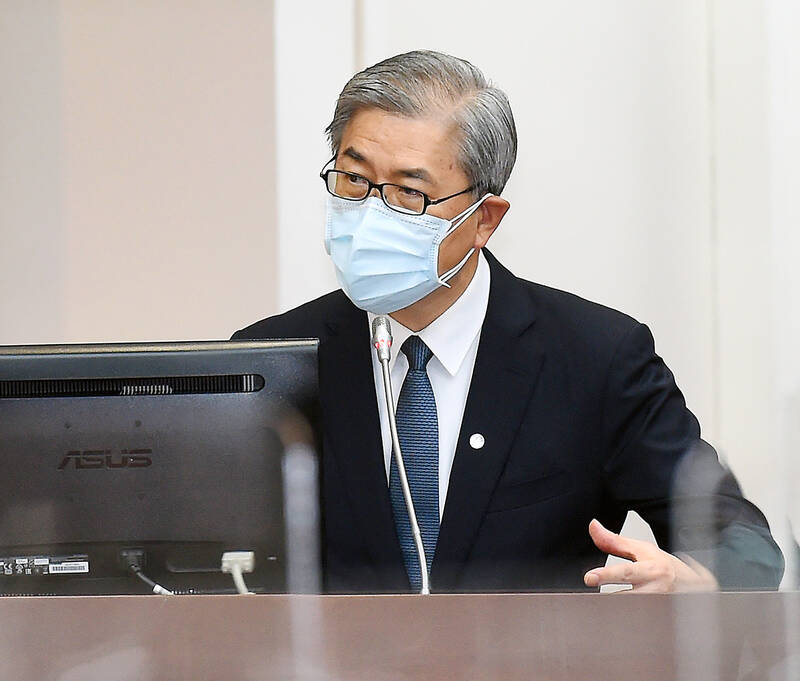

“Board members appoint fund managers and the commission will ask companies to establish an accountability system to enhance their corporate governance,” Securities and Futures Bureau Deputy Director-General Chang Tzy-ming (張子敏) told the conference.

Photo: Chu Pei-hsiung, Taipei Times

If fund managers are found to be involved in malpractice, the commission would consider dismissing the board members from their posts, Chang said, adding that the severest punishment would be to revoke operating permission.

The FSC’s announcement follows reports in the past few years of fund managers at local securities investment companies found to have either colluded with government officials in stocks speculation or to have illegally used insider information to trade personal stocks.

Knowing that the Labor Pension Fund was to invest in some specific stocks, some fund managers allegedly purchased the shares and sold them after the price rose, while other fund managers bought shares with knowledge that their companies were to invest in them, reports said.

In one such case, two fund managers made at least NT$80 million (US$2.56 million) between them, while another group that included an official in charge of a pension fund made NT$538 million, Taipei District Court records show.

Given the rise in malpractice cases among fund managers, the FSC increased the maximum fine for such activity to NT$15 million from NT$3 million.

The commission would bar people from serving on the boards of two or more securities investment companies to prevent conflicts of interests, Chang said.

However, this rule would not apply to state-owned securities firms, he said.

Although the FSC is generally tightening rules for fund managers, it would relax one rule, allowing them to manage the wealth of their dependent children, it said.

This is a reasonable activity, it said.

The changes to the regulations would take effect in 60 days, Chang said.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.