Tesla Inc yesterday operated its Shanghai plant well below capacity, showing the problems factories there face trying to ramp up output under a tightening COVID-19 lockdown, while Beijing kept fighting a small, but elusive outbreak.

Many of the hundreds of companies reopening factories in Shanghai in the past few weeks have faced challenges getting production lines back up to speed while keeping workers on-site in a “closed loop” system.

Even if they get everything right, such firms depend on suppliers facing similar challenges.

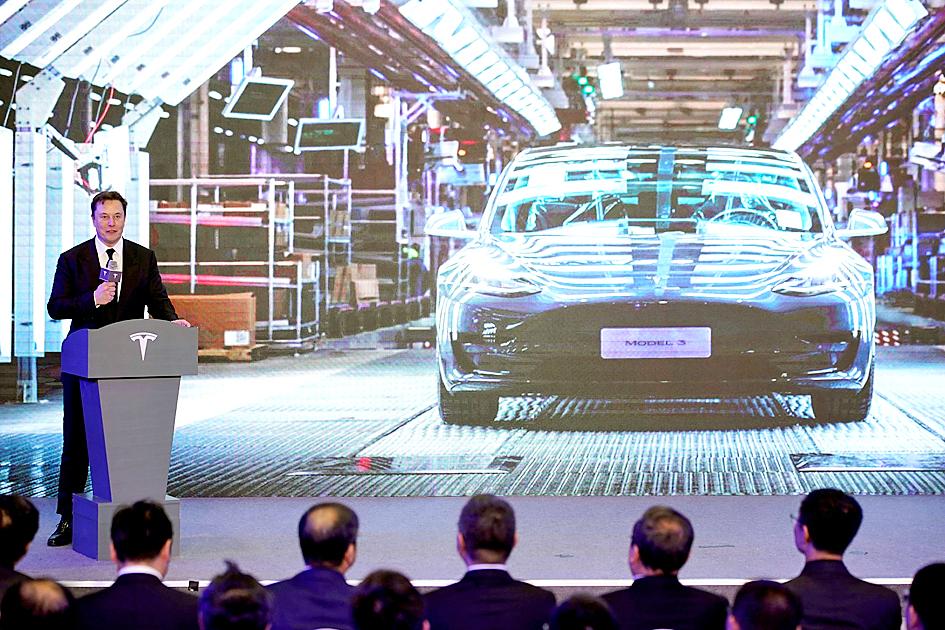

Photo: Reuters

The latest sign of struggle with increasing output under COVID-19 rules came from Tesla’s Shanghai plant, whose resumption three weeks ago received generous coverage in state media as an example of what can still be achieved despite restrictions.

The US automaker has halted most of its production at the plant due to problems securing parts, an internal memo seen by reporters showed.

Tesla had planned as late as last week to increase output to pre-lockdown levels by next week.

Prior to the pandemic-induced halt on March 28, Tesla workers in Shanghai were working three shifts covering 24 hours, seven days a week. The workers in the current closed-loop system have been doing 12-hour shifts, six days a week.

Although the shift is meant to be 12 hours, a shortage of some parts means most days work has had to stop after about eight hours, a person familiar with the matter said.

While workshops at the electric vehicle maker’s China plant were operating yesterday, the situation is fluid and logistics problems might force production to cease later this week, the person said, declining to be identified because the details are private.

One of the problems stems from a shortage of wire harnesses from Aptiv PLC, which had to stop shipping supplies from a plant that supplies Tesla and General Motors Co after infections were found among its employees, sources said on Monday.

Local media, citing an unidentified company official, reported that Tesla produced about 10,000 vehicles from its Shanghai plant between April 19 and April 30, or a run rate of about 830 vehicles a day.

Videos posted online last week showed dozens of workers at Apple Inc and Tesla supplier Quanta Computer Inc (廣達電腦) overwhelming hazmat-suited security guards and vaulting over factory gates fearing being trapped inside amid COVID-19 rumors.

Restrictions in Shanghai, Beijing and dozens of other major population centers and manufacturing hubs across China are taking a heavy toll on the world’s second-largest economy, with significant global spillovers on trade and supply chains.

Shanghai, a vital center for commerce, finance and manufacturing for China and beyond with a population of 25 million people, was enduring its sixth week of a city-wide lockdown.

The number of new COVID-19 cases in Shanghai has been falling for almost two weeks, but they remain in the thousands and restrictions were tightening.

“We are still in a critical period of epidemic prevention and control,” Shanghai Municipal Center for Disease Control and Prevention deputy director Sun Xiaodong (孫曉東) said.

Additional reporting by Bloomberg

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

TikTok abounds with viral videos accusing prestigious brands of secretly manufacturing luxury goods in China so they can be sold at cut prices. However, while these “revelations” are spurious, behind them lurks a well-oiled machine for selling counterfeit goods that is making the most of the confusion surrounding trade tariffs. Chinese content creators who portray themselves as workers or subcontractors in the luxury goods business claim that Beijing has lifted confidentiality clauses on local subcontractors as a way to respond to the huge hike in customs duties imposed on China by US President Donald Trump. They say this Chinese decision, of which Agence