The government would maintain a freeze on prices for liquefied petroleum gas (LPG) and liquefied natural gas (LNG) amid rising costs for many items, Minister of Economic Affairs Wang Mei-hua (王美花) told a meeting of the legislature’s Economics Committee yesterday.

Wang’s remark came as lawmakers were keen to extract promises from her that the price of LPG, commonly sold in 20kg cylinders for cooking, would not rise, despite a steep increase in production costs.

“Is it true that the government subsidy for LPG is already more than what consumers pay?” Democratic Progressive Party Legislator Cheng Yun-peng (鄭運鵬) asked.

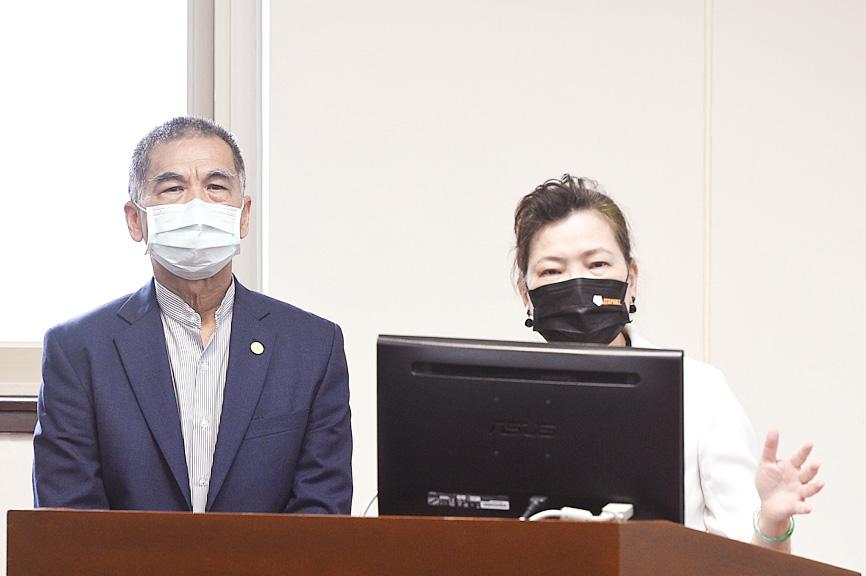

Photo: George Tsorng, Taipei Times

“Yes, we are basically selling LPG to consumers at a 55 percent discount,” Wang said. “That is, the government is paying more for LPG than the consumers who buy it.”

Despite the steep subsidy, Wang committed to maintaining a freeze on the price of LPG for now.

Chinese Nationalist Party (KMT) Legislator Yang Chiung-ying (楊瓊櫻) was similarly concerned about LNG prices, which have been spiking on the spot market.

“Is it not true that the LNG market is going into its peak season and prices might go up further?” she asked CPC Corp, Taiwan (CPC, 台灣中油) acting chairman and president Lee Shun-chin (李順欽). “Please tell me what CPC intends to do.”

Lee said that thanks to the multi-year contracts CPC has signed, the company is not as exposed to wild price swings as the LNG market.

However, the government’s price stabilization policy would come at a cost for CPC, Lee said.

“We will continue to support the government’s policy, although it means that in November and December CPC will lose NT$50 billion (US$1.8 billion),” he said.

While CPC’s petrochemical and refining business was profitable, the losses it has shouldered in its LPG and LNG businesses mean that it projects a NT$40 billion loss for the company this year, he said.

“The money we made for the whole year has been eaten up by fuel subsidies for LNG, LPG, diesel and gasoline products,” Lee said.

Also yesterday, the Bureau of Energy released its third-quarter energy use report, which showed that energy use rose 5.9 percent year-on-year, with industrial consumption making the biggest jump at 13.4 percent due to demand for steel, petrochemicals, plastics and semiconductors.

Industrial use accounted for 61.4 percent of the nations’ energy use in the third quarter, the report said.

Residential use went down 1.9 percent year-on-year and only accounted for 8.7 percent of total use, the report said.

However, gas use went up as people stayed at home and cooked more, it said.

GROWING OWINGS: While Luxembourg and China swapped the top three spots, the US continued to be the largest exposure for Taiwan for the 41st consecutive quarter The US remained the largest debtor nation to Taiwan’s banking sector for the 41st consecutive quarter at the end of September, after local banks’ exposure to the US market rose more than 2 percent from three months earlier, the central bank said. Exposure to the US increased to US$198.896 billion, up US$4.026 billion, or 2.07 percent, from US$194.87 billion in the previous quarter, data released by the central bank showed on Friday. Of the increase, about US$1.4 billion came from banks’ investments in securitized products and interbank loans in the US, while another US$2.6 billion stemmed from trust assets, including mutual funds,

AI TALENT: No financial details were released about the deal, in which top Groq executives, including its CEO, would join Nvidia to help advance the technology Nvidia Corp has agreed to a licensing deal with artificial intelligence (AI) start-up Groq, furthering its investments in companies connected to the AI boom and gaining the right to add a new type of technology to its products. The world’s largest publicly traded company has paid for the right to use Groq’s technology and is to integrate its chip design into future products. Some of the start-up’s executives are leaving to join Nvidia to help with that effort, the companies said. Groq would continue as an independent company with a new chief executive, it said on Wednesday in a post on its Web

Micron Memory Taiwan Co (台灣美光), a subsidiary of US memorychip maker Micron Technology Inc, has been granted a NT$4.7 billion (US$149.5 million) subsidy under the Ministry of Economic Affairs A+ Corporate Innovation and R&D Enhancement program, the ministry said yesterday. The US memorychip maker’s program aims to back the development of high-performance and high-bandwidth memory chips with a total budget of NT$11.75 billion, the ministry said. Aside from the government funding, Micron is to inject the remaining investment of NT$7.06 billion as the company applied to participate the government’s Global Innovation Partnership Program to deepen technology cooperation, a ministry official told the

JOINT EFFORTS: MediaTek would partner with Denso to develop custom chips to support the car-part specialist company’s driver-assist systems in an expanding market MediaTek Inc (聯發科), the world’s largest mobile phone chip designer, yesterday said it is working closely with Japan’s Denso Corp to build a custom automotive system-on-chip (SoC) solution tailored for advanced driver-assistance systems and cockpit systems, adding another customer to its new application-specific IC (ASIC) business. This effort merges Denso’s automotive-grade safety expertise and deep vehicle integration with MediaTek’s technologies cultivated through the development of Media- Tek’s Dimensity AX, leveraging efficient, high-performance SoCs and artificial intelligence (AI) capabilities to offer a scalable, production-ready platform for next-generation driver assistance, the company said in a statement yesterday. “Through this collaboration, we are bringing two