US Federal Reserve policymakers appear confident that they have the weapons they would need to fight the next financial crisis. Some of their predecessors on the front lines are not so sure.

In a joint briefing with reporters, former Fed chairman Ben Bernanke, former US secretary of the Treasury and New York Federal Reserve Bank president Timothy Geithner, and former US secretary of the Treasury Henry Paulson all voiced varying degrees of concern about the US’ ability to combat another financial meltdown 10 years after they played prominent roles battling the last one.

While agreeing that the banking system is a lot stronger than it was back then, they said they see some weak spots in the country’s crisis-fighting arsenal that did not exist a decade ago and decried the nation’s ballooning budget deficits.

“We’ve got better defenses against the more mild, typical sets of shocks that happen to economies and financial systems, but in the extreme crisis probably less degree of freedom, more constraints than would be ideal,” said Geithner, who is now president of private equity firm Warburg Pincus LLC.

The US instituted a raft of reforms after the last crisis drove the economy into its worst recession since the Great Depression. Some were designed to fortify the country’s biggest banks and make it easier to shut them down so they would not have to be rescued by the government if they ran into trouble.

Others limited the discretionary power of the Fed, the US Department of the Treasury and Federal Deposit Insurance Corp (FDIC) to provide financial institutions with support as lawmakers responded to a public backlash against bailouts and Wall Street.

Fed Banking Supervision Vice Chairman Randal Quarles in April said that the tools available to regulators in an emergency had changed, but told a conference in Washington: “I wouldn’t be too negative about our ability to respond in the future.”

Fed Chairman Jerome Powell, has voiced confidence in the government’s ability to shut down a failing financial institution in a crisis without having to sink money in it, telling lawmakers in November last year that no bank is too big to fail.

However, the emergency powers that proved so essential a decade ago are “somewhat weaker” today, Geithner said.

Paulson said he agreed, pointing in particular to the limits that US Congress placed on FDIC and the treasury department’s Exchange Stabilization Fund.

“There is some concern there,” said Bernanke, who is a distinguished fellow at the Brookings Institution in Washington.

However, regulators are now more attuned to potential systemic risks, he added.

The deficit-ballooning tax cuts and spending increases agreed to by US President Donald Trump and Congress are ill-timed, Bernanke said, adding that they come as the country is at or near full employment.

He was also concerned about the longer-term consequences of rapidly rising government debt, he said.

“If we don’t act, that is the most certain fiscal or economic crisis we will have,” said Paulson, who chairs his own institute in Chicago. “It will slowly strangle us.”

The enlarged deficits and debt also mean that the government has less room to pump up demand than it did during the last crisis, when then-US president Barack Obama pushed through a massive stimulus package, Geithner said.

Publicly held federal debt stands at 77 percent of GDP, double what it was in 2007.

The Fed, too, has less scope to act as interest rates are lower, Geithner said.

The central bank’s benchmark rate target is 1.75 to 2 percent. It was 5.25 percent in July 2007.

However, Bernanke said that the US central bank is better positioned to respond than other advanced economies.

The European Central Bank, for instance, has a benchmark interest rate of zero.

The US has made “a lot of progress” toward being able to resolve failing financial institutions without having to bail them out, he said.

Paulson basically agreed, with one big proviso. In the midst of a crisis, policymakers might have to provide temporary support so that a collapsing institution can be liquidated over time — even if that proves politically difficult to do.

“It’s nice to have this authority, but somebody has got to be prepared to use it and use it in controversial ways,” he said.

Asked if policymakers and politicians would be able to set aside their differences to tackle any future turmoil given the toxic atmosphere in Washington, Paulson said that the answer is “unknowable.”

However, “it’s the right question to ask,” he added.

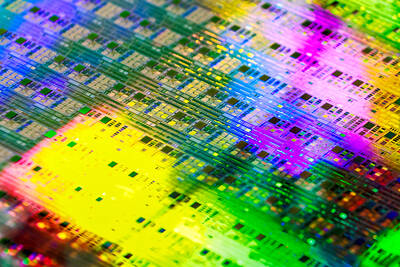

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs

The US on Friday penalized two Chinese firms that acquired US chipmaking equipment for China’s top chipmaker, Semiconductor Manufacturing International Corp (SMIC, 中芯國際), including them among 32 entities that were added to the US Department of Commerce’s restricted trade list, a US government posting showed. Twenty-three of the 32 are in China. GMC Semiconductor Technology (Wuxi) Co (吉姆西半導體科技) and Jicun Semiconductor Technology (Shanghai) Co (吉存半導體科技) were placed on the list, formally known as the Entity List, for acquiring equipment for SMIC Northern Integrated Circuit Manufacturing (Beijing) Corp (中芯北方積體電路) and Semiconductor Manufacturing International (Beijing) Corp (中芯北京), the US Federal Register posting said. The