APEC finance ministers on Friday ended a two-day meeting here during which they got a concession from China that it might break the link between its currency, the yuan, and the US dollar.

The meeting of APEC officials ended in the Chilean capital with a statement by the 21 ministers calling for currency deregulation that particularly targeted the yuan's much-criticized monetary peg to the US dollar.

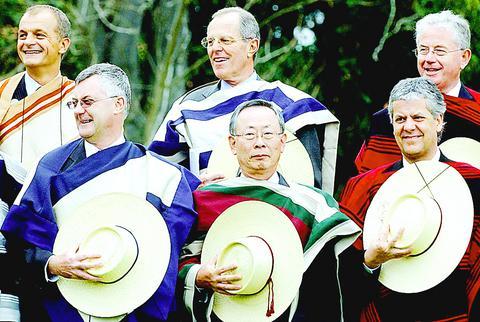

PHOTO: EPA

The yuan has been fixed at 8.28 to the dollar for the past 10 years. With the Chinese economy so strong, this has given Chinese exporters a major advantage on world markets.

Critics, especially in the US, say this has led to unfair trade imbalances in China's favor.

"Ministers welcome steps being taken at the regional and national levels to develop capital markets and strengthen banking systems, which would over time facilitate freer and more stable capital flows and the choice to move to an exchange rate regime with greater flexibility, in some economies, if they deem appropriate," the statement said.

"I was particularly pleased that support for the move to more flexible currency regimes was expressed," US Treasury Undersecretary John Taylor said.

At their meeting last year in Thailand, APEC finance ministers were unable to come up with an agreed formula to criticize fixed currency regimes used by China and other countries in the region.

The finance ministers in their closing statement on Friday cited the "growing importance" of money sent home by immigrant workers as "a steady source of financial flows that can benefit emerging markets."

They called for "continued work on analyzing and reducing the institutional and regulatory impediments to remittance flows."

They applauded the "strength-ening" rate of growth in Asia-Pacific economies and the "continued favorable outlook for 2005, notwithstanding the risks associated with high oil prices."

"We stress the important fact that investment and trade are the leading factors behind the global economic recovery," the statement said. "In our view, both factors are crucial for stronger and broader based growth and for spreading the benefits of globalization."

The ministers set their next meeting for September next year in Jeju, South Korea.

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

TikTok abounds with viral videos accusing prestigious brands of secretly manufacturing luxury goods in China so they can be sold at cut prices. However, while these “revelations” are spurious, behind them lurks a well-oiled machine for selling counterfeit goods that is making the most of the confusion surrounding trade tariffs. Chinese content creators who portray themselves as workers or subcontractors in the luxury goods business claim that Beijing has lifted confidentiality clauses on local subcontractors as a way to respond to the huge hike in customs duties imposed on China by US President Donald Trump. They say this Chinese decision, of which Agence