Asian stocks, US index futures and the dollar tumbled after the Senate rejected a bailout for US automakers, threatening to deepen the global recession. Treasuries rallied and yields fell to record lows.

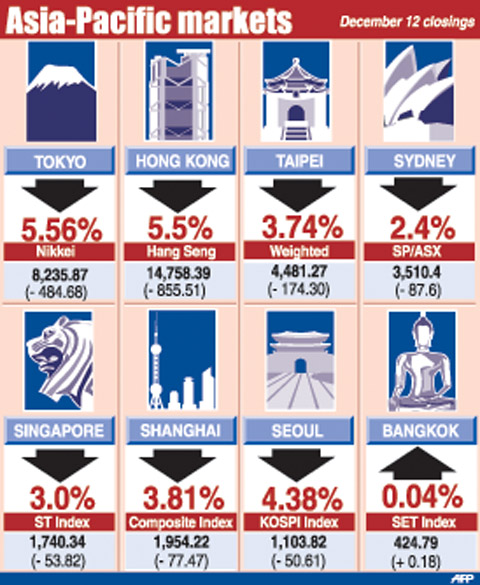

The MSCI Asia Pacific Index lost 3.5 percent to 84.97 as of 4:20pm in Tokyo after senators voted down a bill to provide US$14 billion in emergency funds for General Motors Corp and Chrysler LLC. Honda Motor Co and Nissan Motor Co plunged more than 11 percent. The US dollar fell to a 13-year low against the yen, while the cost of protecting Asian bonds against default advanced. Metals and crude oil prices slumped.

“Investors have been betrayed again by US politiciansm” said Yasuhiro Miyata, who helps manage about US$109 billion at DIAM Co in Tokyo. “Even with the knowledge that we are in the midst of a crisis, they were unable to come to an agreement and investors have decided to abandon ship. This could have a substantial effect on unemployment.”

AFP

Futures on Standard & Poor’s 500 Index sank 4.3 percent. The measure dropped 2.9 percent yesterday, as General Motors shares plunged 10 percent, extending an 83 percent annual decline.

Japan’s Nikkei 225 Stock Average retreated 5.6 percent to 8,235.87. The CSI 300 Index sank 3.8 percent in China, after a government official said growth will slow more sharply next quarter. China Mobile Ltd. fell 7.1 percent in Hong Kong.

South Korea’s Kospi Index lost 4.4 percent, led by KB Financial Group Inc, after the Bank of Korea said the economy will expand at the slowest pace in 11 years next year.

TAIPEI

Taiwanese shares were expected to weaken next week amid uncertainty over the US auto industry’s fate, dealers said on Friday.

Fears have escalated that a possible failure to rescue the auto sector would significantly boost the already high US unemployment rate and further drag down US demand, hurting Taiwan’s exports, they said.

Market sentiment remains cautious ahead of a US Federal Reserve Board policy meeting scheduled for tomorrow, they said.

The Taiwanese market is expected to test the 4,200 point support level next week, while any technical rebound during trade may encounter strong resistance at around 4,700 points, dealers said.

For the week to Dec. 12, the weighted index fell 256.20 points or 6.06 percent to 4,481.27 after a 5.28 percent decline a week earlier.

Average daily turnover stood at NT$85.11 billion (US$2.56 billion), compared with US$54.83 billion a week ago.

The market closed 3.74 percent lower on Friday as investors rushed to take profit after the US Senate reached no deal to keep the Big Three automakers afloat.

“I expect the selling will continue into next week as pessimism towards the US economy seems to run deeper due to the botched rescue plan,” President Securities analyst Steven Huang said.

Huang said the electronic sector may face greater pressure as it has been battered by falling US consumption.

Last month, Taiwan recorded a 23.3 percent decline in exports, marking the steepest fall since October 2001.

Other regional markets:

KUALA LUMPUR: Malaysian shares closed 0.1 percent down. The Kuala Lumpur Composite Index shed 8.41 points to close the day at 852.27 off an intraday low of 848.05.

BANGKOK: Thai share prices closed almost flat, just 0.04 percent higher.

JAKARTA: Indonesian shares ended 4.1 percent lower.

The Jakarta Composite Index fell 54.72 points to 1,261.97 in moderate volume.

MANILA: Philippine shares closed two percent lower.

WELLINGTON: New Zealand shares closed 1.82 percent lower.

The benchmark NZX-50 index fell 49.76 points to 2,676.95 on light turnover worth 70.6 million dollars (US$38.9 million).

People can preregister to receive their NT$10,000 (US$325) cash distributed from the central government on Nov. 5 after President William Lai (賴清德) yesterday signed the Special Budget for Strengthening Economic, Social and National Security Resilience, the Executive Yuan told a news conference last night. The special budget, passed by the Legislative Yuan on Friday last week with a cash handout budget of NT$236 billion, was officially submitted to the Executive Yuan and the Presidential Office yesterday afternoon. People can register through the official Web site at https://10000.gov.tw to have the funds deposited into their bank accounts, withdraw the funds at automated teller

PEACE AND STABILITY: Maintaining the cross-strait ‘status quo’ has long been the government’s position, the Ministry of Foreign Affairs said Taiwan is committed to maintaining the cross-strait “status quo” and seeks no escalation of tensions, the Ministry of Foreign Affairs (MOFA) said yesterday, rebutting a Time magazine opinion piece that described President William Lai (賴清德) as a “reckless leader.” The article, titled “The US Must Beware of Taiwan’s Reckless Leader,” was written by Lyle Goldstein, director of the Asia Program at the Washington-based Defense Priorities think tank. Goldstein wrote that Taiwan is “the world’s most dangerous flashpoint” amid ongoing conflicts in the Middle East and Russia’s invasion of Ukraine. He said that the situation in the Taiwan Strait has become less stable

CONCESSION: A Shin Kong official said that the firm was ‘willing to contribute’ to the nation, as the move would enable Nvidia Crop to build its headquarters in Taiwan Shin Kong Life Insurance Co (新光人壽) yesterday said it would relinquish land-use rights, or known as surface rights, for two plots in Taipei’s Beitou District (北投), paving the way for Nvidia Corp to expand its office footprint in Taiwan. The insurer said it made the decision “in the interest of the nation’s greater good” and would not seek compensation from taxpayers for potential future losses, calling the move a gesture to resolve a months-long impasse among the insurer, the Taipei City Government and the US chip giant. “The decision was made on the condition that the Taipei City Government reimburses the related

FRESH LOOK: A committee would gather expert and public input on the themes and visual motifs that would appear on the notes, the central bank governor said The central bank has launched a comprehensive redesign of New Taiwan dollar banknotes to enhance anti-counterfeiting measures, improve accessibility and align the bills with global sustainability standards, Governor Yang Chin-long (楊金龍) told a meeting of the legislature’s Finance Committee yesterday. The overhaul would affect all five denominations — NT$100, NT$200, NT$500, NT$1,000 and NT$2,000 notes — but not coins, Yang said. It would be the first major update to the banknotes in 24 years, as the current series, introduced in 2001, has remained in circulation amid rapid advances in printing technology and security standards. “Updating the notes is essential to safeguard the integrity