Lehman Brothers Holdings Inc may need to raise capital as some analysts estimate the Wall Street firm will report its first quarterly loss since going public in 1994.

The fourth-biggest US securities firm probably will post a second-quarter loss of US$0.50 to US$0.75 a share, analysts at Oppenheimer & Co and Bank of America Corp said.

New York-based Lehman holds “very large, illiquid” assets and “we can’t rule out equity issuance” to replenish the balance sheet, analysts at Merrill Lynch & Co said in a report on Monday.

Lehman may seek as much as US$4 billion by selling common stock, the Wall Street Journal said yesterday, citing unidentified people with knowledge of the matter.

The company has raised US$6 billion since February amid asset writedowns and losses from the collapse of the US subprime mortgage market. Lehman has dropped 48 percent in New York trading this year, the worst performance on the 11-member Amex Securities Broker/Dealer Index.

“This is adding to the perception that there’s a need for more write-offs and capital raisings,” said Greg Bundy, executive chairman of merger advisory firm InterFinancial Ltd in Sydney and a former head of Merrill’s Australian unit.

Lehman fell 8.1 percent on Monday to US$33.83 in New York Stock Exchange composite trading.

Chief executive officer Richard Fuld said in April at the annual shareholders meeting that “the worst is behind us” in the credit-market contraction that has cost the world’s biggest banks and brokerages more than US$250 billion.

Chief financial officer Erin Callan said last month at an industry conference in New York that the firm’s so-called leverage ratio declined to 27 percent from almost 32 percent at the end of the first quarter after the capital raisings.

The company needs more capital because of declines in the credit markets, David Einhorn, a hedge fund manager who’s betting Lehman shares will fall, said in an interview last week.

Standard & Poor’s downgraded the credit ratings of Lehman and bigger New York-based competitors Morgan Stanley and Merrill on Monday, saying they may disclose more writedowns for devalued assets. Lehman’s credit rating was cut to A from A+, as was Merrill’s.

Investors have “serious concerns that the subprime crisis isn’t over at all,” said Fumiyuki Nakanishi, an equity strategist at Sumitomo Mitsui Financial Group Inc in Tokyo.

The S&P downgrades may make it harder for the banks to sell derivatives such as credit-default swaps that are tied to bonds or loans, said Brad Hintz, an analyst at Sanford C. Bernstein in New York, who has a “market perform” rating on Lehman.

“Lehman needs to reduce its leverage ratios to reflect the new realities of the fixed-income marketplace,” Hintz wrote in a report to clients yesterday.

“This will not be good for the firm’s revenue base,” he wrote.

Right-wing political scientist Laura Fernandez on Sunday won Costa Rica’s presidential election by a landslide, after promising to crack down on rising violence linked to the cocaine trade. Fernandez’s nearest rival, economist Alvaro Ramos, conceded defeat as results showed the ruling party far exceeding the threshold of 40 percent needed to avoid a runoff. With 94 percent of polling stations counted, the political heir of outgoing Costa Rican President Rodrigo Chaves had captured 48.3 percent of the vote compared with Ramos’ 33.4 percent, the Supreme Electoral Tribunal said. As soon as the first results were announced, members of Fernandez’s Sovereign People’s Party

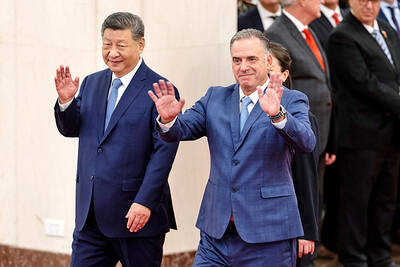

EMERGING FIELDS: The Chinese president said that the two countries would explore cooperation in green technology, the digital economy and artificial intelligence Chinese President Xi Jinping (習近平) yesterday called for an “equal and orderly multipolar world” in the face of “unilateral bullying,” in an apparent jab at the US. Xi was speaking during talks in Beijing with Uruguayan President Yamandu Orsi, the first South American leader to visit China since US special forces captured then-Venezuelan president Nicolas Maduro last month — an operation that Beijing condemned as a violation of sovereignty. Orsi follows a slew of leaders to have visited China seeking to boost ties with the world’s second-largest economy to hedge against US President Donald Trump’s increasingly unpredictable administration. “The international situation is fraught

MORE RESPONSIBILITY: Draftees would be expected to fight alongside professional soldiers, likely requiring the transformation of some training brigades into combat units The armed forces are to start incorporating new conscripts into combined arms brigades this year to enhance combat readiness, the Executive Yuan’s latest policy report said. The new policy would affect Taiwanese men entering the military for their compulsory service, which was extended to one year under reforms by then-president Tsai Ing-wen (蔡英文) in 2022. The conscripts would be trained to operate machine guns, uncrewed aerial vehicles, anti-tank guided missile launchers and Stinger air defense systems, the report said, adding that the basic training would be lengthened to eight weeks. After basic training, conscripts would be sorted into infantry battalions that would take

GROWING AMBITIONS: The scale and tempo of the operations show that the Strait has become the core theater for China to expand its security interests, the report said Chinese military aircraft incursions around Taiwan have surged nearly 15-fold over the past five years, according to a report released yesterday by the Democratic Progressive Party’s (DPP) Department of China Affairs. Sorties in the Taiwan Strait were previously irregular, totaling 380 in 2020, but have since evolved into routine operations, the report showed. “This demonstrates that the Taiwan Strait has become both the starting point and testing ground for Beijing’s expansionist ambitions,” it said. Driven by military expansionism, China is systematically pursuing actions aimed at altering the regional “status quo,” the department said, adding that Taiwan represents the most critical link in China’s