The Alliance for Fair Tax Reform (AFTR) yesterday slammed a recent TV commercial claiming that lower tax rates correlate with a strong economy, and challenged the anonymous advertiser to a public debate.

In recent weeks a repeatedly aired TV commercial has sent the message that the lower the tax rate, the better the economy and the lower the unemployment rate.

The commercial cites the US economy under former president Ronald Reagan’s administration as an example to support their claim on the relationship between the economy and tax rates.

It also says that Hong Kong and Singapore are more economically developed and people there have more purchasing power than Taiwanese because of lower tax rates.

“Economic development in a country is affected by multiple factors, and there is no absolute direct connection between economic development and the tax rate,” Huang Shih-hsin (黃世鑫), a public finance professor at National Taipei University, told a press conference in Taipei yesterday.

“How good is the economy in tax-free paradises such as the British Virgin Islands or the Cayman Islands?” Huang asked. “People register their companies at these places just to avoid taxes, but they usually don’t make any actual investment.”

On the other hand, in high tax countries such as Sweden, “the economy performs quite well, the social welfare system is great and the quality of life there is high,” he said.

Chien Hsi-chieh, spokesman for the alliance, pointed out that the commercial is not telling the full story.

“[Former US presidents Ronald] Reagan and [George] Bush wanted to boost the economy by cutting taxes — it did work at first, but caused a bigger gap between the rich and the poor,” Chien said.

“In the end, the US government became severely indebted, and the unemployment rate went up to 12 percent under the [George] Bush administration,” he said.

The issue only improved a little after Bill Clinton increased taxes, he said.

Chien went on to say that Hong Kong and Singapore were able to keep low tax rates because they were city-states.

“They don’t spend money on agriculture or national defense,” he said. “And in fact, while the tax rate in Taiwan is 40 percent, the real tax rate is only 13 percent after exemptions for businesses, which is already lower than the 17 percent tax rates in Hong Kong and Singapore.”

Chien said he believed further tax cuts may lower the tax rate to below 10 percent.

“While [President] Ma Ying-jeou [馬英九] has so many projects planned, how will the government get the money?” AFTR convener Wang Jung-chang (王榮璋) said.

Wang suspected that business groups lobbying for reductions in inheritance, gift and business taxes were behind the commercial.

“So this is really a tax cut campaign for the rich, but they’re brainwashing the public to join their campaign,” Wang said.

Chinese spouse and influencer Guan Guan’s (關關) residency permit has been revoked for repeatedly posting pro-China videos that threaten national security, the National Immigration Agency confirmed today. Guan Guan has said many controversial statements in her videos posted to Douyin (抖音), including “the red flag will soon be painted all over Taiwan” and “Taiwan is an inseparable part of China,” and expressing hope for expedited reunification. The agency last year received multiple reports alleging that Guan Guan had advocated for armed reunification. After verifying the reports, the agency last month issued a notice requiring her to appear and explain her actions. Guan

GIVE AND TAKE: Blood demand continues to rise each year, while fewer young donors are available due to the nation’s falling birthrate, a doctor said Blood donors can redeem points earned from donations to obtain limited edition Formosan black bear travel mugs, the Kaohsiung Blood Center said yesterday, as it announced a goal of stocking 20,000 units of blood prior to the Lunar New Year. The last month of the lunar year is National Blood Donation Month, when local centers seek to stockpile blood for use during the Lunar New Year holiday. The blood demand in southern Taiwan — including Tainan and Kaohsiung, as well as Chiayi, Pingtung, Penghu and Taitung counties — is about 2,000 units per day, the center said. The donation campaign aims to boost

The Kaohsiung Tourism Bureau audited six hotels in an effort to prevent price gouging ahead of Korean band BTS’ concert tour in the city scheduled for Nov. 19, 21 and 22 this year. The bureau on Friday said that the audits — conducted in response to allegations of unfair pricing posted on social media — found no wrongdoing. These establishments included the local branches of Chateau de Chine, Hotel Nikko, My Humble House, and Grand Hai Lai, it said, adding that the Consumer Protection Commission would have penalized price gougers had the accusations been substantiated. The bureau said the Tourism Development Act

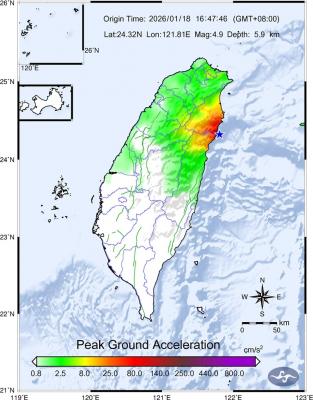

The Central Weather Administration (CWA) said a magnitude 4.9 earthquake that struck off the coast of eastern Taiwan yesterday was an independent event and part of a stress-adjustment process. The earthquake occurred at 4:47pm, with its epicenter at sea about 45.4km south of Yilan County Hall at a depth of 5.9km, the CWA said. The quake's intensity, which gauges the actual effects of a temblor, was highest in several townships in Yilan and neighboring Hualien County, where it measured 4 on Taiwan's seven-tier intensity scale, the CWA said. Lin Po-yu (林柏佑), a division chief at the CWA's Seismological Center, told a news conference