In a manic week full of previously unthinkable market moves, Wall Street on Friday ended with one reminiscent of what things were like before the COVID-19 pandemic upended everything.

The S&P 500 glided to a gain of 1.4 percent, with Apple Inc, Microsoft Corp and other technology stocks leading the way, as they did so many times before the US economy shut down in the hopes of slowing the spread of the novel coronavirus.

The bond market was quiet, while crude prices climbed again.

The gains offered a soothing coda for a wild week, which began with Monday’s astonishing plummet for oil and carried through Thursday’s sudden disappearance of a morning stock rally, as markets pinballed from fear to hope and back again.

“The market sort of feels like Dorothy coming to the crossroads and has yet to meet the scarecrow to tell her which way to go,” Center for Financial Research and Analysis chief investment strategist Sam Stovall said.

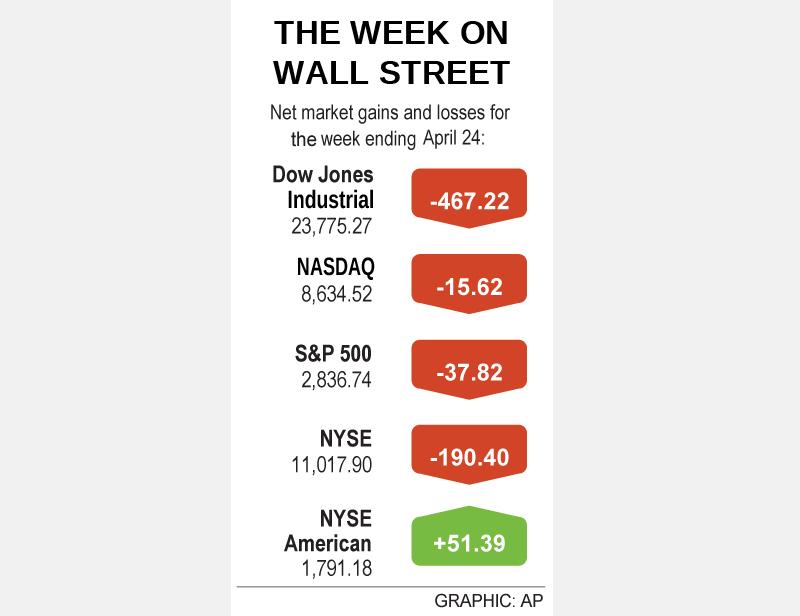

The S&P 500 still lost 1.3 percent for the week as worries about the economic damage dealt by the pandemic outweighed hopes that businesses could soon reopen. That snapped the first two-week winning streak for the S&P 500 since it began selling off in February.

Reports piled higher through the week showing that the pandemic is bludgeoning the US economy even more than economists had feared. Roughly one in six US workers has filed for unemployment benefits over the past five weeks.

The damage is so severe that a heavily divided US Congress has reached bipartisan agreement on massive support for the economy.

US President Donald Trump on Friday signed a bill to provide nearly US$500 billion more, including loans for small businesses and aid for hospitals.

The big question for markets is when the US economy can reopen, Harvest Volatility Management head of trading and research Mike Zigmont said.

Businesses can get by for a few months on government help, but if the shutdown drags on longer, they could be permanently damaged, he said.

Many investors have essentially agreed to swallow horrific corporate profits and economic data in upcoming months, and they are turning their focus to who can survive and eventually grow their profits.

Next week is to be one of the busiest of this earnings season, with more than 150 companies in the S&P 500 reporting how much they made in the first three months of this year.

Many companies have been pulling their profit forecasts entirely for this year given all the uncertainty, and Wall Street is slashing its own estimates.

“I don’t really think that’s added to the concern of investors, because they assume that companies will be doing a lot of writing down in this bad year so that 2021 could look even better,” Stovall said.

The S&P 500 on Friday added 38.94 points to 2,836.74.

The Dow Jones Industrial Average on Friday rose 260.01 points, or 1.1 percent, to 23,775.27, falling 1.9 percent from a close of 24,242.49 on April 17.

The NASDAQ Composite on Friday added 139.77 points, or 1.7 percent, to 8,634.52, edging down 0.2 percent from 8,650.14 a week earlier.

The Russell 2000 index of small company stocks on Friday gained 18.99 points, or 1.6 percent, to 1,233.05, a 0.3 percent increase from 1,229.10 on April 17.

Gains for big tech stocks led the way. Tech makes up an outsized portion of the S&P 500 following years of market dominance, and because changes in market value dictate the index’s moves, the performance of the biggest stocks can have a disproportionate effect.

Stocks have been generally rallying since late last month on promises for massive aid from Congress and the US Federal Reserve, along with more recent hopes that parts of the US economy might be close to reopening.

In Georgia, some businesses on Friday began welcoming back customers after Georgia Governor Brian Kemp eased a month-long shutdown.

However, many professional investors have been skeptical of the market’s recent rally, saying that there is still too much uncertainty about how long the recession would last and that attempts to reopen the US economy could trigger more waves of infections if they are premature.

In a demonstration of how hungry the market is for a vaccine or treatment for COVID-19, the S&P 500 on Thursday erased a rally of more than 1 percent in a span of seconds following a discouraging report about a potential drug treatment.

The Financial Times reported that a Chinese study of the Gilead Sciences Inc’s experimental antiviral drug remdesivir found no positive effect, citing data published accidentally by the WHO.

However, Gilead said that the data represented “inappropriate characterizations” of the study.

Through all the volatility, many investors saving for retirement have been holding steady. They have been calling in for advice much more often, but the majority of savers with 401(k) accounts at Fidelity Investments Inc did not pull back on their contributions in this quarter.

The S&P 500 is down 16.2 percent from its record in February, although it has more than halved its loss since late last month.

The yield on the 10-year US Treasury note slipped from 0.61 percent late on Thursday to 0.60 percent.

Yields tend to fall when investors are downgrading their expectations for the economy and inflation.

Additional reporting by staff writer

KEEPING UP: The acquisition of a cleanroom in Taiwan would enable Micron to increase production in a market where demand continues to outpace supply, a Micron official said Micron Technology Inc has signed a letter of intent to buy a fabrication site in Taiwan from Powerchip Semiconductor Manufacturing Corp (力積電) for US$1.8 billion to expand its production of memory chips. Micron would take control of the P5 site in Miaoli County’s Tongluo Township (銅鑼) and plans to ramp up DRAM production in phases after the transaction closes in the second quarter, the company said in a statement on Saturday. The acquisition includes an existing 12 inch fab cleanroom of 27,871m2 and would further position Micron to address growing global demand for memory solutions, the company said. Micron expects the transaction to

Vincent Wei led fellow Singaporean farmers around an empty Malaysian plot, laying out plans for a greenhouse and rows of leafy vegetables. What he pitched was not just space for crops, but a lifeline for growers struggling to make ends meet in a city-state with high prices and little vacant land. The future agriculture hub is part of a joint special economic zone launched last year by the two neighbors, expected to cost US$123 million and produce 10,000 tonnes of fresh produce annually. It is attracting Singaporean farmers with promises of cheaper land, labor and energy just over the border.

US actor Matthew McConaughey has filed recordings of his image and voice with US patent authorities to protect them from unauthorized usage by artificial intelligence (AI) platforms, a representative said earlier this week. Several video clips and audio recordings were registered by the commercial arm of the Just Keep Livin’ Foundation, a non-profit created by the Oscar-winning actor and his wife, Camila, according to the US Patent and Trademark Office database. Many artists are increasingly concerned about the uncontrolled use of their image via generative AI since the rollout of ChatGPT and other AI-powered tools. Several US states have adopted

A proposed billionaires’ tax in California has ignited a political uproar in Silicon Valley, with tech titans threatening to leave the state while California Governor Gavin Newsom of the Democratic Party maneuvers to defeat a levy that he fears would lead to an exodus of wealth. A technology mecca, California has more billionaires than any other US state — a few hundred, by some estimates. About half its personal income tax revenue, a financial backbone in the nearly US$350 billion budget, comes from the top 1 percent of earners. A large healthcare union is attempting to place a proposal before