Creating new jobs is a good way to get the US economy moving again. That’s not the controversial part of US president-elect Barack Obama’s economic stimulus plans. As usual, the devil is in the details. And innovation advocates fear that if the devil runs amok, a short-sighted emphasis on jobs over long-term productivity may bog down the economic recovery.

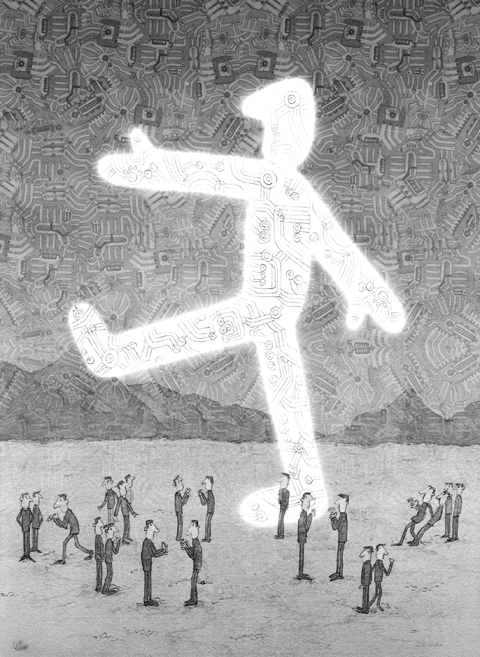

The problem, as they see it, is a centuries-old misconception that innovation is synonymous with automation, which in turn leads to the elimination of jobs.

“If you invest in a technology that makes something more efficient, the fear is that people will be put out of work,” says Kevin Efrusy, the venture capitalist whose firm Accel Partners is the lead funder of several important Silicon Valley start-ups, including Facebook.

“But it’s just the opposite. When anything becomes cheaper, we consume a lot more of it. The overall economic effect is, you create and expand entire new industries and employment goes up,” Efrusy said.

A 1995 study by the Organization for Economic Cooperation and Development showed that periods of high productivity — often achieved through automation — were correlated with periods of high job growth throughout the last half of the 20th century.

“Innovation leads to job growth directly and clearly,” says Robert Atkinson, president of the Information Technology and Innovation Foundation.

The data collected since that study was published continue to prove the point, he says, adding that even with the trend toward offshoring earlier this decade, unemployment rates in the US remained quite low until the recent economic downturn began.

While creating jobs by upgrading the nation’s physical infrastructure may help in the short term, Atkinson says, “there’s another category of stimulus you could call innovation or digital stimulus — ‘stimovation,’ as a colleague has referred to it.”

Although many economists believe that a stimulus package must be timely, targeted and temporary, Atkinson’s organization argues that a fourth adjective — transformative — may be the most important. Transformative stimulus investments, he said, lead to economic growth that wouldn’t be there otherwise.

A new report by the Information Technology and Innovation Foundation presents the case for investing US$30 billion in the nation’s digital infrastructure, including health information technology, broadband Internet access and the so-called smart grid, an effort to infuse detailed digital intelligence into the electricity distribution grid.

The stimulus money is “a wonderful opportunity” to integrate innovative technologies at a far faster pace than would otherwise be possible, he said.

“You’d have an economy and society within three to four years that would be a lot better than we have today, and you’d create a lot of jobs,” Atkinson said.

Beyond direct stimulus investments, he supports an initiative being circulated in Silicon Valley that seeks an information technology investment tax credit to foster innovation through the downturn.

Citing an op-ed essay on Nov. 30 in the New York Times by the economist Joseph Stiglitz, the Silicon Valley petition calls for a tax credit for companies that spend more than 80 percent of what they had been spending annually on information technology like computers and software.

The petition’s creator is David Thompson, the chief executive of Genius.com.

“I think it’s great that they want to build more highways and bridges,” Thompson said. “But if you really want to invest in long-term job viability, you need to invest in the innovation economy.”

Various organizations have previously backed such a tax credit specifically for clean technologies, biotech and broadband development. But TechNet, an advocacy group for the technology industry, is pushing for a tax credit that would underwrite innovation more broadly.

“Innovation is the lifeblood of the American economy,” says Jim Hock, a spokesman for TechNet. “We’re only as good as our next innovation. TechNet believes we shouldn’t be picking and choosing technologies to back with a tax credit. We should be technology-neutral and create an atmosphere of innovation that will let a thousand flowers bloom.”

Stiglitz, who was chairman of the Council of Economic Advisers from 1995 to 1997, said in an interview that there has been a slow divergence between traditional economics and what may be called innovation economics.

“I’ve been a bit astonished that all the discussion around the private-sector stimulus has centered on infrastructure,” he said.

“Bailouts, too, are aimed at correcting mistakes of the past, so they are backward-looking. We would be much better off spending our money forward-looking. If we spend US$700 billion on new technology and innovation, we’d have a stronger, new, real economy. Up to now, the discussion has focused on the sectors that have been mismanaged rather than the sectors that are creating our future,” he said.

Geoffrey Moore, a partner with Mohr Davidow Ventures and author of five bestselling business books, says that whatever form the government stimulus takes, it must focus on the nation’s greatest strength.

“America is probably the best culture in the world at failing,” he said. “We’re willing to navigate in a fog and keep moving forward. Our competitive advantage tends to be at the fuzzy front end of things when you’re still finding your way. Once the way has been found, we’re back at a disadvantage. So, yes, investing in innovation is critical.”

Jaw Shaw-kong (趙少康), former chairman of Broadcasting Corp of China and leader of the “blue fighters,” recently announced that he had canned his trip to east Africa, and he would stay in Taiwan for the recall vote on Saturday. He added that he hoped “his friends in the blue camp would follow his lead.” His statement is quite interesting for a few reasons. Jaw had been criticized following media reports that he would be traveling in east Africa during the recall vote. While he decided to stay in Taiwan after drawing a lot of flak, his hesitation says it all: If

When Democratic Progressive Party (DPP) caucus whip Ker Chien-ming (柯建銘) first suggested a mass recall of Chinese Nationalist Party (KMT) legislators, the Taipei Times called the idea “not only absurd, but also deeply undemocratic” (“Lai’s speech and legislative chaos,” Jan. 6, page 8). In a subsequent editorial (“Recall chaos plays into KMT hands,” Jan. 9, page 8), the paper wrote that his suggestion was not a solution, and that if it failed, it would exacerbate the enmity between the parties and lead to a cascade of revenge recalls. The danger came from having the DPP orchestrate a mass recall. As it transpired,

Sitting in their homes typing on their keyboards and posting on Facebook things like, “Taiwan has already lost its democracy,” “The Democratic Progressive Party is a party of green communists,” or “President William Lai [賴清德] is a dictator,” then turning around and heading to the convenience store to buy a tea egg and an iced Americano, casually chatting in a Line group about which news broadcast was more biased this morning — are such people truly clear about the kind of society in which they are living? This is not meant to be sarcasm or criticism, but an exhausted honesty.

Much has been said about the significance of the recall vote, but here is what must be said clearly and without euphemism: This vote is not just about legislative misconduct. It is about defending Taiwan’s sovereignty against a “united front” campaign that has crept into the heart of our legislature. Taiwanese voters on Jan. 13 last year made a complex decision. Many supported William Lai (賴清德) for president to keep Taiwan strong on the world stage. At the same time, some hoped that giving the Chinese Nationalist Party (KMT) and the Taiwan People’s Party (TPP) a legislative majority would offer a