China will come under renewed pressure at this weekend's G7 meeting in London to ditch its fixed exchange rate regime and instead allow the yuan to float freely on the foreign exchanges.

The country is causing panic among European manufacturers as a flood of Chinese-made clothes and shoes has come into the EU since import restrictions were ended on Jan. 1. It emerged on Wednesday that imports of Chinese-made shoes into the EU rose nearly 700 percent in the first four months of this year.

Chinese Finance Minister Jin Renqing (

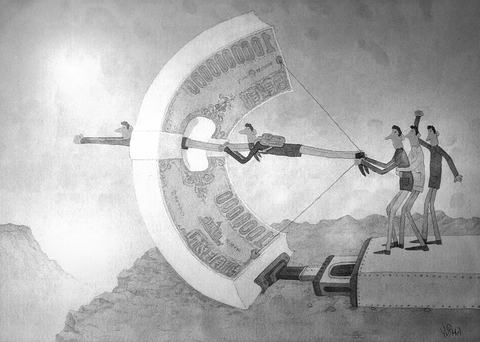

ILLUSTRATION: YU SHA

But the country's growing importance in the world economy -- it will overtake Britain in size over the next year or so -- means it cannot be ignored.

It is far from clear that Jin will be persuaded by any amount of ear-bashing to change the yuan's 10-year-old fixed exchange rate of 8.3 to the US dollar.

China considers the peg to be a domestic affair and many experts think that pressure from other countries to change or even abandon it could make the Chinese authorities simply dig their heels in further.

While Chinese officials have indicated that it would be desirable at some point to move to some sort of floating currency, they have resisted intense pressure, especially from the US, to announce an immediate revaluation of the yuan.

US Secretary of the Treasury John Snow has long maintained that part of the reason that the US has such an enormous trade deficit is that China is holding its currency artificially low by buying up huge quantities of dollar assets thereby making Chinese exports artificially cheap.

Indeed, Snow has given the Chinese a six-month deadline in which to revalue the yuan. Failing that, the US Congress is preparing to slap tariffs on Chinese imports.

US Federal Reserve chief Alan Greenspan piled on the pressure on Tuesday, telling a conference in Beijing: "The issue of allowing flexibility in some form in the [yuan] strikes me as very much to the advantage of China and indeed it is something that I am certain they will take on reasonably soon."

His opposite number at the People's Bank of China, Zhou Xiaochuan (

Political pressure from other countries would not help, he said.

"This is not a favorable environment for China to put forward its reform and for its decision-making process," Zhou said, adding that each stage of the reform process would be consulted on with different groups in the country.

Chinese Premier Wen Jiabao (

Nevertheless, financial markets across the globe are abuzz with speculation that the Chinese could be saying all this to keep any revaluation under wraps until it actually happens. Some economists expect some sort of change before Chinese President Hu Jintao (

That could be a small revaluation linking the yuan to a basket of currencies rather than just the dollar, or even a larger revaluation.

Janet Henry, senior global economist at HSBC, warns against great expectations of any move from the Chinese.

"Our assumption remains that the Chinese authorities will focus primarily on domestic financial reform, with only limited changes likely to the exchange rate regime in the coming months," she said.

The most plausible options for China would be either changing to a peg against a basket of currencies or allowing a "crawling" peg against the dollar -- whereby the exchange rate would be altered periodically and gradually.

With the economy already slowing, although still growing strongly, the Chinese authorities will be keen to avoid a large revaluation for fear of the impact of a drop in the competitiveness of the country's exports, Henry said.

The Chinese economy has been growing at an annual 10 percent or more for many years, sucking in raw materials from around the world and pushing up commodity prices to record levels. Gleaming new cities in places such as Shanghai have sprung up as a result of a construction boom.

Irritation is growing in the West about the surge in exports of Chinese textiles and shoes this year since the quota regimes were phased out.

Wednesday's figures from the European Commission showed imports of Chinese shoes into the EU in the first four months of the year were up 681 percent from the same period last year, to 161 million pairs.

The average price per pair was 2.4 euros (US$2.94), a tenth of the price of the average pair of shoes exported by Italy.

The EU is about to slap temporary emergency quotas on imports of Chinese T-shirts and flax yarn if China does not voluntarily rein in exports, something the Chinese agreed to when they joined the WTO in 2001.

Recently, China launched another diplomatic offensive against Taiwan, improperly linking its “one China principle” with UN General Assembly Resolution 2758 to constrain Taiwan’s diplomatic space. After Taiwan’s presidential election on Jan. 13, China persuaded Nauru to sever diplomatic ties with Taiwan. Nauru cited Resolution 2758 in its declaration of the diplomatic break. Subsequently, during the WHO Executive Board meeting that month, Beijing rallied countries including Venezuela, Zimbabwe, Belarus, Egypt, Nicaragua, Sri Lanka, Laos, Russia, Syria and Pakistan to reiterate the “one China principle” in their statements, and assert that “Resolution 2758 has settled the status of Taiwan” to hinder Taiwan’s

Can US dialogue and cooperation with the communist dictatorship in Beijing help avert a Taiwan Strait crisis? Or is US President Joe Biden playing into Chinese President Xi Jinping’s (習近平) hands? With America preoccupied with the wars in Europe and the Middle East, Biden is seeking better relations with Xi’s regime. The goal is to responsibly manage US-China competition and prevent unintended conflict, thereby hoping to create greater space for the two countries to work together in areas where their interests align. The existing wars have already stretched US military resources thin, and the last thing Biden wants is yet another war.

As Maldivian President Mohamed Muizzu’s party won by a landslide in Sunday’s parliamentary election, it is a good time to take another look at recent developments in the Maldivian foreign policy. While Muizzu has been promoting his “Maldives First” policy, the agenda seems to have lost sight of a number of factors. Contemporary Maldivian policy serves as a stark illustration of how a blend of missteps in public posturing, populist agendas and inattentive leadership can lead to diplomatic setbacks and damage a country’s long-term foreign policy priorities. Over the past few months, Maldivian foreign policy has entangled itself in playing

A group of Chinese Nationalist Party (KMT) lawmakers led by the party’s legislative caucus whip Fu Kun-chi (?) are to visit Beijing for four days this week, but some have questioned the timing and purpose of the visit, which demonstrates the KMT caucus’ increasing arrogance. Fu on Wednesday last week confirmed that following an invitation by Beijing, he would lead a group of lawmakers to China from Thursday to Sunday to discuss tourism and agricultural exports, but he refused to say whether they would meet with Chinese officials. That the visit is taking place during the legislative session and in the aftermath