Recycling, as conceived in the flower-power 1970s, was never about making pots of money, and mostly it hasn't. In recent years, hopes began to fade in many cities around the nation that it could ever even pay its own way.

New York City led the gloomy refrain last summer when it announced that recycling of glass and plastic containers would be halted to help ease the city's budget crisis. The program, Mayor Michael R. Bloomberg said, had simply become too expensive to sustain. And when the Department of Sanitation sought offers in November to resume part of the program, early returns were just as bleak: Seven proposals came in for a combined metals and plastics contract and most would require the city to pay, and pay dearly, if recycling were to return.

All the bids, that is, but one.

A family-owned scrap-metal company, the Hugo Neu Corp, which has been shredding cars and appliances for sale on the global steel market for the last half century, quietly raised its hand and announced that despite all arguments to the contrary, recycling was profitable.

The company, through a joint partnership that it manages, Hugo Neu Schnitzer East, offered to pay the city US$5.15 a ton (about 0.9 tonnes) for all the tuna fish cans and plastic water bottles New Yorkers could sort. It was the only bid to carry that shimmering, illusive word, written in black ink rather than red: pay. The next closest offer, from Waste Management, the giant disposal company, would require the city to pay US$67 for every ton of metal and plastic taken away. Before the program was suspended, the city was collecting about 7,900 tonnes of plastic and metal for recycling every month.

Surprise bid

The surprise bid put recycling back on the table in New York, environmentalists and waste-industry experts said. First, it would generate, rather than cost, money -- perhaps, for plastic and metal, for the first time (paper recycling is already profitable). Second, it came from outside the traditional waste-disposal industry, which has taken over more and more of the nation's recycling business in the last decade.

"What this remarkable bid shows is that markets are not the problem -- there is real private interest," said Mark A. Izeman, a lawyer at the Natural Resources Defense Council, a New York-based conservation group. "I think this is one of the most significant solid-waste developments in New York in years."

But the bid from Hugo Neu, which processed much of the twisted steel from the World Trade Center for sale on the world scrap market, also presents risks for New York, other experts say, because it would mean stepping away from the familiar corporate umbrella offered by companies like Waste Management, which have established track records and national networks on which recycled materials can be sold.

Waste Management was the second-place bidder for New York's full recycling program for metal, plastic and glass, which was opened for bidding last fall for a scheduled return in 2004. The price to beat? Once again, Hugo Neu's. In that part of the bidding, all the competitors offered bids requiring the city to pay rather than get paid -- mainly because glass is so costly and problematic to recycle and resell -- but Hugo Neu's was the cheapest, by US$13 a ton.

A spokeswoman for the Department of Sanitation said that the agency was still reviewing the bids, and so could not comment on the specifics of any offer. A decision is expected later this year.

Officials at Hugo Neu, which is led by the tightly knit Neu family (the chairman and chief executive, John L. Neu, is the son of the founder, Hugo Neu, a German immigrant who started the company in 1945), said they were led to make the bid by a complicated arc of changes in their industry and in the company's relationship with New York City.

Salvaging Ground zero

Neu said that the tense, emotional months of rescue and cleanup at ground zero, as the scarred steel from the trade towers arrived here ton by ton, created a bond -- emotional and economic -- that wasn't there before.

Last summer, the company began handling New York's residential metal recycling -- until a permanent contract could be awarded -- and that also changed the calculations; officials said they learned how valuable that portion of the recycling stream was, and what exactly was in it. Commodity prices can fluctuate widely, but since July, the company said, it has paid New York US$22 to US$30 a ton for the metals.

The general manager of the Hugo Neu Schnitzer East partnership, Robert A. Kelman, who is Neu's brother-in-law, said that if the company was awarded the contract, the profits from metal recycling would subsidize the plastics portion, just enough to make both work financially. He said that about 40 new jobs would be added, mostly for the plastics operation, in addition to the 750 people the company already employs in the region and around the country.

A spokesman for Waste Management said the company did not comment on bids that were still being considered, or on other companies' bids.

Hugo Neu's vice president in charge of environmental and public affairs, Wendy K. Neu (John Neu's wife and Kelman's sister), said she thought Bloomberg, however much he was criticized for suspending recycling, should also get credit for reframing the debate, because it was on that altered terrain of profit and loss that the company analyzed the process and realized that money could be made.

"At the time, I was horrified -- you worry that once you dismantle a program, it's very hard to bring it back," Wendy Neu said. "But in hindsight, I think there have been problems, and perhaps this has encouraged a debate -- whether we're the ones to do it or someone else is, people are thinking differently."

But nothing Hugo Neu has to offer will make New York's choice easy, waste experts said. Environmentalists like Izeman at the Natural Resources Defense Council are already applying pressure to accept the Hugo Neu bid and bring back recycling immediately, saying the city would be "foolish" to reject an offer with immediate revenue benefits.

Other experts said the city had to think about the long term, and that the national network of contacts and contracts that the big waste companies provide might simply be something that smaller scrap dealers are would be unable to offer. "A small guy is just going to have a hard time," said James Thompson Jr., the president of Chartwell Information Publishers, a San Diego company that tracks the waste industry.

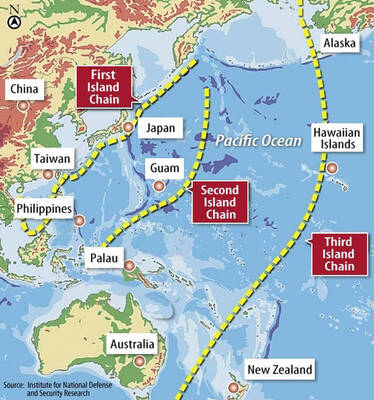

The US government has signed defense cooperation agreements with Japan and the Philippines to boost the deterrence capabilities of countries in the first island chain, a report by the National Security Bureau (NSB) showed. The main countries on the first island chain include the two nations and Taiwan. The bureau is to present the report at a meeting of the legislature’s Foreign Affairs and National Defense Committee tomorrow. The US military has deployed Typhon missile systems to Japan’s Yamaguchi Prefecture and Zambales province in the Philippines during their joint military exercises. It has also installed NMESIS anti-ship systems in Japan’s Okinawa

‘WIN-WIN’: The Philippines, and central and eastern European countries are important potential drone cooperation partners, Minister of Foreign Affairs Lin Chia-lung said Minister of Foreign Affairs Lin Chia-lung (林佳龍) in an interview published yesterday confirmed that there are joint ventures between Taiwan and Poland in the drone industry. Lin made the remark in an exclusive interview with the Chinese-language Liberty Times (the Taipei Times’ sister paper). The government-backed Taiwan Excellence Drone International Business Opportunities Alliance and the Polish Chamber of Unmanned Systems on Wednesday last week signed a memorandum of understanding in Poland to develop a “non-China” supply chain for drones and work together on key technologies. Asked if Taiwan prioritized Poland among central and eastern European countries in drone collaboration, Lin

BACK TO WORK? Prosecutors said they are considering filing an appeal, while the Hsinchu City Government said it has applied for Ann Kao’s reinstatement as mayor The High Court yesterday found suspended Hsinchu mayor Ann Kao (高虹安) not guilty of embezzling assistant fees, reducing her sentence to six months in prison commutable to a fine from seven years and four months. The verdict acquitted Kao of the corruption charge, but found her guilty of causing a public official to commit document forgery. The High Prosecutors’ Office said it is reviewing the ruling and considering whether to file an appeal. The Taipei District Court in July last year sentenced Kao to seven years and four months in prison, along with a four-year deprivation of civil rights, for contravening the Anti-Corruption

NO CONFIDENCE MOTION? The premier said that being toppled by the legislature for defending the Constitution would be a democratic badge of honor for him Premier Cho Jung-tai (卓榮泰) yesterday announced that the Cabinet would not countersign the amendments to the local revenue-sharing law passed by the Legislative Yuan last month. Cho said the decision not to countersign the amendments to the Act Governing the Allocation of Government Revenues and Expenditures (財政收支劃分法) was made in accordance with the Constitution. “The decision aims to safeguard our Constitution,” he said. The Constitution stipulates the president shall, in accordance with law, promulgate laws and issue mandates with the countersignature of the head of the Executive Yuan, or with the countersignatures of both the head of the Executive Yuan and ministers or