Taiwan’s two major fuel suppliers yesterday announced small hikes in fuel prices for this week, citing an increase in global crude prices due to tensions in the Middle East.

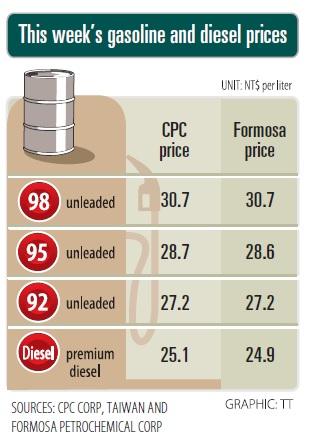

The state-run oil refiner, CPC Corp, Taiwan (CPC, 台灣中油), said it will raise its gasoline and diesel prices by NT$0.2 per liter, starting today. With the adjustment, retail prices at CPC gas stations will be NT$27.2 per liter for 92 octane unleaded, NT$28.7 per liter for 95 octane unleaded, NT$30.7 per liter for 98 octane unleaded, and NT$25.1 per liter for super diesel.

The price of crude oil rose US$0.89 last week to US$62.35 per barrel, said CPC, which calculates its fuel prices based on a weighted formula composed of 70 percent Dubai crude and 30 percent Brent crude.

One of the main factors that contributed to the rise in crude prices was the recent attack on oil tankers in the Gulf of Oman, CPC said.

Formosa Petrochemical Corp (台塑石化) announced identical fuel price hikes, which also take effect today.

With the increase, prices at Formosa gas stations will be NT$27.2 per liter for 92 octane unleaded, NT$28.6 per liter for 95 octane unleaded, NT$30.7 per liter for 98 octane unleaded and NT$24.9 per liter for diesel.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

It is challenging to build infrastructure in much of Europe. Constrained budgets and polarized politics tend to undermine long-term projects, forcing officials to react to emergencies rather than plan for the future. Not in Austria. Today, the country is to officially open its Koralmbahn tunnel, the 5.9 billion euro (US$6.9 billion) centerpiece of a groundbreaking new railway that will eventually run from Poland’s Baltic coast to the Adriatic Sea, transforming travel within Austria and positioning the Alpine nation at the forefront of logistics in Europe. “It is Austria’s biggest socio-economic experiment in over a century,” said Eric Kirschner, an economist at Graz-based Joanneum

BUBBLE? Only a handful of companies are seeing rapid revenue growth and higher valuations, and it is not enough to call the AI trend a transformation, an analyst said Artificial intelligence (AI) is entering a more challenging phase next year as companies move beyond experimentation and begin demanding clear financial returns from a technology that has delivered big gains to only a small group of early adopters, PricewaterhouseCoopers (PwC) Taiwan said yesterday. Most organizations have been able to justify AI investments through cost recovery or modest efficiency gains, but few have achieved meaningful revenue growth or long-term competitive advantage, the consultancy said in its 2026 AI Business Predictions report. This growing performance gap is forcing executives to reconsider how AI is deployed across their organizations, it said. “Many companies

France is developing domestic production of electric vehicle (EV) batteries with an eye on industrial independence, but Asian experts are proving key in launching operations. In the Verkor factory outside the northern city of Dunkirk, which was inaugurated on Thursday, foreign specialists, notably from South Korea and Malaysia, are training the local staff. Verkor is the third battery gigafactory to open in northern France in a region that has become known as “Battery Valley.” At the Automotive Energy Supply Corp (AESC) factory near the city of Douai, where production has been under way for several months, Chinese engineers and technicians supervise French recruits. “They