Despite its weak revenue growth guidance for this quarter, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) might see stronger growth from next quarter thanks to its next-generation packaging technology.

Analysts said the integrated fan-out (InFO) packaging could help TSMC beat rival Samsung Electronic Co in winning more A10 application processor orders from Apple, because the technology has the advantage of lower costs, higher speed and thinner form, compared with conventional flip chip packaging.

The InFO technology is at least 20 percent cheaper than existing packaging technology, Yuanta Securities Investment Consulting Co (元大投顧) analyst George Chang (張家麒) said in a report issued on Tuesday last week.

TSMC already has a complete InFO portfolio aimed at different package sizes and applications, he said in the report.

In a quarterly earnings conference call with investors on Thursday last week, TSMC co-chief executive officer C.C. Wei (魏哲家) said the company has almost completed equipment installation at a facility in Taoyuan’s Longtan District (龍潭) in preparation for InFO volume production.

“We expect to complete customer product qualification shortly and will be ready for volume production this quarter,” Wei said at the conference.

In addition to high-volume preparation and product qualification, “we are working on yield improvement and cost reduction,” Wei said.

TSMC, the world’s largest contract chipmaker, is sticking to its original estimate that InFO technology would contribute about US$100 million revenue in the final quarter of this year, Wei said.

“InFO will be a powerful technology to catch growth opportunity in both mobile and IoT [Internet of Things] markets,” he said.

Apple is widely speculated to unveil its new iPhone in the second half of this year, which analysts think is likely to drive TSMC’s business.

Daiwa Capital Markets Inc semiconductor analyst Rick Hsu (徐稦成) said that InFO is key to TSMC forging a closer relationship with Apple and adding momentum to future growth.

Hsu said TSMC demonstrated a solid track record of execution for A9 processors and its new InFO packaging is “another key to gaining traction with Apple.”

Researchers at Daiwa estimated that Apple’s order split for A9 processors was 45 to 55 percent for TSMC and Samsung, but this time the Taiwanese chipmaker could claim a lead in A10 processor orders against its South Korean rival, Hsu said in a report this week.

The increase in A10 orders is expected to help TSMC accelerate its revenue growth at “an above-seasonal” pace of 14 percent in the third quarter this year from the second quarter, Hsu said in a report on Thursday last week.

TSMC forecast revenue growth for the second quarter would only be between 6 to 7 percent from the previous quarter.

Following a significant volume ramp-up in the final quarter this year, the revenue contribution from InFO packaging could total US$300 million this year, Hsu said.

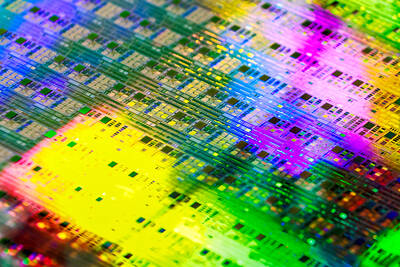

Industry watchers have said that TSMC’s interest in supporting the fan-out wafer-level packaging — which eliminates the need for the bumping process and it does not use the substrate in the flip chip process — shows that the company’s ambition to have a complete application processor, microcontroller units and graphics processing unit manufacturers, as well as semiconductor front-end process manufacturing and full back-end packaging services.

TSMC is the first chipmaker to commercialize the InFO technology for its 16 nanometer chips, providing both front-end and back-end services, Chang said, adding that it is becoming more difficult to solely rely on front-end tech node migration to drive better performance and cost.

Aside from Apple, other smartphone chip vendors are likely to follow suit in adopting InFO packaging along with TSMC’s 16 nanometer technology, if they are looking for a better solution for cost-sensitive, mid-end handsets, he said.

Shares of TSMC closed 1.24 percent lower at NT$159.5 on Friday in Taipei trading, after the company reported net profit fell 18 percent year-on-year in the first quarter.

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs