When US first lady Michelle Obama and Beyonce Knowles attended high-profile events in clothes made by African designers, it was a sure sign that the continent’s vibrant style has arrived on the world stage.

The showcasing of clothes from homegrown African designers in stores in New York, London and Tokyo is a sign of a broader change of attitude toward a continent that is earning a brighter reputation beyond stories of war and disease.

It has proven difficult for Africa’s homegrown designers to break into the mainstream fashion market because the perception has often been that products from the world’s poorest continent are of low quality or just not cool.

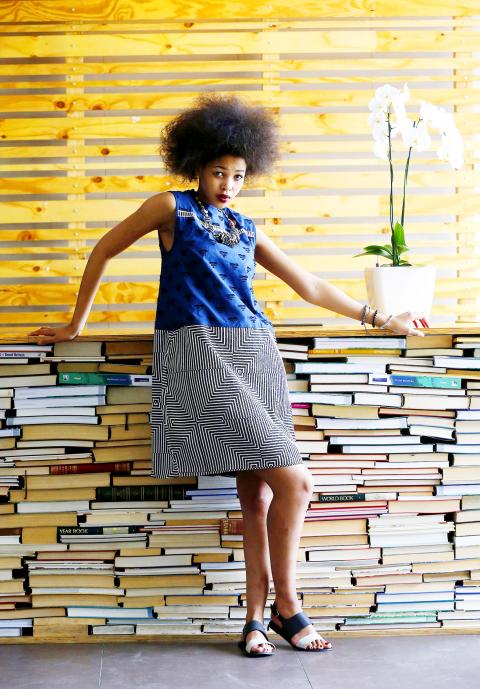

Photo: Reuters

Global fashion designers like Yves Saint Laurent took inspiration from Africa decades ago and more recently brands like Burberry, Louis Vuitton and Christian Dior have embraced the continent’s style and broadened its appeal.

However, consumers now want products made by Africans, not replicas produced by Western clothing chains, said Bethlehem Tilahun Alemu, who owns Ethiopian shoe company soleRebels, which has a dozen stores from Singapore to Greece.

“The global consumer today is hyper-aware. They want authentic and innovative ideas delivered from the authors of those ideas,” Bethlehem said.

“We have always had incredible design and production talent here, but it was invisible. That is changing,” she said.

In 2010, the first annual New York African Fashion Week gave homegrown designers the chance to showcase their work on the world stage.

Global celebrities have endorsed African designers, including Nigerian label Maki-Oh, Ghana’s Osei-Duro and South Africa-based retailer Kisua.com.

Nigerian lawyer-turned-designer Duro Olowu has become a well-known name in fashion circles and has a collection at US department store J.C. Penney and his own boutique store in central London.

“It was a good thing to see international designers putting African fashion on the map,” said Ghanaian entrepreneur Samuel Mensah, who quit his job as a fund manager to launch online clothes retailer Kisua.com.

“Now we’re starting to see Africa taking ownership of its own cultural assets. African designers are being noticed. They are stocked in international stores,” Mensah said.

While attitudes abroad have changed, the industry is also trying to meet latent demand for quality fashion among the growing middle-class at home.

“The change has been brought about by global developments, both economical change and a communication change,” said Roger Gerards, creative director at Vlisco, one of the world’s biggest producers of African fabric.

“People see other countries and other cultures more easily than 20 years ago because of social media,” Gerards added.

Sub-Saharan Africa is the second-fastest growing economic region in the world behind Asia and has a rapidly growing middle-class who have more access to world trends as mobile phones and the Internet reach tens of millions more people every year.

The industry has chosen to focus on middle-class consumers who value traditional manufacturing methods and local materials because it cannot compete with cheap mass-produced imports.

The lack of investment in infrastructure and a failure of African governments to agree on favorable trade agreements with each other have seen imports continue to rise.

China has grown its share of Africa’s clothing imports from 16 percent in 2001 to 55 percent in 2013, while intra-African trade has remained flat at about 10 percent of imports, according to International Trade Center data.

Even companies that are showcasing African talent often have to rely on resources outside the continent. Vlisco is based in the Netherlands, while Kisua.com only gets half of its materials from within Africa.

“It is easier for me to serve a client in New York or London than in Lagos or Nairobi,” said Mensah, who struggles with reliable warehousing and postal services in Africa.

CHIP RACE: Three years of overbroad export controls drove foreign competitors to pursue their own AI chips, and ‘cost US taxpayers billions of dollars,’ Nvidia said China has figured out the US strategy for allowing it to buy Nvidia Corp’s H200s and is rejecting the artificial intelligence (AI) chip in favor of domestically developed semiconductors, White House AI adviser David Sacks said, citing news reports. US President Donald Trump on Monday said that he would allow shipments of Nvidia’s H200 chips to China, part of an administration effort backed by Sacks to challenge Chinese tech champions such as Huawei Technologies Co (華為) by bringing US competition to their home market. On Friday, Sacks signaled that he was uncertain about whether that approach would work. “They’re rejecting our chips,” Sacks

NATIONAL SECURITY: Intel’s testing of ACM tools despite US government control ‘highlights egregious gaps in US technology protection policies,’ a former official said Chipmaker Intel Corp has tested chipmaking tools this year from a toolmaker with deep roots in China and two overseas units that were targeted by US sanctions, according to two sources with direct knowledge of the matter. Intel, which fended off calls for its CEO’s resignation from US President Donald Trump in August over his alleged ties to China, got the tools from ACM Research Inc, a Fremont, California-based producer of chipmaking equipment. Two of ACM’s units, based in Shanghai and South Korea, were among a number of firms barred last year from receiving US technology over claims they have

It is challenging to build infrastructure in much of Europe. Constrained budgets and polarized politics tend to undermine long-term projects, forcing officials to react to emergencies rather than plan for the future. Not in Austria. Today, the country is to officially open its Koralmbahn tunnel, the 5.9 billion euro (US$6.9 billion) centerpiece of a groundbreaking new railway that will eventually run from Poland’s Baltic coast to the Adriatic Sea, transforming travel within Austria and positioning the Alpine nation at the forefront of logistics in Europe. “It is Austria’s biggest socio-economic experiment in over a century,” said Eric Kirschner, an economist at Graz-based Joanneum

France is developing domestic production of electric vehicle (EV) batteries with an eye on industrial independence, but Asian experts are proving key in launching operations. In the Verkor factory outside the northern city of Dunkirk, which was inaugurated on Thursday, foreign specialists, notably from South Korea and Malaysia, are training the local staff. Verkor is the third battery gigafactory to open in northern France in a region that has become known as “Battery Valley.” At the Automotive Energy Supply Corp (AESC) factory near the city of Douai, where production has been under way for several months, Chinese engineers and technicians supervise French recruits. “They