European car sales rose at the slowest pace in five months last month as doubts about economic growth in the region contributed to a drop in Germany.

Registrations increased 4.2 percent to 1.13 million vehicles from 1.08 million a year earlier, the Brussels-based European Automobile Manufacturer’s Association (ACEA) said yesterday. Four-month sales gained 7.1 percent to 4.48 million cars.

Economic expansion in the countries sharing the euro has been unsteady since a recession ended a year ago, with Italian GDP shrinking in the first quarter and French GDP stagnating.

Car sales in Germany, Europe’s largest market at about one-quarter of deliveries, fell 3.6 percent last month, while Italy’s gain was just 1.9 percent. Growth was also was held back by a decline at the namesake brand of market leader Volkswagen AG and a slower-than-average increase at Fiat SpA.

“The fall of car sales in Germany reflects consumers’ and investors’ concern that other European countries’ problems could have an impact internally,” Milan Polytechnic business school dean Gianluca Spina said by telephone.

“The latest economic figures from France and Italy are worrisome for the entire region,” Spina added.

Group European sales by Wolfsburg, Germany-based Volkswagen rose 4.1 percent. Growth was restrained by a 0.5 percent decline at the VW marque, which is revising its midsize Passat sedan later this year, and a gain of 0.7 percent at the Audi luxury unit.

Turin, Italy-based Fiat’s sales increased just 1.5 percent as deliveries dropped at the Lancia and Chrysler units and at the Alfa Romeo division that is being retooled into a premium marque.

Industrywide sales gains last month were pushed by jumps of 16 percent at Renault SA, 8.7 percent at Ford Motor Co and 5.2 percent at Paris-based PSA Peugeot Citroen, Europe’s second-biggest automaker.

Renault’s no-frills Dacia nameplate has revamped the Duster sport-utility vehicle and Sandero hatchback, while the main brand of Boulogne-Billancourt, France-based Renault, has attracted buyers with the Captur crossover brought out a year ago.

The ACEA compiles figures from the 28-country EU, excluding Malta, as well as numbers from Switzerland, Norway and Iceland. Automaker executives in the region are predicting industrywide delivery growth of 2 to 3 percent for this year, following a six-year contraction to a two-decade low last year.

The increase last month was the slowest since November last year, with demand affected by the Easter holiday period being wholly in April this year. The period took place partly in March last year.

Germany was the only market among the top five in Europe to post a decline last month. Demand surged 29 percent in Spain, which ranks fifth in Europe, and rose 8.2 percent in the UK, the No. 2 market.

Investor confidence in Germany fell for a fourth straight month last month, and has declined this month as well.

“We are not seeing a real recovery in the car market in Europe, just a modest rebound,” said Gian Primo Quagliano, head of automotive-research company CSP in Bologna, Italy.

“Europe needs economic measures to boost consumption and bring back customers into showrooms,” Quagliano said.

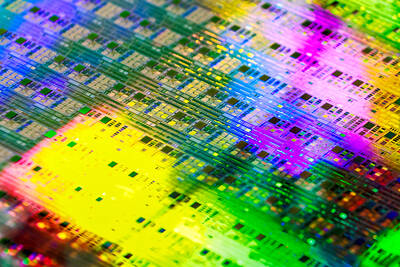

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

EXPORT GROWTH: The AI boom has shortened chip cycles to just one year, putting pressure on chipmakers to accelerate development and expand packaging capacity Developing a localized supply chain for advanced packaging equipment is critical for keeping pace with customers’ increasingly shrinking time-to-market cycles for new artificial intelligence (AI) chips, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) said yesterday. Spurred on by the AI revolution, customers are accelerating product upgrades to nearly every year, compared with the two to three-year development cadence in the past, TSMC vice president of advanced packaging technology and service Jun He (何軍) said at a 3D IC Global Summit organized by SEMI in Taipei. These shortened cycles put heavy pressure on chipmakers, as the entire process — from chip design to mass

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs