Australia’s latest floods disaster will have a minimal economic impact nationally despite some damage to rail lines, mines and crops in certain areas, Australian Treasurer Wayne Swan said yesterday.

In recent weeks record floods have swamped large areas of New South Wales and Queensland, prompting fears of a repeat of last year’s floods, which put a significant dent in Australia’s GDP for the financial year to June last year.

“Despite the terrible impact on affected communities, we’re not expecting the flooding to have a significant impact on the national economy at this stage,” Swan wrote in a regular economic note.

“While the heavy rainfall has resulted in the temporary closure of several rail lines and caused disruption to some coal mines, it hasn’t caused any significant disruptions to major coal mining operations in the Bowen Basin or the Hunter Valley,” he wrote. “And while some crops are likely to be affected by the damage to farm land, Treasury advises the impact on the supply and prices of fresh produce is not expected to be great.”

Swan said Australia’s economy continued to do well, forecasting output in the key resources sector would increase by about 77 percent by 2020.

The floods forced thousands of people from their homes and killed one person.

On Saturday, Australian Prime Minister Julia Gillard toured the flood-hit town of St George in Queensland, where she said A$1.9 billion (US$2 billion) of funding had been released to the state government in recent days to help it combat the latest disaster.

However, Swan said Australia’s economy, buoyed by demand from China for iron ore and coal, is feeling the impact of a global slowdown as employers defer hiring new workers on European uncertainty.

While Australia can still expect “solid growth,” the global environment and gains in the nation’s currency will affect non-mining sectors such as manufacturing, he said.

“We shouldn’t pretend that there’s a simple solution,” Swan said. “The affected businesses will need to do more to adapt, to improve their efficiency, to spot new opportunities, to find new markets and to design new products.”

The Reserve Bank of Australia sees average growth of 3.5 percent this year, down from last year’s Nov. 4 estimate of 4 percent. Consumer prices will rise 3 percent in the year through to the fourth quarter, less than a previous prediction of 3.25 percent, the central bank said on Friday.

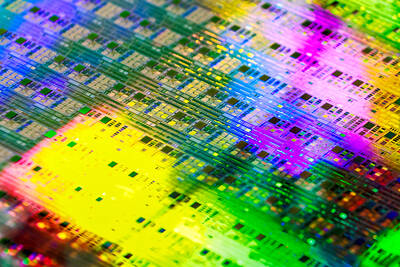

SEMICONDUCTOR SERVICES: A company executive said that Taiwanese firms must think about how to participate in global supply chains and lift their competitiveness Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) yesterday said it expects to launch its first multifunctional service center in Pingtung County in the middle of 2027, in a bid to foster a resilient high-tech facility construction ecosystem. TSMC broached the idea of creating a center two or three years ago when it started building new manufacturing capacity in the US and Japan, the company said. The center, dubbed an “ecosystem park,” would assist local manufacturing facility construction partners to upgrade their capabilities and secure more deals from other global chipmakers such as Intel Corp, Micron Technology Inc and Infineon Technologies AG, TSMC said. It

People walk past advertising for a Syensqo chip at the Semicon Taiwan exhibition in Taipei yesterday.

NO BREAKTHROUGH? More substantial ‘deliverables,’ such as tariff reductions, would likely be saved for a meeting between Trump and Xi later this year, a trade expert said China launched two probes targeting the US semiconductor sector on Saturday ahead of talks between the two nations in Spain this week on trade, national security and the ownership of social media platform TikTok. China’s Ministry of Commerce announced an anti-dumping investigation into certain analog integrated circuits (ICs) imported from the US. The investigation is to target some commodity interface ICs and gate driver ICs, which are commonly made by US companies such as Texas Instruments Inc and ON Semiconductor Corp. The ministry also announced an anti-discrimination probe into US measures against China’s chip sector. US measures such as export curbs and tariffs

The US on Friday penalized two Chinese firms that acquired US chipmaking equipment for China’s top chipmaker, Semiconductor Manufacturing International Corp (SMIC, 中芯國際), including them among 32 entities that were added to the US Department of Commerce’s restricted trade list, a US government posting showed. Twenty-three of the 32 are in China. GMC Semiconductor Technology (Wuxi) Co (吉姆西半導體科技) and Jicun Semiconductor Technology (Shanghai) Co (吉存半導體科技) were placed on the list, formally known as the Entity List, for acquiring equipment for SMIC Northern Integrated Circuit Manufacturing (Beijing) Corp (中芯北方積體電路) and Semiconductor Manufacturing International (Beijing) Corp (中芯北京), the US Federal Register posting said. The