Taiwan’s once-booming textile industry entered this decade in need of a wake-up call, with global competition having reduced exports by more than a third. However, one firm has received a boost from a surprising source: coffee.

The S. Cafe fabric, made by Singtex Industrial Co (興采實業), incorporates recycled coffee grounds from Starbucks and 7-Eleven, and has proved to be a hit with heavyweight international brands including Nike and North Face.

Industry figures say the fiber — more than three years in development and sold under the slogan “Drink it, wear it” — shows how the sector might reinvent itself as green, savvy and even cool.

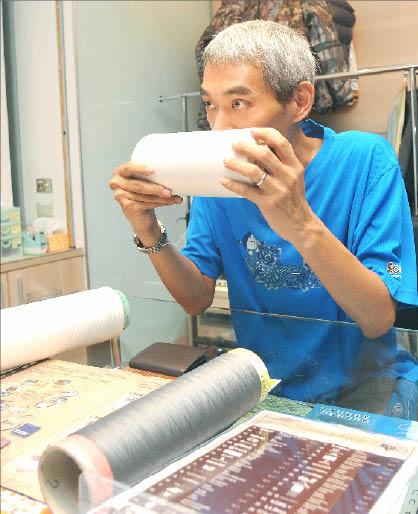

Photo: AFP, Patrick Lin

“S. Cafe fiber marks a technological breakthrough in the company’s research and development,” said Jason Chen (陳國欽), the company’s 50-year-old chairman, who drinks four cups of coffee a day.

The nation’s textile exports peaked in 1997 with a value of US$16.7 billion, but since then overseas shipments have been declining, as wages have gone up while tough and nimble rivals have emerged in China.

Partly because of the global financial crisis, exports hit a nadir of US$9.4 billion in 2009, according to figures compiled by Taiwan Textile Research Institute (紡織產業綜合研究所), a semi-official industry research unit.

Yet Frank Hsu (許文正), deputy secretary-general of the Taiwan Textile Federation (台灣紡拓會), says this is not the end of the story.

“The textile industry is by no means a ‘sunset industry,’” he said. “Rather, the sun is right above our heads.”

The textile sector, in which 4,000 companies now employ about 190,000 workers, needs a renaissance, but it may not be easy — and it definitely will not be cheap.

Singtex spent NT$50 million (US$1.7 million), or about a third of its capital, to develop its new fabric, about 2 percent of which is coffee extracts, with the rest polyester or nylon. However, the investment has paid off.

S. Cafe revenues came in at about NT$100 million last year and sales from fiber-related businesses have hit NT$170 million in the five months to May, accounting for 20 percent of the company’s revenues.

The addition of coffee grounds helps to control odors and protect against UV rays, as well as enabling the fabric to dry faster. However, too many grounds would make the fibers snap easily, meaning the process had to be finely calibrated.

The results have created a buzz. US outdoor footwear and apparel giant Timberland describes a jacket using the fabric as “our most environmentally conscious performance jacket ever.”

Altogether, Singtex supplies fabric to nearly 70 globally noted brands, from Germany’s Puma to Japan’s Mizuno.

Its secret was helping those firms make environmental concerns part of their corporate image.

“This is a smart marketing strategy. It speaks directly to the hearts of environmentally conscious consumers,” said Yin Cheng-ta, a Taiwan Textile Research Institute official.

As the industry seeks fresh vitality, Singtex’s success is remarkable, but not unique. Inventiveness has become a necessity for companies who have not moved their production to low-cost areas in China and Southeast Asia.

Several firms have branched out into creating fine fibers, with companies including Nan Ya Plastics Co (南亞塑膠), Zig Sheng Industrial Co (集盛實業) and Chain Yarn Co (展頌) producing yarns with less than five denier — compared with a normal 75 denier.

“Cloth made of such yarns is so fine that it is usually described as ‘second skin’ — it’s almost like the skin of babies,” Yin said.

Cloth made of such fine yarns sells for about US$5 per meter, compared with US$1 or US$2 for normal cloth.

However, the dyeing and -manufacturing processes are so demanding that only a few countries, such as Italy and Taiwan, produce the cloth, he added.

Hsu said he was optimistic about the outlook for the industry despite the drop in volumes. Profit margins are currently a healthy 20 percent, he said.

Still, Chen said that innovation is a challenge for small textile businesses in Taiwan, which spend an average 1.7 percent to 2 percent of their yearly revenues on research compared with Singtex’s 3.5 percent spend.

“Maintaining the niche isn’t easy,” he said.

Shares in Taiwan closed at a new high yesterday, the first trading day of the new year, as contract chipmaker Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) continued to break records amid an artificial intelligence (AI) boom, dealers said. The TAIEX closed up 386.21 points, or 1.33 percent, at 29,349.81, with turnover totaling NT$648.844 billion (US$20.65 billion). “Judging from a stronger Taiwan dollar against the US dollar, I think foreign institutional investors returned from the holidays and brought funds into the local market,” Concord Securities Co (康和證券) analyst Kerry Huang (黃志祺) said. “Foreign investors just rebuilt their positions with TSMC as their top target,

H200 CHIPS: A source said that Nvidia has asked the Taiwanese company to begin production of additional chips and work is expected to start in the second quarter Nvidia Corp is scrambling to meet demand for its H200 artificial intelligence (AI) chips from Chinese technology companies and has approached contract manufacturer Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) to ramp up production, sources said. Chinese technology companies have placed orders for more than 2 million H200 chips for this year, while Nvidia holds just 700,000 units in stock, two of the people said. The exact additional volume Nvidia intends to order from TSMC remains unclear, they said. A third source said that Nvidia has asked TSMC to begin production of the additional chips and work is expected to start in the second

REVENUE PERFORMANCE: Cloud and network products, and electronic components saw strong increases, while smart consumer electronics and computing products fell Hon Hai Precision Industry Co (鴻海精密) yesterday posted 26.51 percent quarterly growth in revenue for last quarter to NT$2.6 trillion (US$82.44 billion), the strongest on record for the period and above expectations, but the company forecast a slight revenue dip this quarter due to seasonal factors. On an annual basis, revenue last quarter grew 22.07 percent, the company said. Analysts on average estimated about NT$2.4 trillion increase. Hon Hai, which assembles servers for Nvidia Corp and iPhones for Apple Inc, is expanding its capacity in the US, adding artificial intelligence (AI) server production in Wisconsin and Texas, where it operates established campuses. This

Garment maker Makalot Industrial Co (聚陽) yesterday reported lower-than-expected fourth-quarter revenue of NT$7.93 billion (US$251.44 million), down 9.48 percent from NT$8.76 billion a year earlier. On a quarterly basis, revenue fell 10.83 percent from NT$8.89 billion, company data showed. The figure was also lower than market expectations of NT$8.05 billion, according to data compiled by Yuanta Securities Investment and Consulting Co (元大投顧), which had projected NT$8.22 billion. Makalot’s revenue this quarter would likely increase by a mid-teens percentage as the industry is entering its high season, Yuanta said. Overall, Makalot’s revenue last year totaled NT$34.43 billion, down 3.08 percent from its record NT$35.52