The government’s efforts to restructure the troubled computer memory chip sector has made little headway since a consolidation plan was unveiled earlier this year when local companies were in a financial mess.

Moreover, a recent price rebound for dynamic random access memory (DRAM) chips and expected new chip demand following the launch of Microsoft Corp’s Windows 7 operating system are likely to undermine the government’s clout in shaping the industry landscape, analysts and companies said.

“The government’s efforts are destined to be a flop,” Liu Szu-liang (劉思良), a DRAM analyst with Yuanta Investment Consulting (元大投顧), said by telephone on Friday. “The optimal timing for consolidation and securing technological support from outside has passed.”

Global DRAM prices leaped 21 percent quarter-on-quarter in the third quarter, after a rise of 19 percent in the previous quarter, market researcher iSuppli Corp said in its latest report on Thursday. The second-quarter price rebound marked the first since the fourth quarter of 2006, the report showed.

“Third-quarter results from major suppliers show that the DRAM industry recovery is no mirage,” Mike Howard, senior analyst at iSuppli, said in a statement.

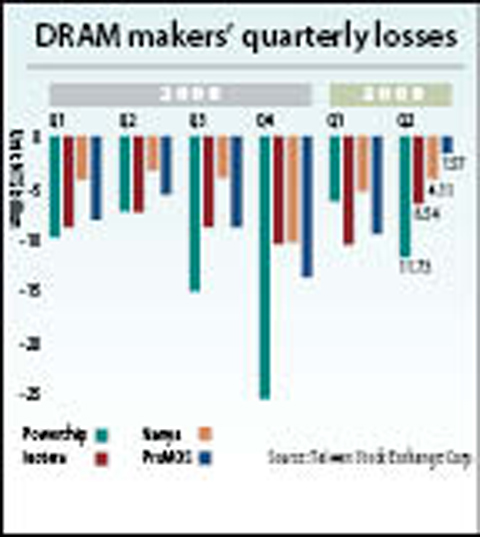

Taiwan’s major DRAM makers — Nanya Technology Corp (南亞科技), Powerchip Semiconductor Corp (力晶半導體), Inotera Memories Inc (華亞科技) and ProMOS Technologies Inc (茂德科技) — have seen monthly revenues rise by 15 percent per month for the last three months, iSuppli said.

Meanwhile, Nanya and Inotera on Wednesday posted narrower losses for the third quarter, indicating further progress toward profitability.

“It is almost impossible now to bring DRAM representatives back to the negotiating table as rebounding demand ignites their new hope of making a comeback without government controls,” Liu said.

TAIWAN MEMORY CO

In June, the government-backed Taiwan Memory Co (TMC, 台灣創新記憶體公司) was launched with small capital of NT$500,000. In July, the government said it would allocate a maximum of NT$30 billion (US$926 million) to support one or two DRAM companies to compete with South Korean firms and set last Tuesday as the deadline for local firms to submit requests for government funds.

The government hoped the establishment of TMC would help overhaul the local DRAM sector. TMC, however, has made no progress apart from saying it was seeking a partnership with Elpida Memory Inc, Japan’s biggest memory-chip maker, as its technological partner and secured supply capacity from ProMOS.

One obvious example that local DRAM companies feel no need for government support is Nanya’s announcement last Tuesday that it decided not to launch a consolidation plan to get a government capital injection.

“The DRAM industry is now different from what it was a year ago. The best timing for DRAM reformation or consolidation under this scheme has passed. To consolidate partial capacity does not bring much help to DRAM restructuring,” Nanya, the nation’s top DRAM maker, said in a statement issued after the application deadline passed.

Inotera president Charles Kau (高啟全) also said the company would not apply for state funding because market situations had improved.

Inotera is a joint venture between Nanya and Micron.

“At present, every DRAM company has found a way [to survive],” Kau told reporters last week. “And we are able to do what the government meant to do [developing technologies independently and rooting technologies in Taiwan] on our own,” Kau said. “Private companies should not run their businesses with public funds.”

Nanya and Inotera do not need government money because they have gained strong financial support from parent company Formosa Plastic Group (台塑集團) to pay for a pricey technological migration. After posting narrower third-quarter losses, the two companies said on Wednesday they planned to invest a NT$64 billion next year in upgrading their manufacturing lines to the cost-efficient 50-nanometer and 40-nanometer technologies, up from an investment of about NT$26 billion this year.

POWERCHIP

Powerchip — the nation’s No. 2 DRAM supplier and once seen as a potential capacity supplier to TMC — decided to submit an application for government funding just before the deadline.

The company said it planned to accelerate its diversification into flash memory chipmaking by forming Taiwan Flash Co (TFC, 台灣快閃記憶體公司) and was confident in securing the funds because it had developed flash memory manufacturing technologies with the assistance of Japan’s Renesas Technology Corp several years ago.

DRAM chips are mainly used in personal computers, while flash chips are commonly seen in music players and digital cameras.

The Hsinchu-based company is expected to obtain an initial NT$4.5 billion investment from the government to develop TFC into a flash memory designer. Overall, Powerchip said it hoped to obtain as much as NT$8 billion in public funds.

As for the smaller Winbond Electronics Corp (華邦電子), which produces DRAM and other memory chips used in consumer electronics, the company decided to stick to its previous plan of gradually exiting the PC DRAM market.

“Without fresh capital to upgrade DRAM manufacturing technologies, Winbond and Powerchip were forced to shift to new product lines that are less demanding in technologies,” Liu said.

While some Taiwanese DRAM companies survived the last industrial slump in 2000, there is slim possibility that they can make a comeback this time, because most firms have accumulated massive debts and were unlikely to get any new bank loans or investment to finance technological migration, he said.

“Most Taiwanese DRAM makers may be forced out of the market in the foreseeable future. They have lagged far behind their global rivals in technology and are unable to catch up,” Liu said.

Quanta Computer Inc (廣達) chairman Barry Lam (林百里) is expected to share his views about the artificial intelligence (AI) industry’s prospects during his speech at the company’s 37th anniversary ceremony, as AI servers have become a new growth engine for the equipment manufacturing service provider. Lam’s speech is much anticipated, as Quanta has risen as one of the world’s major AI server suppliers. The company reported a 30 percent year-on-year growth in consolidated revenue to NT$1.41 trillion (US$43.35 billion) last year, thanks to fast-growing demand for servers, especially those with AI capabilities. The company told investors in November last year that

Intel Corp has named Tasha Chuang (莊蓓瑜) to lead Intel Taiwan in a bid to reinforce relations between the company and its Taiwanese partners. The appointment of Chuang as general manager for Intel Taiwan takes effect on Thursday, the firm said in a statement yesterday. Chuang is to lead her team in Taiwan to pursue product development and sales growth in an effort to reinforce the company’s ties with its partners and clients, Intel said. Chuang was previously in charge of managing Intel’s ties with leading Taiwanese PC brand Asustek Computer Inc (華碩), which included helping Asustek strengthen its global businesses, the company

Taiwanese suppliers to Taiwan Semiconductor Manufacturing Co. (TSMC, 台積電) are expected to follow the contract chipmaker’s step to invest in the US, but their relocation may be seven to eight years away, Minister of Economic Affairs J.W. Kuo (郭智輝) said yesterday. When asked by opposition Chinese Nationalist Party (KMT) Legislator Niu Hsu-ting (牛煦庭) in the legislature about growing concerns that TSMC’s huge investments in the US will prompt its suppliers to follow suit, Kuo said based on the chipmaker’s current limited production volume, it is unlikely to lead its supply chain to go there for now. “Unless TSMC completes its planned six

TikTok abounds with viral videos accusing prestigious brands of secretly manufacturing luxury goods in China so they can be sold at cut prices. However, while these “revelations” are spurious, behind them lurks a well-oiled machine for selling counterfeit goods that is making the most of the confusion surrounding trade tariffs. Chinese content creators who portray themselves as workers or subcontractors in the luxury goods business claim that Beijing has lifted confidentiality clauses on local subcontractors as a way to respond to the huge hike in customs duties imposed on China by US President Donald Trump. They say this Chinese decision, of which Agence