The Bank of Japan (BOJ) stepped closer to currency intervention yesterday than at any time in the last five years by checking exchange rates with commercial banks as the yen rallied to a 14-year high against the dollar.

Still, market sources said intervention was highly unlikely in the short term and that authorities were instead aiming to temper the sentiment driving the yen higher.

While the central bank made its presence known in the market, Japanese Finance Minister Hirohisa Fujii raised the prospect of a G7 joint statement on currencies to cool the yen’s rally.

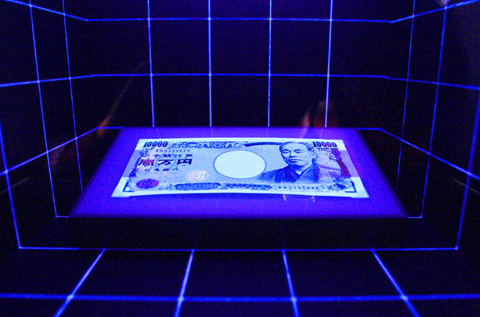

PHOTO: REUTERS

The dollar slumped to a low of ¥84.82 as investors shunned riskier assets after news about Dubai’s debt problems, but it pared its losses after Fujii’s comments because his rhetoric was sharper than it had been on Thursday.

G7 countries issued a statement in October last year when the yen rallied against other major currencies, so traders and analysts said a joint statement was possible.

But joint intervention was extremely unlikely, they said. Such action might send the wrong signal at a time when the G7 wants to encourage China to let the yuan rise by maintaining flexible currency markets.

Unilateral intervention by Japan was also unlikely because the yen’s rise is largely the result of the dollar’s broad weakness, and the BOJ would not have enough financial firepower to reverse the dollar’s decline.

The mere threat of joint action though was enough to curb the yen’s gains against the dollar, traders said.

“I would respond flexibly to a joint statement on currencies,” Fujii told reporters after a Cabinet meeting.

Fujii said he was also flexible about contacting currency authorities in the US and Europe, adding that he was very nervous about currency moves and it was possible Japan could respond.

He declined to comment on intervention, saying he was not in a position to use the word due to commitments with other G7 countries on currency flexibility.

Market sources said the government and the Bank of Japan had checked dollar-yen rates with commercial banks, going beyond their usual practice of market contact than at any time since authorities intervened earlier this decade to curb yen strength from harming exports.

That intervention came to a stop in March 2004 after authorities dumped ¥35 trillion over 15 months.

During that period, the finance ministry and the BOJ often checked rates as a prelude to intervention.

“The Bank of Japan may have wanted to make its presence felt,” a trader said of yesterday’s rate checking.

The dollar has been in a long-term decline. Against a basket of major currencies it hit a 15-month low on Thursday.

“I would not be surprised if the G7 or the Group of 20 issues a statement to prevent the dollar from weakening further, although it is unclear if they will act now or wait until a G7 meeting in February,” said Koji Fukaya, a senior currency strategist at Deutsche Securities in Tokyo. “But the statement would unlikely be the kind issued in October last year, because the current situation stems from a weak dollar.”

The yen has risen 5.3 percent since the end of last year. In trade-weighted terms, its rise is also modest with the currency well below highs hit in January.

“I have not heard of intervention at this point but in the future there will be various options and if necessary I’ll talk to ministers involved,” Japanese National Strategy Minister Naoto Kan told reporters.

The dollar’s decline against major currencies has been more pronounced, and traders say its slump against the yen is more a symptom of worries that low US interest rates are fostering economic bubbles and that chances of a Dubai debt default are reigniting financial turmoil.

“I can’t see what purpose dollar/yen intervention would serve,” said Hideki Amikura, executive director of foreign exchange services at Nomura Trust & Banking Co in Tokyo.

CALL FOR SUPPORT: President William Lai called on lawmakers across party lines to ensure the livelihood of Taiwanese and that national security is protected President William Lai (賴清德) yesterday called for bipartisan support for Taiwan’s investment in self-defense capabilities at the christening and launch of two coast guard vessels at CSBC Corp, Taiwan’s (台灣國際造船) shipyard in Kaohsiung. The Taipei (台北) is the fourth and final ship of the Chiayi-class offshore patrol vessels, and the Siraya (西拉雅) is the Coast Guard Administration’s (CGA) first-ever ocean patrol vessel, the government said. The Taipei is the fourth and final ship of the Chiayi-class offshore patrol vessels with a displacement of about 4,000 tonnes, Lai said. This ship class was ordered as a result of former president Tsai Ing-wen’s (蔡英文) 2018

UKRAINE, NVIDIA: The US leader said the subject of Russia’s war had come up ‘very strongly,’ while Jenson Huang was hoping that the conversation was good Chinese President Xi Jinping (習近平) and US President Donald Trump had differing takes following their meeting in Busan, South Korea, yesterday. Xi said that the two sides should complete follow-up work as soon as possible to deliver tangible results that would provide “peace of mind” to China, the US and the rest of the world, while Trump hailed the “great success” of the talks. The two discussed trade, including a deal to reduce tariffs slapped on China for its role in the fentanyl trade, as well as cooperation in ending the war in Ukraine, among other issues, but they did not mention

HOTEL HIRING: An official said that hoteliers could begin hiring migrant workers next year, but must adhere to a rule requiring a NT$2,000 salary hike for Taiwanese The government is to allow the hospitality industry to recruit mid-level migrant workers for housekeeping and three other lines of work after the Executive Yuan yesterday approved a proposal by the Ministry of Labor. A shortage of workers at hotels and accommodation facilities was discussed at a meeting of the legislature’s Transportation Committee. A 2023 survey conducted by the Tourism Administration found that Taiwan’s lodging industry was short of about 6,600 housekeeping and cleaning workers, the agency said in a report to the committee. The shortage of workers in the industry is being studied, the report said. Hotel and Lodging Division Deputy Director Cheng

‘SECRETS’: While saying China would not attack during his presidency, Donald Trump declined to say how Washington would respond if Beijing were to take military action US President Donald Trump said that China would not take military action against Taiwan while he is president, as the Chinese leaders “know the consequences.” Trump made the statement during an interview on CBS’ 60 Minutes program that aired on Sunday, a few days after his meeting with Chinese President Xi Jinping (習近平) in South Korea. “He [Xi] has openly said, and his people have openly said at meetings, ‘we would never do anything while President Trump is president,’ because they know the consequences,” Trump said in the interview. However, he repeatedly declined to say exactly how Washington would respond in