US President Donald Trump's administration is negotiating a deal that could commit Taiwan to fresh investment and training of US workers in semiconductor manufacturing and other advanced industries, five people familiar with the matter said. Under the arrangement, Taiwanese companies including Taiwan Semiconductor Manufacturing Co (TSMC) would send new capital and workers to expand their US operations and train US workers, the sources said. Taiwan's exports to the US are currently subject to a 20 percent tariff, and Taipei has been in talks to reduce that figure as part of an overarching deal with Washington. Semiconductors, vital for all kinds of high-tech products, are currently exempt from tariffs while the US builds domestic capacity. One of the people said the total US investment to be pledged by Taiwan would be smaller than that of its main regional economic rivals, and would include support to help Washington build science park infrastructure drawing on Taiwanese know-how. The person and others spoke on condition of anonymity because of the sensitivity of the matter. South Korea and Japan have pledged a total of US$350 billion and US$550 billion in investment in the US respectively, under deals to trim US tariffs on most of their goods to 15 from 25 percent. It was unclear when the Taiwan deal would close or what specifics would make it into the final agreement, the people said. They cautioned that any deal terms could change until they were finalized in negotiations. The workforce training aspect of the deal has not previously been reported. "Until announced by President Trump, reporting about potential trade deals is speculation," White House spokesman Kush Desai said. The US trade representative's office did not respond to a request for comment. Trump has previously said some skilled foreign workers may be necessary to train Americans in state-of-the-art factories. TSMC, which declined to comment on the

About 7,000 people on Saturday evening attended a Double Ten National Day event at Arizona State University (ASU) in Phoenix. The free event offered Taiwanese delicacies, a night market with craft vendors, children's activities and live performances. Phoenix and Taipei have been sister cities for 46 years. About 30,000 Taiwanese live in the US city, which is also home to more than 40 Taiwanese companies and more than 500 Taiwanese students. The celebration was organized in partnership with Phoenix Sister Cities and Taipei Sister Cities, as well as Phoenix Mayor Kate Gallego and Vice Mayor Ann O’Brien. The highlight of the event was a drone show sponsored by Taiwan Semiconductor Manufacturing Co (TSMC), with 150 colored drones lighting up the sky to form the Taiwan flag, the Chinese characters for Taiwan, and motifs including Taipei 101 and a Formosan black bear, staged to the song Far Away (千里之外) by Jay Chou (周杰倫) featuring Fei Yu-ching (費玉清). Phoenix has hosted Double Ten National Day celebrations at ASU for the past four years. More than 1,000 TSMC employees and their families were in attendance. Gallego spoke of the strong bond between Phoenix and Taiwan, saying she hopes that through the celebration, “our friends from Taiwan will feel at home, and that those who are only just learning about Taiwan feel as moved as I do.” China Airlines and Starlux this year announced direct flights between Phoenix and Taipei, the city’s first non-stop route to Asia, she said. From bubble tea shops to soup dumplings, and from healthcare to the semiconductor industry, the relationship between the two cities boosts the local economy and makes Phoenix stronger, she added. “I proudly stand with the people of Taiwan. Tonight is about friendship, community and cultural exchange,” O’Brien said. Taiwan’s story is one of resilience and

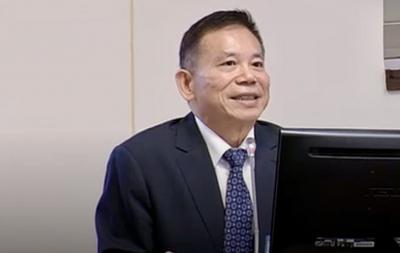

Taiwan is considering forming a high-tech strategic partnership with the US, which wants increased Taiwanese investment, Taipei’s top tariff negotiator said yesterday, giving an update on talks with Washington. Home to the world's biggest contract chipmaker, Taiwan Semiconductor Manufacturing Co (TSMC), Taiwan runs a large trade surplus with the US. Its exports to the US are currently subject to a 20 percent tariff, a figure Taipei is seeking to cut. Vice Premier Cheng Li-chiun (鄭麗君), who is leading the tariff talks with Washington, told reporters in Taipei she was hopeful both sides could reach a consensus on expanding investment in the US through a "Taiwan model." That would not involve relocating supply chains, but rather extending and expanding US production capacity, said Cheng, who returned this week from the latest round of talks. The government views the model for investing in the country as "industrial investment planning" coupled with government support measures such as export credit guarantees and joint Taiwan-US development of industrial clusters, she added. "The current negotiation focus is that the United States expects us to expand investments and engage in supply chain cooperation," she said. Neither the US Department of Commerce nor the Office of the US Trade Representative has responded to requests for comment on the talks. The US government went into shutdown yesterday. TSMC, whose business is surging on strong demand for artificial intelligence applications, is investing US$165 billion to build chip factories in Arizona, although the bulk of its production would remain in Taiwan. Cheng, who said that TSMC did not take part in the latest talks, repeated that a proposal floated in US media by US Secretary of Commerce Howard Lutnick for a 50-50 split in making chips is not something Taiwan would agree to and was not brought up. "We can clearly say that we understand that the US side's hope

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) today dismissed a local media report that claimed Nvidia CEO Jensen Huang (黃仁勳) visited Taiwan late last month to deliver a message from US President Donald Trump's administration. TSMC said Huang, a Taiwan-born naturalized US citizen, came at the company's invitation to give an internal speech. Chinese-language Mirror Media had reported that Huang's trip was aimed at pressing TSMC chairman C.C. Wei (魏哲家) to share profits on behalf of the Trump administration. Citing industry sources, the magazine said that Nvidia and Advanced Micro Devices Inc (AMD) had agreed to hand over 15 percent of revenue from artificial intelligence (AI) chip sales to China to the US government in exchange for approval to sell controlled products in China. Huang arrived in Taiwan by private jet on Aug. 22, spoke to TSMC executives at the company's research and development center in Hsinchu City, and attended a belated birthday celebration for TSMC founder Morris Chang (張忠謀). He also joined Wei and other TSMC executives for dinner before returning to the US shortly afterward, ending a whirlwind visit that lasted about 13 hours. TSMC today said that it has smooth communication channels with the US government and that the CEO of Nvidia — the world's largest company in terms of market capitalization as of last month — was invited by TSMC to give a speech. On Aug. 22, Wei was asked about reported US government plans to take an equity stake in TSMC in exchange for subsidies. "They have already announced that they will not take shares," he said. At the time, TSMC stated there had never been any discussions of equity participation and that communication with the US government has been smooth and positive.

The administration of US President Donald Trump is considering taking equity stakes in companies getting funds from the 2022 CHIPS and Science Act but has no similar plans for bigger firms boosting US investments, such as Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) and Micron Technology Inc, a White House official told Reuters yesterday. The official confirmed a Wall Street Journal report that the administration does not intend to seek equity stakes in semiconductor companies, such as Micron and TSMC, that plan to step up investment. On Tuesday, US Secretary of Commerce Howard Lutnick said the government was continuing to work on the possibility of taking a 10 percent stake in troubled chipmaker Intel Corp and suggested it would seek further stakes in other grant recipients. "If we're going to give you the money, we want a piece of the action for the American taxpayer," Lutnick told CNBC. While the administration of former US president Joe Biden had been giving "money for free" to companies such as Intel and TSMC, he added, "Donald Trump turned it into saying, 'Hey, we want equity for the money.'" At a March event with Trump at the White House, TSMC, which has Nvidia Corp and Apple Inc as key clients, announced plans for the new US$100-billion US investment, in addition to US$65 billion committed for three manufacturing facilities in Arizona. Micron boosted its US investment plans in June. TSMC executives have already had discussions about returning their subsidies if the Trump administration asks to become a shareholder, the Wall Street Journal said. The White House and TSMC declined to comment. Micron did not immediately respond to a request for comment. The US Department of Commerce, which oversees the US$52.7-billion CHIPS and Science Act, finalized subsidies of US$6.6 billion late last year for TSMC to produce semiconductors in the US. The commerce department did not immediately

Nvidia Corp cofounder and chief executive officer Jensen Huang (黃仁勳) arrived in Taipei today to visit chip foundry partner Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), as the world's most valuable company navigates rising friction between Washington and Beijing over access to its industry-leading artificial intelligence (AI) chips. "My main purpose coming here is to visit TSMC," he told reporters, adding that he would only stay a few hours and leave after dinner with TSMC leaders, according to a live feed broadcast by local media at Taipei's Songshan airport, where he landed in a private jet. TSMC confirmed Huang’s visit, saying it was an honor to host him and that he shared his business philosophy with managers at the company. US President Donald Trump earlier this month opened the door to the possibility of more advanced Nvidia chips beyond the H20 being sold in China. Reuters earlier this week reported that Nvidia was working on a new chip tentatively named the B30A based on its latest Blackwell architecture that would be more powerful than the H20 model. Asked about the B30A, Huang said Nvidia was in talks with the US over offering China a successor to its H20 chip, but that it was not the company's decision to make. "It’s up to, of course, the US government, and we are in dialogue with them, but it is too soon to know." he said. Nvidia only received permission last month to recommence sales of the H20. It was developed specifically for China after export restrictions were put in place in 2023, but the company was abruptly ordered to stop sales in April. Shortly after Washington's greenlight, Nvidia placed orders for 300,000 H20 chips with TSMC to add to its existing inventory due to strong demand from Chinese companies, Reuters reported. However, Nvidia was days later hit by allegations from China's

The interests of Taiwan and its companies are the government's top priority, a Cabinet source said today in response to reports that Washington may seek a stake in Taiwan Semiconductor Manufacturing Co (TSMC) in exchange for CHIPS and Science Act funding. Reuters reported on Wednesday that US Secretary of Commerce Howard Lutnick said the US government is considering taking equity stakes in chipmakers that receive CHIPS Act subsidies. Lutnick told CNBC that the administration is in talks with Intel Corp about a 10-percent stake, and may pursue similar arrangements with other companies. According to two anonymous sources, the firms under consideration could include Micron Technology Inc, Samsung Electronics Co and TSMC, the world's largest advanced chipmaker. The Cabinet source, who requested anonymity, said the US is Taiwan's most important strategic partner but that the competitiveness of Taiwan's semiconductor and electronics sectors is predicated on government policies and cooperation with the global high-tech industry. "It did not come out of nowhere, and it will not be gone all of a sudden," the source said. Minister of Economic Affairs J.W. Kuo (郭智輝) said on Wednesday that TSMC is a private company and that Taiwan's negotiating team has not raised the issue with him. If the US does seek to invest in TSMC, Kuo said the Department of Investment Review would review the matter, noting that an expert assessment of its potential impact would be necessary. Meanwhile, Pegatron Corp chairman Tung Tzu-hsien (童子賢) cited former US president Ronald Reagan's words: "In this present crisis, government is not the solution to our problem; government is the problem." Calling on the Trump administration to "take your hands off," Tung argued that "TSMC, Intel and Samsung will become more competitive if they can be put to the market's test [without interference]." The Wall Street Journal reported today that a US official downplayed the possible inclusion of

US President Donald Trump said yesterday that the US is to place a tariff of approximately 100 percent on imported semiconductor chips. "We'll be putting a tariff of approximately 100% on chips and semiconductors. But if you're building in the United States of America, there's no charge," Trump said in the Oval Office. The announcement came just hours before Trump's country-specific tariffs were set to take effect. It also came amid mounting concern in Taiwan — a leading producer of the world's most advanced semiconductors — about the potential impact a chip tariff could have on its semiconductor industry and overall economy. Taiwan is home to the world's leading chipmaker, Taiwan Semiconductor Manufacturing Co. (TSMC), and plays a vital role in the global supply of semiconductors used in everything from smartphones and cars to military equipment. In March, TSMC pledged to invest an additional US$100 billion to expand its semiconductor manufacturing operations in the US.

National Development Council (NDC) Minister Paul Liu (劉鏡清) today said Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) could benefit from new US tariffs. US President Donald Trump announced 100-percent tariffs on semiconductor imports, with exemptions for companies that already have or are in the process of building production facilities in the US. TSMC is expected to be relatively unscathed as it has US factories, so key customers such as Nvidia are unlikely to face increased tariff costs for US-made chips. Nvidia also reportedly plans to invest hundreds of billions of US dollars in the US. TSMC did not immediately reply to a request for comment, and a Nvidia spokesperson declined to comment. “At the present time, we are optimistic towards them [TSMC],” Liu said today. As for Trump’s comments on Tuesday that TSMC would increase its investment to US$300 billion, Liu said that it was not discussed and that this outlook is based on the already-announced investment of US$165 billion. Other Taiwanese firms that qualify for exemptions include Sino-American Silicon Products Inc (SAS, 中美晶), through its facility in Texas, and United Microelectronics Corp (UMC, 聯電), through its collaboration with Intel. Liu made his comments at a meeting of the Legislative Yuan’s Economics Committee, where lawmakers from both the ruling and opposition parties questioned him about tariffs. In response to a question from Democratic Progressive Party (DPP) Legislator Chen Ting-fei (陳亭妃) about the new 100-percent tariffs, Liu said that the total impact is “not as big as imagined,” once TSMC and SAS are removed from the equation. TSMC has factories in the US already not subject to tariffs, which is a positive for the company, Liu added. The industry as a whole has three options for how to respond to tariffs: building factories in the US, like TSMC; acquiring manufacturing facilities through mergers and acquisitions, like SAS; and collaborating with US firms, like

US President Donald Trump yesterday suggested that Taiwan Semiconductor Manufacturing Co (TSMC) could invest US$300 billion in Arizona, which, if true, would be nearly double the total investment TSMC has announced to date in the US. "We have the biggest in the world ... from Taiwan is coming over and spending US$300 billion in Arizona building the biggest plant in the world for chips and semiconductors," Trump said in an interview on CNBC's financial talk show Squawk Box. Trump also said new tariffs on semiconductors and chips would be unveiled "within the next week or so," calling them a separate category because the US wants those products made domestically. TSMC declined to respond to media inquiries about Trump's remarks this morning, but said any related comments would be made through official company statements. Following Trump's remarks, TSMC's US depositary receipts fell 2.73 percent to close at US$232.47 and the company's shares on the Taiwan Stock Exchange (TWSE) dropped NT$25 (US$0.84) to NT$1,125 during early trading today, down 2.17 percent. With TSMC the largest company in Taiwan in terms of market capitalization, the share drop pulled the weighted index down by about 201 points and erased NT$648.3 billion from the market. Trump's comment attracted attention in Taiwan because of the tariff situation it faces. Unlike its main competitors Japan and South Korea, which are being hit with 15 percent tariffs by the US, Taiwan faces tariffs of 20 percent. There has been speculation that Taiwan would have to pledge a huge amount of investment in the US to bring that tariff rate down, with Minister of Economic Affairs J.W. Kuo (郭智輝) suggesting on Monday in a meeting with business representatives that the figure could be as high as US$400 billion. In March, TSMC announced it would "expand its investment in the US to US$165 billion to power the future of

The US’ Semiconductor Industry Association (SIA) yesterday announced it has selected Taiwan Semiconductor Manufacturing Co (TSMC) chairman C.C. Wei (魏哲家) and former chairman Mark Liu (劉德音) to receive its highest honor. The two were selected as corecipients of the Robert N Noyce Award, which recognizes leaders for “outstanding contributions to the semiconductor industry in technology and/or public policy.” They are to accept their prize at the SIA Awards Dinner on Nov. 20 in San Jose, California, it said. “Dr C.C. Wei and Dr Mark Liu are titans in our industry, having reshaped the modern semiconductor ecosystem,” SIA president and CEO John Neuffer said in a news release. “Combined, these visionary leaders have brought more than 80 years of industry experience and expertise to bear while leading pioneering work to advance semiconductor innovation,” Neuffer said. TSMC is the world’s largest contract chipmaker, a “cornerstone” of the semiconductor supply chain and a “critical player” within the industry, the association said. The firm has developed “countless” advancements that have enabled technology breakthroughs in computers, smartphones, artificial intelligence and more, it said. “It is humbling to receive SIA’s Noyce Award and to follow in the footsteps of so many industry visionaries, including TSMC founder Dr Morris Chang (張忠謀),” Wei said in the news release. “[This award] reflects the collective efforts and dedication of countless individuals,” Wei added. “To receive the Noyce Award is both a profound honor and a great responsibility, as it inspires us to encourage future generations of industry leaders,” Liu said. “I am thankful to SIA for recognizing both C.C. and me, and to the many mentors, including Dr Morris Chang, colleagues and partners who have supported me in contributing to the remarkable innovation and growth of the semiconductor field,” he added. TSMC continues to expand, having announced in May that it is building nine new manufacturing and packaging facilities this year

Rick Cassidy, the chairman of Taiwan Semiconductor Manufacturing Co's (TSMC, 台積電) US subsidiary, TSMC Arizona Corp, plans to retire, but the company has yet to name a successor. After Cassidy made his intention to retire known, TSMC Arizona held a special general meeting and approved a resolution that Cassidy would not continue as chairman and would not remain as a director, TSMC said in a statement filed with the Taiwan Stock Exchange last night. The meeting also approved a plan to appoint TSMC Arizona president Rose Castanares as a director, the company said, adding that Cassidy has been named as an advisor to TSMC Arizona. Cassidy joined TSMC's subsidiary in North America in 1997 as a vice president for customer management and was promoted to be the subsidiary's president and chief executive officer in 2005, the world's largest contract chipmaker said. Cassidy was named TSMC's vice president in 2008, supervising the chipmaker's business in the North American market, and then took the title of TSMC senior vice president, TSMC said. He served as TSMC Arizona president from December 2020 to April 2023, before becoming chairman of the board in April 2023, it said. During his 27 years at TSMC, Cassidy was dedicated to providing the best service to the company's clients and won their trust, and he made a significant contribution to the fabless IC design model and to the company's growth, TSMC said. TSMC held a board meeting in Arizona in mid-February, marking the first time that the company held such a meeting in the US in its 37-year history. The chipmaker is investing US$65 billion in Arizona to build three advanced wafer fabs. The first one began mass production last year, using the 4-nanometer process, and construction of the second is nearly completed, with the installation of equipment under way. TSMC broke ground on the

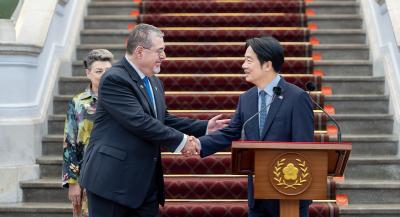

President William Lai (賴清德) met with Guatemalan President Bernardo Arevalo at the Presidential Office in Taipei with full military honors. The two signed agreements, including a memorandum of understanding (MOU) that would boost cooperation in the semiconductor field to increase Guatemala’s microchip capabilities and an MOU to establish a framework for political consultations, which would ensure regular, strategic coordination on key issues. The two countries would continue to build a mutually beneficial partnership in the face of mounting global challenges, Lai said, adding that the agreements would create new opportunities for cooperation. Arevalo, accompanied by his wife, and foreign and economic ministers, arrived in Taiwan yesterday, his first visit to the nation since taking office last year. Last year also marked the 90th anniversary of diplomatic ties between Taiwan and Guatemala, one of Taiwan’s 12 UN-recognized diplomatic allies. "Our two countries are geographically distant, but the ideals and values of the two peoples are closely intertwined," Lai said, adding that the long-standing partnership reflects their shared commitment to democracy, freedom and human rights. Ties have grown closer in the past few years, bringing a multitude of successes as cooperation expanded and diversified in the fields of health and sanitation, education and culture, science and technology and economic trade, he said. Taiwan would continue to work closely with Guatemala to provide youth exchange programs and scholarships to foster exceptional talent in science, technology and communications, he added. Lai encouraged Taiwanese businesses to invest in Guatemala and utilize its strategic location, natural resources and strong workforce to improve supply chain resilience and promote bilateral relations. The delegation is to visit Hsinchu Science Park and the headquarters of Taiwan Semiconductor Manufacturing Co this week. Guatemala last month sent a mission of 28 engineers to Taiwan for a three-week intensive training program in semiconductors. This week's visit reaffirms the two nations’ close ties and marks

Starlux Airlines today confirmed it is planning to launch direct flights to Phoenix in February next year. Starlux's confirmation came after Phoenix Mayor Kate Gallego said in a statement posted on the Phoenix Sky Harbor International Airport's Web site yesterday that the airline would begin nonstop flights between the US airport and Taiwan Taoyuan International Airport early next year, pending final government approval. According to the statement, Starlux is to fly to Phoenix three to four times a week. Gallego said the flights would be the first nonstop air services between Asia and Phoenix. It comes following a commitment by Taiwan Semiconductor Manufacturing Co (TSMC) to invest US$165 billion in chip production in Arizona. "Phoenix's first nonstop flight to Asia reflects the incredible strides we've made with our local economy, and our emergence as an international city," Gallego said in the statement. "TSMC's historic investment in Phoenix has brought thousands of high-wage jobs and boosted our reputation as a semiconductor hub, and now it's helping increase air service demand," she added. The statement cited the airport's most recent economic impact report as saying Phoenix international flights add more than US$3 billion to the local economy each year, and the Starlux service alone could have an economic impact of more than US$100 million a year. Also in the statement, Starlux chairman Chang Kuo-Wei (張國煒) said that from the moment when he set foot in Phoenix, he knew the carrier should make an investment there. "Not only is the growth of business between Taipei and Phoenix staggering, it's a perfect match for our level of service. We are proud and honored to be the first carrier to provide nonstop Asia service for the Phoenix community," Chang said. Starlux said services to Phoenix would initially begin using A350-900 aircraft equipped with 306 seats, and tickets would be available once it secures government approval. The

A former Japanese economics minister visiting Taiwan yesterday said that Taiwan, Japan and the US are establishing closer trilateral cooperation in the semiconductor industry, forming what he called a "semiconductor iron triangle." Former Japanese minister of economy, trade and industry Yasutoshi Nishimura, a current member of the lower house of the Japanese Diet, said he came up with the phrase "semiconductor iron triangle," because global semiconductor powerhouse Taiwan Semiconductor Manufacturing Co (TSMC) has a presence in Japan and the US. TSMC has a factory in Kumamoto, Japan, and is building chip fabs in Arizona, Nishimura said. TSMC's Arizona factory is using Japan-made manufacturing devices and materials, he said. That is why the trilateral cooperation in building advanced semiconductors is heading in the right direction in strengthening global supply chains, he added. Nishimura said he hopes with collaboration in advanced chips, Taiwan, Japan and the US can work closely in areas such as 5G, self-driving vehicles and generative artificial intelligence. Nishimura first proposed his "semiconductor iron triangle" idea during a speech to overseas Taiwanese in Japan last month. During that speech on April 13, Nishimura said Taiwan, Japan and the US need to closely unite to promote semiconductor development to jointly face an "arch enemy that steals semiconductor technology for military use," referring to China. The 62-year-old Japanese politician previously served as minister of state for economic and fiscal policy, and minister of economic revitalization. He promoted bilateral cooperation between Taiwan and Japan in the semiconductor industry while heading the economy and trade office from 2022 to 2023. Other than semiconductors and high-tech, the visiting Japanese Diet member also proposed closer Taipei-Tokyo exchanges in the energy sector. Japan is set to take advantage of renewable energy and nuclear energy to make sure it has sufficient power supply in pushing for

Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) broke ground on its third semiconductor manufacturing fab in Arizona yesterday, US President Donald Trump's 100th day in office, featuring a visit from US Secretary of Commerce Howard Lutnick. Lutnick visited TSMC's semiconductor fabrication facility in Phoenix where the company broke ground on a third fab facility, the US Department of State said in a news release issued later yesterday. In the statement, Lutnick emphasized the importance of TSMC's investments in the US, saying: "We are at TSMC Arizona to celebrate the return of American manufacturing." During the visit, TSMC chairman and CEO C.C. Wei (魏哲家) welcomed Lutnick and highlighted the progress made in its Arizona operation, the news release said. To support the needs of the US' leading innovators in smartphones, HPC and artificial intelligence (AI), "we recently broke ground on our third fab, which will introduce more advanced semiconductor capacity to the United States." Wei said. TSMC's major customers in the US also expressed support for the project. Apple Inc CEO Tim Cook said that as TSMC Arizona's largest customer, "we're excited for the future of American innovation and the incredible opportunities it will create." Nvidia founder and CEO Jensen Huang (黃仁勳) also said that AI is revolutionizing every aspect of the technology stack, and Nvidia AI supercomputers are at the foundation. "We're proud to produce our technology in Arizona, bringing AI infrastructure manufacturing back to America," he said. AMD chair and CEO Lisa Su (蘇姿丰) said that TSMC has been a key partner of her company for many years and AMD's deep collaboration with TSMC's R&D and manufacturing teams has enabled AMD to consistently deliver leadership products. TSMC, the world's largest chipmaker, said last month that it would invest an additional US$100 billion in the US to build three new chip manufacturing plants, along with two packaging facilities and a

Taiwan Semiconductor Manufacturing Co (TSMC) could face a penalty of US$1 billion or more to settle a US export control investigation over a chip it made that ended up inside a Huawei artificial intelligence (AI) processor, two people familiar with the matter said. The US Department of Commerce has been investigating the world's biggest contract chipmaker's work for China-based Sophgo, the sources said. The design company's TSMC-made chip matched one found in Huawei's high-end Ascend 910B AI processor, according to the people, who requested anonymity because they were not authorized to speak publicly about the matter. Huawei — a company at the center of China's AI chip ambitions that has been accused of sanctions busting and trade secret theft — is on a US trade list that restricts it from receiving goods made with US technology. TSMC made nearly 3 million chips in recent years that matched the design ordered by Sophgo and likely ended up with Huawei, according to Lennart Heim, a researcher at RAND's Technology and Security and Policy Center in Arlington, Virginia, who is tracking Chinese developments in AI. The US$1 billion-plus potential penalty comes from export control regulations allowing for a fine of up to twice the value of transactions that contravene the rules, the sources said. Because TSMC's chipmaking equipment includes US technology, the company's Taiwan factories are within reach of US export controls that prevent it from making chips for Huawei, or producing certain advanced chips for any customer in China without a US license. Heim said that based on the design, which is for AI applications, TSMC should not have made the chip for a company headquartered in China, especially given the risk that it could be diverted to a restricted entity like Huawei. Reuters could not determine how the White House is to proceed with TSMC or when the

A wave of stop-loss selling and panic selling hit Taiwan's stock market at its opening today, with the weighted index plunging 2,086 points — a drop of more than 9.7 percent — marking the largest intraday point and percentage loss on record. The index bottomed out at 19,212.02, while futures were locked limit-down, with more than 1,000 stocks hitting their daily drop limit. Three heavyweight stocks — Taiwan Semiconductor Manufacturing Co (TSMC, 台積電), Hon Hai Precision Industry Co (Foxconn, 鴻海精密) and MediaTek (聯發科) — hit their limit-down prices as soon as the market opened, falling to NT$848 (US$25.54), NT$138.5 and NT$1,295 respectively. TSMC's losses today mean that the microchip manufacturing company's share value has dropped NT$312 (26.9 percent) since its all-time high of NT$1,160 on Jan. 7, representing a total loss of NT$8.1 trillion. Meanwhile, the artificial intelligence sector suffered significant losses, with key stocks Quanta Computer Inc (廣達電腦) and Wistron Corp (緯創) also hitting their limit-downs at NT$210 and NT$90.9. Following Taiwan's four-day Tomb Sweeping Festival holiday, the local stock market's opening was the first trading in Taiwan since US President Donald Trump announced "reciprocal" tariffs against the US' global trading partners.

US Secretary of State Marco Rubio yesterday said that US President Donald Trump is opposed to any change of Taiwan's "status quo" by force or extortion and would maintain that policy. Speaking with conservative TV host Hugh Hewitt, Rubio said the US' policy is to maintain Taiwan's "status quo" and to oppose any changes in the situation by force or extortion. "That's the policy of the United States. That remains the policy of the United States," Rubio said. "That's been the policy of President Trump, and that will continue to be his policy. And when he makes policy decisions, he means them." Rubio's comments followed a statement on Tuesday by a US Department of State spokesperson, who described China's latest drills near Taiwan the previous day as "brazen and irresponsible threats" and reiterated Washington's decades-long support for Taipei. On Monday, the Chinese People's Liberation Army deployed more than two dozen military aircraft across the median line of the Taiwan Strait and sent dozens more into Taiwan's air defense identification zone (ADIZ), in collaboration with Chinese naval vessels, from 6am to about 9pm, according to data issued by Taiwan's military. In Rubio's interview on Tuesday, he was asked about the significance of Trump's meeting earlier this month with C.C. Wei (魏哲家), chairman of Taiwan Semiconductor Manufacturing Co (TSMC), which the president described as a "big deal." When asked whether Trump's comment was an indication of the US' resolve to stand with Taiwan, Rubio said Washington's policy on the issue remains the same as it has always been. On March 3, during a visit by Wei to the White House, Trump announced that TSMC would invest an additional US$100 billion in the US. According to Wei, the investment is intended to cover the establishment of three more advanced wafer fabs, two IC assembly plants, and one research and development

US President Donald Trump yesterday said that Taiwan Semiconductor Manufacturing Co (TSMC) chairman C.C. Wei (魏哲家) is one of the "most respected" people in the business world and is fully aware that his company should make large investments in the US to avoid tariffs. The US' current tariff policies would allow the US public to see "immediate" benefits, and TSMC has pledged to invest billions in the US to avoid tariffs on its products, Trump said in an interview with conservative TV host Sharyl Attkisson on her program Full Measure. "So you have the biggest chipmaker in the world coming in with US$200 billion," Trump said. "Mr Wei, one of the most respected people in business ... he's coming in, he's spending hundreds of billions of dollars, and he'll be spending it largely in Arizona." Trump said his tariffs threats have prompted many companies to bring large amounts of money into the US to build plants, which would need contractors, subcontractors, concrete and steel suppliers, and would provide more benefits down the road as job openings increase. The investment figure cited by Trump in the interview was at odds with the amount announced earlier for the expected new investment in the US by TSMC. On March 3, during a visit to the White House by Wei, Trump said that TSMC would invest an additional US$100 billion over the next few years to expand its semiconductor manufacturing operations in the US. Wei has said that the US$100 billion would be spent to build three new wafer fabs, two advanced IC packaging plants, and a research and development center in the state of Arizona. TSMC has already invested US$65 billion in three wafer fabs in Arizona, and the additional US$100 billion that was announced would push up the company's total investments in the US to US$165 billion. The expanded investment