Visitors mill around a bright red hilltop pagoda in southwestern China, gazing down at a sprawling cigarette factory whose deadly output has put an otherwise unremarkable city on the map.

China is home to a third of the world’s smokers and tobacco-related diseases are a major cause of death in the country — a trend likely to worsen as its population rapidly ages.

Beijing hopes to dramatically reduce that by the end of the decade, but even the government machine is struggling to achieve that as it clashes with a powerful state tobacco monopoly and local economies reliant on the crop.

Photo AP

That contradiction smolders in Yuxi, Yunnan province, whose nascent tourism businesses and local farmers thrive on its history of cigarette production.

A mostly agricultural area where incomes lag behind the national average, the city has firmly hitched its fortunes to tobacco, which accounted for almost a third of its gross domestic product in the first quarter of last year, according to official figures.

That income helps “pay for our children’s schooling or to build a house,” said farmer Li as her husband ploughed furrows into a hilltop field.

She said her family can earn up to 60,000 yuan (US$8,300) annually from the tobacco harvest, far exceeding other crops with more variable prices.

Tobacco also brings tourists to Yuxi — local firm Hongta, or “red tower,” is one of China’s most prominent cigarette brands.

Named for a centuries-old pagoda painted scarlet after the country’s communist takeover, it is owned by state-run monopoly the China National Tobacco Corporation and offers visitors factory tours, a museum and a tobacco-themed cultural park.

UP IN SMOKE

“Yuxi’s cigarettes are quite famous, so we’ve always wanted to come and have a look,” said a tourist surnamed Dong from the northeastern city of Dalian.

Foreign cigarettes, he said, “don’t put the same demand on quality.”

China is the world’s largest producer and consumer of tobacco and has more than 300 million smokers, according to the WHO.

As trains pull into stations across China, passengers frequently jump off for a quick cigarette on the platform before continuing their journey.

Indoor smoking bans are loosely enforced and the stench of tobacco smoke is commonplace, from public toilets to taxis and late-night eateries.

Beijing says it aims to reduce the number of smokers from around a quarter of the population to a fifth by 2030.

Progress has been slow. The number of smokers fell just 14 percent between 2010 and 2022, well below the average for richer nations, a study by a Chinese think tank found last year.

Policymakers must also navigate the interests of China Tobacco, which controls virtually all of the domestic production, processing and distribution.

The company has a chokehold on a domestic tobacco sector that last year generated a record 1.6 trillion yuan (US$220 billion) in taxes and profits.

The State Tobacco Monopoly Administration, responsible for industry oversight, has been criticized by researchers for being essentially the same organization under a different name.

This means the country’s largest cigarette manufacturer is its own regulator, in what has been decried by public health advocates as a clear conflict of interest and an impediment to effective tobacco controls.

The firm touts its contribution to the economy, but researchers into China’s tobacco market argue that the revenue does not outweigh the health costs.

CHANGING TIMES

A recent study found that the annual economic cost of cigarette smoking in China — estimated at 2.43 trillion yuan in 2020 — was approximately 1.6 times greater than the gains from the industry.

“Stronger tobacco control policies can reduce smoking prevalence without severely harming government revenue,” said Qinghua Nian at the Institute for Global Tobacco Control at Johns Hopkins Bloomberg School of Public Health.

Efforts to curb cigarette consumption at home have coincided with an overseas push from Hongta and other tobacco brands.

The country exported more than US$9 billion in tobacco and tobacco products in 2023, up from less than US$1.5 billion five years prior, according to the UN.

Beneath Yuxi’s looming red pagoda, tourist Dong said smoking was slowly losing its appeal among younger generations.

“As society develops, some things are progressing and it’s better to smoke less,” he said. “My children and grandchildren don’t smoke at all.”

But nearby, a worker surnamed Long watching over tobacco seedlings in a greenhouse at a plant nursery said the crop was still a good way to earn a living.

“Tobacco used to be a couple of yuan per pound, but now it’s a couple of dozen yuan,” the 54-year-old said.

“This critical industry is still a good source of income for farmers.”

Taiwan has next to no political engagement in Myanmar, either with the ruling military junta nor the dozens of armed groups who’ve in the last five years taken over around two-thirds of the nation’s territory in a sprawling, patchwork civil war. But early last month, the leader of one relatively minor Burmese revolutionary faction, General Nerdah Bomya, who is also an alleged war criminal, made a low key visit to Taipei, where he met with a member of President William Lai’s (賴清德) staff, a retired Taiwanese military official and several academics. “I feel like Taiwan is a good example of

March 2 to March 8 Gunfire rang out along the shore of the frontline island of Lieyu (烈嶼) on a foggy afternoon on March 7, 1987. By the time it was over, about 20 unarmed Vietnamese refugees — men, women, elderly and children — were dead. They were hastily buried, followed by decades of silence. Months later, opposition politicians and journalists tried to uncover what had happened, but conflicting accounts only deepened the confusion. One version suggested that government troops had mistakenly killed their own operatives attempting to return home from Vietnam. The military maintained that the

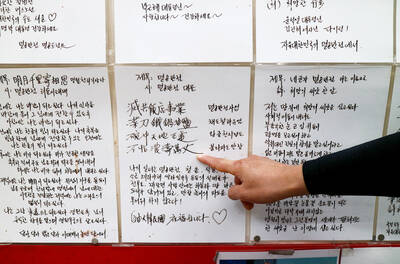

“M yeolgong jajangmyeon (anti-communism zhajiangmian, 滅共炸醬麵), let’s all shout together — myeolgong!” a chef at a Chinese restaurant in Dongtan, located about 35km south of Seoul, South Korea, calls out before serving a bowl of Korean-style zhajiangmian —black bean noodles. Diners repeat the phrase before tucking in. This political-themed restaurant, named Myeolgong Banjeom (滅共飯館, “anti-communism restaurant”), is operated by a single person and does not take reservations; therefore long queues form regularly outside, and most customers appear sympathetic to its political theme. Photos of conservative public figures hang on the walls, alongside political slogans and poems written in Chinese characters; South

Taipei Mayor Chiang Wan-an (蔣萬安) announced last week a city policy to get businesses to reduce working hours to seven hours per day for employees with children 12 and under at home. The city promised to subsidize 80 percent of the employees’ wage loss. Taipei can do this, since the Celestial Dragon Kingdom (天龍國), as it is sardonically known to the denizens of Taiwan’s less fortunate regions, has an outsize grip on the government budget. Like most subsidies, this will likely have little effect on Taiwan’s catastrophic birth rates, though it may be a relief to the shrinking number of