AFP, PARIS

Carbon-polluting corporations and their investors face a rising tide of climate litigation, according to a report released Friday, two days after a Dutch court ordered oil giant Shell to slash its greenhouse gas emissions.

Companies operating in rich economies — Britain, the EU, Australia and especially the US, which accounts for the vast majority of cases to date — are most vulnerable to future legal action, business risk analysts Verisk Maplecroft found.

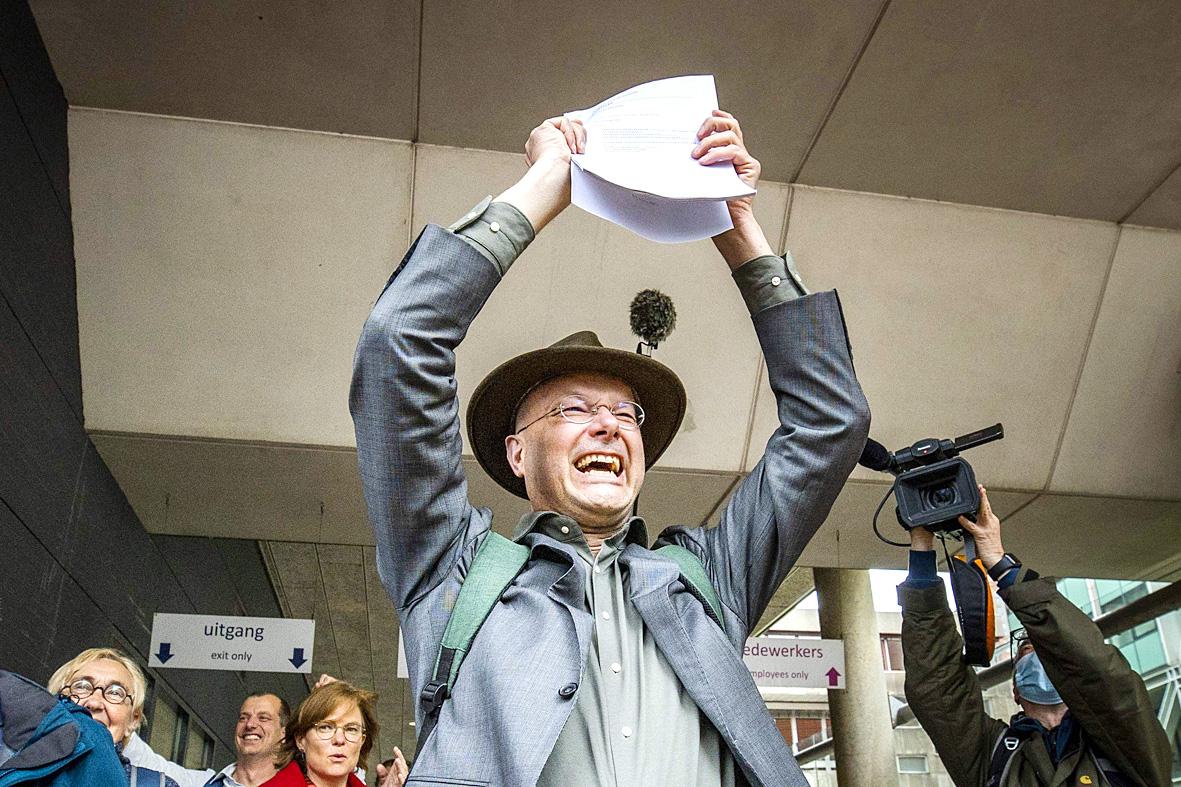

Photo: AFP

But the report also highlights a growing number of cases in developing countries despite more limited civil rights and a weaker rule of law.

“Our data points to a shift in major emerging economies, which might not bode well for the carbon-intensive companies operating there,” said Liz Hypes, Verisk Maplecroft’s senior environment and climate change analyst. “We are seeing climate litigation expand into countries where climate activism is lower but the threat of climate change is more significant.”

So far, most cases suing for strong climate action have been filed against governments.

But the Shell ruling, which ordered the Anglo-Dutch company to cut carbon emissions 45 percent by 2030, and other recent challenges to fossil fuel companies suggest the corporate world could see a crescendo of lawsuits.

Last month, New York City sued ExxonMobil and two other oil giants for greenwashing their products and intentionally misleading consumers about the extent to which they contribute to climate change.

An earlier bid by the Big Apple to hold five major gas and oil companies liable for damages caused by global warming was rejected weeks before by a federal court, but still inflicted reputational harm, Hypes said.

Also this week, investors brushed aside resistance from the company to install two activists board members at ExxonMobil, and at another annual investor meeting directed Chevron to deepen its emissions cuts.

More than 1,800 climate change-related cases have been filed in courts around the world in the last 25 years, most of them since 2010, according to a database maintained by the Sabin Center for Climate Change Law at Columbia Law School.

A “climate litigation index” in the new report assesses the likelihood of climate lawsuits in nearly 200 countries, based on prior litigation, public awareness, climate activism, and the strength of judicial systems. Not surprisingly, the US tops the risk ranking, followed by the UK, Australia, France and Germany. The next 17 countries on the list are all European, with the exception of Canada (10th) and Japan (18th).

But Mexico, Colombia, South Africa, Brazil and the Philippines are all in the top 50, with Indonesia, Pakistan and India just behind, the index showed.

As governments reacts to public pressure for faster climate action, corporations may run afoul of rapidly shifting regulatory environment.

Failure to curb emissions, and lack of transparency about business exposure to climate risk, can also damage brand reputation, even when courts rule in a company’s favour, as has happened in several US cases involving oil and gas majors.

Risk can also comes in the form of financial penalties as the scope of nature and climate litigation expands.

Companies, and their financial backers, “are facing genuine legal risks from which the repercussions may be significant,” Hypes said.

With fossil fuels generating 80 percent greenhouse gas emissions, oil and gas companies, and coal-powered electric utilities, are especially vulnerable to climate liability lawsuits.

Jacques Poissant’s suffering stopped the day he asked his daughter if it would be “cowardly to ask to be helped to die.” The retired Canadian insurance adviser was 93, and “was wasting away” after a long battle with prostate cancer. “He no longer had any zest for life,” Josee Poissant said. Last year her mother made the same choice at 96 when she realized she would not be getting out of hospital. She died surrounded by her children and their partners listening to the music she loved. “She was at peace. She sang until she went to sleep.” Josee Poissant remembers it as a beautiful

For many centuries from the medieval to the early modern era, the island port of Hirado on the northwestern tip of Kyushu in Japan was the epicenter of piracy in East Asia. From bases in Hirado the notorious wokou (倭寇) terrorized Korea and China. They raided coastal towns, carrying off people into slavery and looting everything from grain to porcelain to bells in Buddhist temples. Kyushu itself operated a thriving trade with China in sulfur, a necessary ingredient of the gunpowder that powered militaries from Europe to Japan. Over time Hirado developed into a full service stop for pirates. Booty could

Before the last section of the round-the-island railway was electrified, one old blue train still chugged back and forth between Pingtung County’s Fangliao (枋寮) and Taitung (台東) stations once a day. It was so slow, was so hot (it had no air conditioning) and covered such a short distance, that the low fare still failed to attract many riders. This relic of the past was finally retired when the South Link Line was fully electrified on Dec. 23, 2020. A wave of nostalgia surrounded the termination of the Ordinary Train service, as these train carriages had been in use for decades

Lori Sepich smoked for years and sometimes skipped taking her blood pressure medicine. But she never thought she’d have a heart attack. The possibility “just wasn’t registering with me,” said the 64-year-old from Memphis, Tennessee, who suffered two of them 13 years apart. She’s far from alone. More than 60 million women in the US live with cardiovascular disease, which includes heart disease as well as stroke, heart failure and atrial fibrillation. And despite the myth that heart attacks mostly strike men, women are vulnerable too. Overall in the US, 1 in 5 women dies of cardiovascular disease each year, 37,000 of them