Europe’s aging power grid and lack of energy storage capacity would require trillions of dollars in investments to cope with rising green energy output, increasing electricity demand and to avoid blackouts.

On Monday last week, Spain and Portugal lost power in their worst blackout. Authorities are investigating the cause, but whatever the findings, analysts and industry representatives say infrastructure investment is essential.

“The blackout was a wake-up call. It showed that the need to modernize and reinforce Europe’s electricity grid is urgent and unavoidable,” said Kristina Ruby, secretary general at Eurelectric, Europe’s electricity industry association.

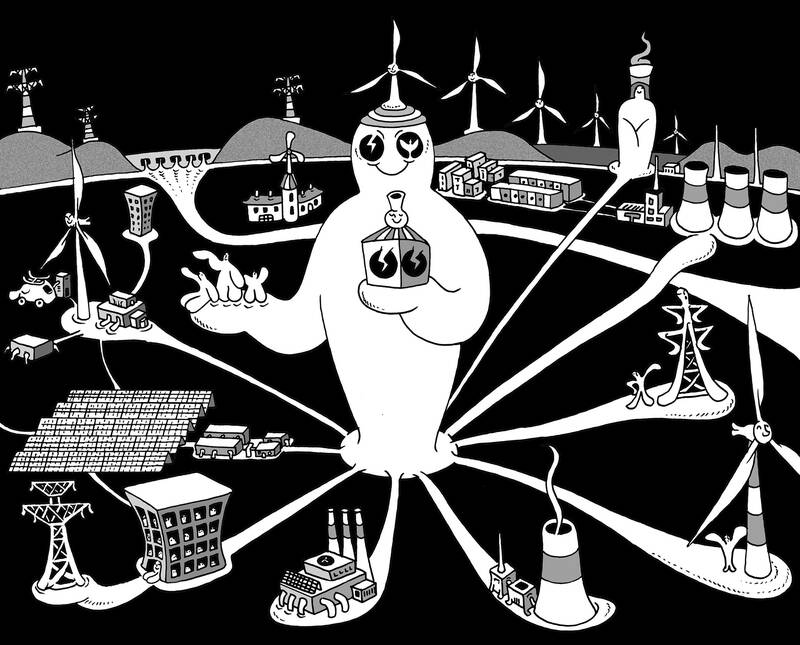

Illustration: Mountain People

The EU’s power grid mostly dates back to the last century and half the lines are more than 40 years old. Rising low-carbon energy production and booming demand from data centers and electric vehicles require an overhaul of the grids that also need digital protection to withstand cyber attacks.

While global investment in renewables has nearly doubled since 2010, investment in grids has barely changed at about US$300 billion per year. The amount needs to double by 2030 to more than US$600 billion per year to cover the necessary overhauls, according to the International Energy Agency.

Spain has asked its own investigators and EU regulators to look into the outage.

While the underlying issues have yet to become clear, grid operator Red Electrica said two separate incidents had triggered the massive power loss.

It follows an acceleration in renewable energy use, especially in Spain, after Russia’s invasion of Ukraine in February 2022, and the resulting disruption of oil and gas supplies focused EU efforts on reducing dependence on fossil fuel.

The share of renewables rose to 47 percent in the EU’s power mix last year from 34 percent in 2019, while fossil fuels dropped to 29 percent from 39 percent, data from think tank Ember showed.

Spain plans to phase out coal and nuclear power. Renewable generation hit a record high at 56 percent of Spain’s power mix last year.

Wind and solar projects are relatively quick to build compared with grids, which can take more than a decade.

Part of the problem is the huge sums and complexity of improving a grid over a large distance.

The European Commission has estimated Europe needs to invest US$2.0 trillion to US$2.3 trillion in grids by 2050.

Last year, European firms invested 80 billion euros (US$90.5 billion) in grids, up from 50 billion euros to 70 billion euros in previous years, analysts at Bruegel said, while adding investments might need to rise to 100 billion euros.

Spain and Portugal’s power systems are among those in Europe that lack connections to other grids that can provide back up. Spain needs more links to France and Morocco, said Jose Luis Dominguez-Garcia from Spain’s energy research center IREC in Catalunya.

Spain has only 5 percent of connections outside the Iberian Peninsula, he added.

As some other countries also lag, the European Commission has a target to increase interconnection to 15 percent by 2030, from a previous goal of 10 percent, meaning each EU member country should be able to import at least 15 percent of its power production capacity from neighboring countries.

Spain would reinforce connections with France, including a new link via the Bay of Biscay that would double the interconnection capacity between the two countries, Red Electrica said on Tuesday.

As solar and wind generation grows, the challenges go beyond upgrading grids to the need for back-up generation.

Solar and wind farms generate direct current power, while traditional gas or nuclear plants generate alternating current.

DC power is converted to AC in inverters to standard 50 hertz frequency for European grids and use in homes and businesses. If power generation drops, the grid requires backup AC power to prevent the frequency from dropping.

In the event frequency drops, automatic safety mechanisms disconnect some generation to prevent overheating and damage to transformers or transmission lines. If too many plants drop off at the same time, the system can experience a blackout.

Before last week’s outage, Spain had suffered power glitches, and industry officials had repeatedly warned of grid instability.

Spain’s energy officials have also said that the country’s plans to shut down all seven of its nuclear reactors by 2035 could put power supply at risk.

Portugal has only two backup plants — a gas and a hydro plant — able to quickly respond if the grid needs more power, Portuguese Prime Minister Luis Montenegro said on Tuesday, adding that the country wants more.

In the UK, a blackout in 2019 cut power to 1 million customers when a lightning strike and a second, unrelated incident lowered the frequency of the grid.

Since then, the country has invested to expand battery storage and had around 5 gigawatts of capacity installed at the end of last year, according to industry association RenewableUK. It can help balance the grid in the same way as power plants.

Europe has 10.8 gigawatts (GW) of battery storage and it would grow to 50GW by 2030 — much less than the required 200GW, according to the European Association for Storage of Energy.

In Ireland, Siemens Energy has built the world’s largest flywheel, which can also operate as power storage and help to stabilize the grid.

The image was oddly quiet. No speeches, no flags, no dramatic announcements — just a Chinese cargo ship cutting through arctic ice and arriving in Britain in October. The Istanbul Bridge completed a journey that once existed only in theory, shaving weeks off traditional shipping routes. On paper, it was a story about efficiency. In strategic terms, it was about timing. Much like politics, arriving early matters. Especially when the route, the rules and the traffic are still undefined. For years, global politics has trained us to watch the loud moments: warships in the Taiwan Strait, sanctions announced at news conferences, leaders trading

Eighty-seven percent of Taiwan’s energy supply this year came from burning fossil fuels, with more than 47 percent of that from gas-fired power generation. The figures attracted international attention since they were in October published in a Reuters report, which highlighted the fragility and structural challenges of Taiwan’s energy sector, accumulated through long-standing policy choices. The nation’s overreliance on natural gas is proving unstable and inadequate. The rising use of natural gas does not project an image of a Taiwan committed to a green energy transition; rather, it seems that Taiwan is attempting to patch up structural gaps in lieu of

The Executive Yuan and the Presidential Office on Monday announced that they would not countersign or promulgate the amendments to the Act Governing the Allocation of Government Revenues and Expenditures (財政收支劃分法) passed by the Legislative Yuan — a first in the nation’s history and the ultimate measure the central government could take to counter what it called an unconstitutional legislation. Since taking office last year, the legislature — dominated by the opposition alliance of the Chinese Nationalist Party (KMT) and Taiwan People’s Party — has passed or proposed a slew of legislation that has stirred controversy and debate, such as extending

Chinese Nationalist Party (KMT) legislators have twice blocked President William Lai’s (賴清德) special defense budget bill in the Procedure Committee, preventing it from entering discussion or review. Meanwhile, KMT Legislator Chen Yu-jen (陳玉珍) proposed amendments that would enable lawmakers to use budgets for their assistants at their own discretion — with no requirement for receipts, staff registers, upper or lower headcount limits, or usage restrictions — prompting protest from legislative assistants. After the new legislature convened in February, the KMT joined forces with the Taiwan People’s Party (TPP) and, leveraging their slim majority, introduced bills that undermine the Constitution, disrupt constitutional