European shares rose on Friday as industrial and financial stocks gained on China-led optimism, but recession worries ahead of a slew of central bank decisions dragged the STOXX 600 index to a weekly loss after a seven-week rally.

The STOXX 600 closed 0.8 percent higher, at 439.13, snapping a five-day losing streak that was largely driven by concerns about an impending global recession due to sharp interest rate increases by global central banks. The index was down 0.94 percent from a week earlier.

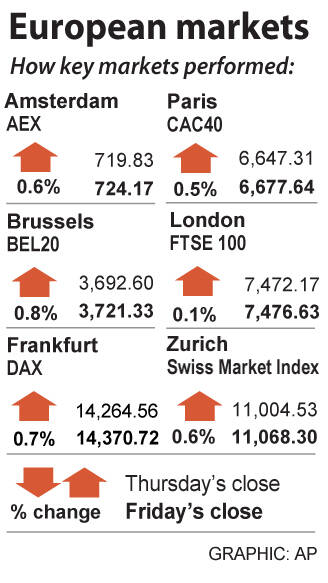

The FTSE 100 on Friday gained 0.06 percent to 7,476.63, but lost 1.05 percent from a week earlier.

Data on Thursday showing a rise in US weekly jobless claims raised hopes that the US Federal Reserve could temper its aggressive stance on interest rate hikes, with China’s easing of its strict COVID-19 prevention measures also aiding sentiment.

The next week would be crucial, with rate decisions due from the Fed, the Bank of England and the European Central Bank (ECB).

The ECB might raise rates by 50 basis points next week, a Reuters poll showed, following two straight 75 basis point increases.

Photo: REUTERS

“It’s uncertainty as to what central banks are likely to do in the new year, not next week, that’s prompting a little bit of caution given that most of the economic data that we’re seeing indicate that we are going to see a bit of a slowdown in economic activity,” CMC Markets chief market analyst Michael Hewson said.

Industrial stocks such as Siemens AG and Schneider Electric SE were among the biggest boosts to the index, while China-exposed stocks such as Prudential PLC rose 3.0 percent.

Lenders snapped their four-day losing streak and advanced 0.9 percent, as eurozone banks are set to repay another 447.5 billion euros (US$471.7 billion) in multiyear loans from the ECB, bringing the total paydown to nearly 800 billion euros in just a few weeks, the ECB said.

Credit Suisse jumped 6.8 percent after the embattled bank on Thursday hailed a “milestone” in its turnaround plan after raising 2.24 billion Swiss francs (US$2.39 billion) as part of a SF4 billion cash call.

Vestas A/S gained 6.4 percent as the Danish wind turbine maker announced new orders and UBS raised its price target.

AI BOOST: Although Taiwan’s reliance on Chinese rare earth elements is limited, it could face indirect impacts from supply issues and price volatility, an economist said DBS Bank Ltd (星展銀行) has sharply raised its forecast for Taiwan’s economic growth this year to 5.6 percent, citing stronger-than-expected exports and investment linked to artificial intelligence (AI), as it said that the current momentum could peak soon. The acceleration of the global AI race has fueled a surge in Taiwan’s AI-related capital spending and exports of information and communications technology (ICT) products, which have been key drivers of growth this year. “We have revised our GDP forecast for Taiwan upward to 5.6 percent from 4 percent, an upgrade that mainly reflects stronger-than-expected AI-related exports and investment in the third

Mercuries Life Insurance Co (三商美邦人壽) shares surged to a seven-month high this week after local media reported that E.Sun Financial Holding Co (玉山金控) had outbid CTBC Financial Holding Co (中信金控) in the financially strained insurer’s ongoing sale process. Shares of the mid-sized life insurer climbed 5.8 percent this week to NT$6.72, extending a nearly 18 percent rally over the past month, as investors bet on the likelihood of an impending takeover. The final round of bidding closed on Thursday, marking a critical step in the 32-year-old insurer’s search for a buyer after years of struggling to meet capital adequacy requirements. Local media reports

TECHNOLOGICAL RIVALRY: The artificial intelligence chip competition among multiple players would likely intensify over the next two years, a Quanta official said Quanta Computer Inc (廣達), which makes servers and laptops on a contract basis, yesterday said its shipments of artificial intelligence (AI) servers powered by Nvidia Corp’s GB300 chips have increased steadily since last month, should surpass those of the GB200 models this quarter. The production of GB300 servers has gone much more smoothly than that of the GB200, with shipments projected to increase sharply next month, Quanta executive vice president Mike Yang (楊麒令) said on the sidelines of a technology forum in Taipei. While orders for GB200 servers gradually decrease, the production transition between the two server models has been

ASE Technology Holding Co (日月光投控), the world’s largest integrated circuit (IC) packaging and testing supplier, yesterday announced a strategic collaboration with Analog Devices Inc (ADI), coupled with the signing of a binding memorandum of understanding. Under the agreement, ASE intends to purchase 100 percent shares of Analog Devices Sdn Bhd and acquire its manufacturing facility in Penang, Malaysia, a press release showed. The ADI Penang facility is located in the prime industrial hub of Bayan Lepas, with an area of over 680,000 square feet, it said. In addition, the two sides intend to enter into a long-term supply agreement for ASE to