China’s rise has been the defining story of the past three decades. No analysis of international economics or politics can ignore it.

However, the conversation has shifted.

Before 2017, it was widely believed that China could become a “responsible stakeholder” in the international institutions that emerged after World War II and survived the Cold War, but now many worry that China is “an illiberal state seeking leadership in a liberal world order,” as former Bank of England deputy governor Paul Tucker puts it in Global Discord.

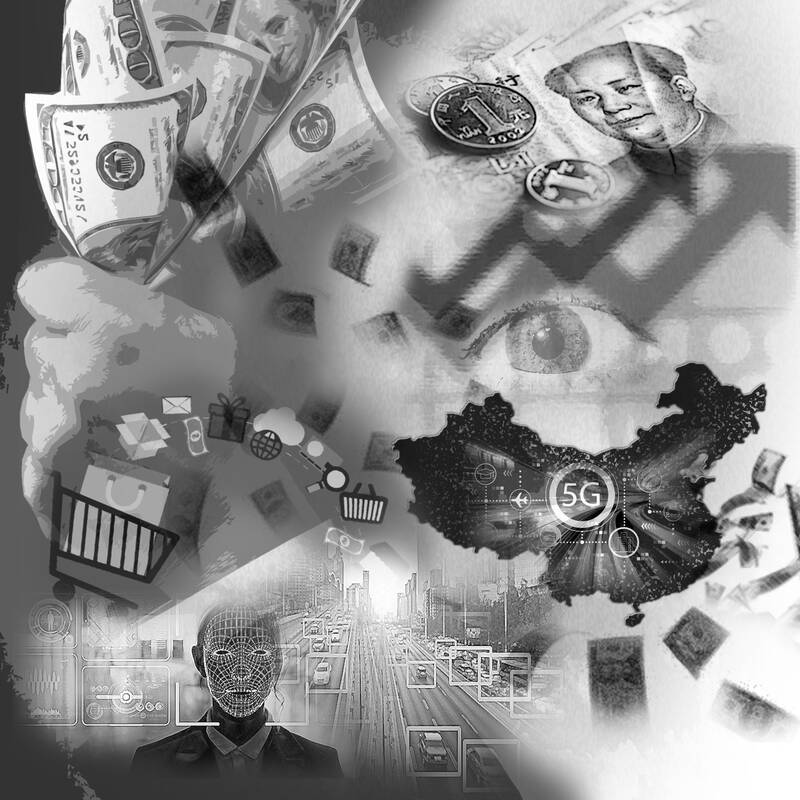

Illustration: Kevin Sheu

The question, then, is how liberal democracies with market economies should deal with such a state when it becomes a systematically important power.

None of the four books reviewed here — Martin Chorzempa’s The Cashless Revolution: China’s Reinvention of Money and the End of America’s Domination of Finance and Technology, PublicAffairs, 2022; Edwin Lai’s (黎麟祥) One Currency, Two Markets: China’s Attempt to Internationalize the Renminbi, Cambridge University Press, 2021; Andrew Small’s The Rupture: China and the Global Race for the Future, Hurst Publishers, 2022; and Tucker’s Global Discord: Values and Power in a Fractured World Order, Princeton University Press, 2022 — provides a convincing answer, but that might be because the China question does not admit of one. Instead, each author offers a clear narrative of China’s transformation from a poor developing country to the main global competitor to the West. Perhaps most important, China has gained a lead in cutting-edge technologies such as telecommunications, fintech and artificial intelligence — all sectors of great strategic importance not only for future economic competitiveness, but also for international and national security.

Understanding China’s advantage in these areas is critical to recognizing why it is no longer on the path to becoming a “responsible stakeholder” in the world economy. China’s leaders simply do not have as strong an incentive as they once did to live with — and within — a US-led system.

CHANGING TIMES

When it comes to China’s long-term strategic trajectory, discrete passing events are not as significant as the execution of the overall plan. That process is necessarily gradual and incremental, following the Chinese adage — popularized in the modern era by former Chinese leader Deng Xiaoping (鄧小平) — counseling leaders to “cross the river by feeling the stones.”

Turning points are not always obvious, and they sometimes become evident only much later.

Consider the year 2016, when China, holding the G20’s rotating presidency, played the role of “responsible stakeholder” at its best. That September, the IMF added the yuan to the basket of currencies underpinning its global reserve asset, special drawing rights (SDRs), putting it in the same group as the US dollar, the euro, the pound sterling and the Japanese yen.

As Small of the German Marshall Fund recounts in The Rupture, then-US president Barack Obama joked at the time that with the launch of the China-Pakistan Economic Corridor, China could perhaps assume responsibility for dealing with a country that has been a longtime source of headaches for Washington.

The intervening years have been messy. When former US president Donald Trump arrived in the White House in 2017, his administration took an aggressive stance against China’s positive trade balance with the US and formally accused it of “currency manipulation” — a charge that was subsequently withdrawn.

However, of course, the bilateral trade balance was not the real issue — as all those who mocked Trump’s economic illiteracy pointed out. Rather, it was that China had long enjoyed asymmetric access to the US and European markets, including the UK, and that the global race for dominance in advanced technologies was heating up.

International integration through trade and financial flows had driven global economic growth for two decades, but the process seemed to be reaching its limits. China was no longer just a major exporter of low-cost, labor-intensive garments and electronics, it had become a competitor in capital-intensive strategic industries.

While Western policymakers could tolerate competition in low-value industries — with some even encouraging this as a way to drive “structural reforms” in advanced economies, an argument that Small and Tucker dissect — sectors higher up the value chain were supposed to be beyond China’s reach.

A powerful illustration of the change was China’s unquestioned global lead in 5G telecommunications technology. As Small shows in painstaking detail, recent battles over who should provide 5G in Europe well encapsulate the global dynamics of China’s progress on the technological frontier. One effect was to divide the West. The US and its European partners had diverging views about the economic and security challenges that Chinese technology posed.

For example, Germany, which relies heavily on trade with China, and the UK, which was preparing for Brexit, were lulled into obliviousness about the risks implied by sourcing their 5G networks from Huawei Technologies Co. The British government, in particular, was adamant that Huawei posed no significant security threat and offered the best value for money, but this put it starkly at odds with the US.

Eventually, the UK reversed its position, owing to what Small describes as “the most significant mobilization of political resources on a China-related issue in Europe that [the US] had ever undertaken.”

LOCKING DOWN

The most recent turning point came with China’s handling of the COVID-19 pandemic. First, Chinese authorities’ attempts to deny and cover up the outbreak derailed the best chance the world had to marshal a coordinated international response. Then came Chinese President Xi Jinping’s (習近平) ill-fated “zero COVID-19” policy, which contributed to higher inflation and far slower economic growth in China, as well as putting China’s leadership further out of sync with the US and Europe.

The pandemic thus left China more isolated than it had been in many years. Since early 2020, it has been shut away from the rest of the world; until this week, all travelers to mainland China were subject to a mandatory 10-day quarantine.

The result, Tucker explains, is “an asymmetric decline in news flowing from east to west” and a collapse in mutual trust.

With low-quality vaccines — and a government that refuses to avail itself of more effective Western vaccines — and a much lower vaccination rate than the US and the EU, China’s efforts to protect its population from the virus have accelerated an inward-looking trend that was already gaining momentum.

For example, compared with the years before 2017, it has become much more difficult for American and European researchers to collaborate with their Chinese colleagues. And, as China has become more isolated internationally, it has become more rigid and authoritarian at home.

Innovative private companies with cutting-edge technologies and the capacity to outcompete state-owned enterprises are now being held back. Most of these upstarts emerged and flourished in the pre-2017 era, when China’s leadership was still grappling with new digital technologies — social media, e-commerce, mobile banking — and their implications for political stability.

Among the best-known success stories are the Chinese technology conglomerates Tencent and Alibaba. Both have come under intense scrutiny from Chinese authorities in the past few years.

NESTED SYSTEMS

In a speech at the Bund Finance Summit on Oct. 24, 2020, Jack Ma (馬雲), then the influential founder of Alibaba and China’s richest person, openly criticized the Chinese political leadership for what he saw as regulatory overreach.

“To make risk-free innovation is to stifle innovation,” he rightly warned.

However, the tone of his speech was problematic and he had clearly misread the political climate under Xi. The space for public debate had narrowed considerably since 2014, when Ma had successfully challenged the monopolistic power of China’s big banks.

Ma paid a heavy price for speaking out. As Chorzempa of the Peterson Institute for International Economics notes in The Cashless Revolution, Ma’s Bund Summit appearance might have been the “costliest speech in history.”

Just days later, the highly anticipated public listing for Alibaba’s financial arm, Ant Group, was suddenly blocked. With a valuation of US$313 billion, it was the largest initial public offering ever planned, but it was not to be. Ant’s top executives were dragged before Chinese regulators, and Ma — whose personal stake was approximately US$27 billion — was not seen or heard from for three months.

These events shocked the world and seriously undermined investors’ perception of China as a safe place to do business. Ant’s market value has since collapsed to about US$70 billion and it remains a private company with little prospect of going public in the short term.

Through a meticulous reconstruction of the events leading up to Ant’s downfall, Chorzempa concludes that China’s regulators were deeply concerned about the power that Tencent and Alibaba had accumulated. Each company’s super-app — which offer a suite of basic services such as messaging, shopping and payments — furnished it with an abundance of personal data and the power that comes with it. By 2013, a mere two years after its launch, Tencent’s WeChat app already had 270 million users.

Moreover, financial innovation had allowed the two companies to offer short-term credit in an extraordinarily convenient fashion, putting them in direct competition with state-controlled banks, especially in Ant’s case , and introducing a potential threat to financial stability.

They had built a new system within the system and when one considers the implications of that achievement, it is not surprising that regulators seized on Ma’s speech as a way to reassert control.

As Chorzempa shows, the success of Alibaba and Tencent followed from their having solved the problem of digital mobile payments. Suddenly, smartphones could be used to pay for goods and services everywhere in large Chinese cities — and this at a time when credit card “tap and pay” was still considered cutting-edge technology in Europe.

As is typical for latecomers, China leapfrogged to the latest technology, skipping an intermediate stage to which the incumbents were still clinging. In 2008, only about 10 percent of payment cards in China were regularly used and foreign customers often had to find the one shop in the neighborhood with a credit card terminal, or they were asked to sign a hand-written Visa slip.

Yet by 2010, Alipay already had 500 million users transacting 2 billion yuan (US$290 million) per day, making it the world’s largest online-payment company — larger than PayPal.

PARTY FIRST

In those years — again, pre-2017 — China offered an ideal environment for fintech. The so-called shadow-banking sector — an unregulated credit channel, often run by the banks themselves — provided a growing market for new financial products. Demand was ripe for savings vehicles with higher returns than those found in the official banking sector, where poorly remunerated savings were channeled into lending at favorable rates to state-owned enterprises.

Keen to access credit, privately owned firms came to appreciate the flexibility offered by new blockchain technologies, which were also used to extend credit to millions of Chinese without credit histories.

Alibaba and Tencent occupied this market well before China’s regulators became too concerned. By Chorzempa’s reckoning, about seven years passed between the introduction of the new financial products and the first regulation.

Meanwhile, Alipay and WeChat Pay were granted new licenses, and barriers to entry in the financial sector were removed. There was no robust protection for personal data, because China’s patchy and inconsistent privacy laws were not clearly applicable to fintech.

For financial reformers like Zhou Xiaochuan (周小川), the governor of the People’s Bank of China from 2002 to 2018, fintech looked like the spark that was needed to overhaul the broader financial sector.

With regulators remaining benignly indifferent, the fintech companies ventured ahead with new technologies. It was all a staggering success. By 2017, China was the world’s largest and most advanced market for digital finance.

Chorzempa wrote that nearly 70 percent of digitally active people in the country were using fintech, compared with only 33 percent in the US. Between them, Alipay and WeChat Pay controlled 90 percent of the market for online payments.

However, China’s fintech boom was also intrinsically vulnerable, because it posed systemic risks to financial stability. Ant alone had more than US$271 billion in outstanding loans to consumers. The collapse of the stock market bubble in June 2015 was the first warning sign.

Eventually, Chinese monetary authorities rushed out new regulations to regain some control over the financial infrastructure from Alibaba and Tencent. In addition to restoring financial stability, this earlier fintech crackdown also curbed powerful business elites and thereby strengthened the central government’s control.

DIGITAL YUAN

A financial system that is responsive to, and aligned with, the state’s policy objectives is the key to explain China’s cashless revolution, but it is also the source of deeper problems in the financial sector, such as the slow pace of reforms and the constrained convertibility of the Chinese currency. It is these limitations that have held back international use of the yuan.

In One Currency, Two Markets, Hong Kong University of Science and Technology’s Lai provides an overview of the yuan’s shortfalls and the policies that have been established in an effort to overcome them. He pays special attention to the policy of yuan internationalization, which has rested on the notion that the yuan can be treated like any other international currency in offshore markets, even while its convertibility is constrained domestically by capital controls.

However, from 2017 onward, offshore yuan markets no longer played their intended role. While the yuan has made notable achievements since 2010, when the policy of internationalization was launched (it is used in about one-quarter of China’s trade and it is the world’s fifth most traded currency, in addition to being part of the IMF’s SDR basket), its turnover remains low relative with Chinese GDP — just 3 percent, compared with 30 percent for the US dollar.

Lai concludes that it is still nowhere close to rivaling the greenback.

Nor does China’s status as a first mover in introducing central bank digital currencies pose any meaningful challenge to the dollar. The digital yuan will have some attractive features — such as rapid, safe payments — that could facilitate its wider use, but it will remain firmly under the centralized control of Chinese monetary authorities. Non-residents will remain reluctant to hold it as a store of value, which is one of the key tests for international money.

As Tucker reminds us, the fundamental features of monetary systems have not really changed since the late 18th century, and the separation of credit allocation decisions from government has always been critical. Without that, there is no assurance of privacy for individuals transacting with one another.

However, unlike cash, which allows for anonymity — for better or worse — digital payments and currencies are fully traceable.

There is thus a clear trade-off between convenience and privacy. As we all know by now, digital services, usually private companies, are constantly gathering user data for the purposes of marketing, product placement or sales to third parties, but China has taken this practice further. Alibaba and Tencent’s super-apps yield an even broader set of personal data, from consumer preferences to credit ratings, and the Chinese government has used it to develop a comprehensive social credit system that effectively determines what opportunities are available to each and every individual.

Because data governance is so critical for China, Chorzempa, Small and Tucker anticipate that the state will assert even greater control over these sectors, stifling innovation in the process. If so, it will be quite difficult for Alibaba and Tencent to grow as international companies (the great aspiration of the pre-2017 era), because they will inevitably be seen not as commercial entities, but as extensions of the Chinese state, like Huawei.

China’s leaders seem fully prepared to accept these costs as the price of breaking free from the US-led order. They might have concluded that even if the digital yuan will not challenge the dollar, fintech innovation and digital currencies will make it easier for non-Chinese to use the yuan in international transactions, and that this will come in handy for countries facing sanctions.

The digital yuan will also help China reduce its dollar dependency in bilateral transactions, allowing it to step out of the international monetary system and into a parallel — albeit shallower — system that it dominates. That will raise many new geopolitical, financial and macroeconomic questions, but one thing is already certain: The international financial and monetary system will become more fragmented, leaving even less scope for policy cooperation and coordination.

Paola Subacchi is a professor of international economics at the University of London’s Queen Mary Global Policy Institute.

Copyright: Project Syndicate

After more than a year of review, the National Security Bureau on Monday said it has completed a sweeping declassification of political archives from the Martial Law period, transferring the full collection to the National Archives Administration under the National Development Council. The move marks another significant step in Taiwan’s long journey toward transitional justice. The newly opened files span the architecture of authoritarian control: internal security and loyalty investigations, intelligence and counterintelligence operations, exit and entry controls, overseas surveillance of Taiwan independence activists, and case materials related to sedition and rebellion charges. For academics of Taiwan’s White Terror era —

On Feb. 7, the New York Times ran a column by Nicholas Kristof (“What if the valedictorians were America’s cool kids?”) that blindly and lavishly praised education in Taiwan and in Asia more broadly. We are used to this kind of Orientalist admiration for what is, at the end of the day, paradoxically very Anglo-centered. They could have praised Europeans for valuing education, too, but one rarely sees an American praising Europe, right? It immediately made me think of something I have observed. If Taiwanese education looks so wonderful through the eyes of the archetypal expat, gazing from an ivory tower, how

China has apparently emerged as one of the clearest and most predictable beneficiaries of US President Donald Trump’s “America First” and “Make America Great Again” approach. Many countries are scrambling to defend their interests and reputation regarding an increasingly unpredictable and self-seeking US. There is a growing consensus among foreign policy pundits that the world has already entered the beginning of the end of Pax Americana, the US-led international order. Consequently, a number of countries are reversing their foreign policy preferences. The result has been an accelerating turn toward China as an alternative economic partner, with Beijing hosting Western leaders, albeit

After 37 US lawmakers wrote to express concern over legislators’ stalling of critical budgets, Legislative Speaker Han Kuo-yu (韓國瑜) pledged to make the Executive Yuan’s proposed NT$1.25 trillion (US$39.7 billion) special defense budget a top priority for legislative review. On Tuesday, it was finally listed on the legislator’s plenary agenda for Friday next week. The special defense budget was proposed by President William Lai’s (賴清德) administration in November last year to enhance the nation’s defense capabilities against external threats from China. However, the legislature, dominated by the opposition Chinese Nationalist Party (KMT) and Taiwan People’s Party (TPP), repeatedly blocked its review. The