The mid-level bureaucrats left China’s richest man waiting as they prepared for a meeting that would send shockwaves across the financial world.

It was Monday morning in Beijing, and Jack Ma (馬雲) had been summoned to a conference room at the China Securities Regulatory Commission just days before he was set to take Ant Group Co public in the biggest stock market debut of all time.

When the bureaucrats finally turned up, they skipped over pleasantries and delivered an ominous message: Ant’s days of relaxed government oversight and minimal capital requirements were over.

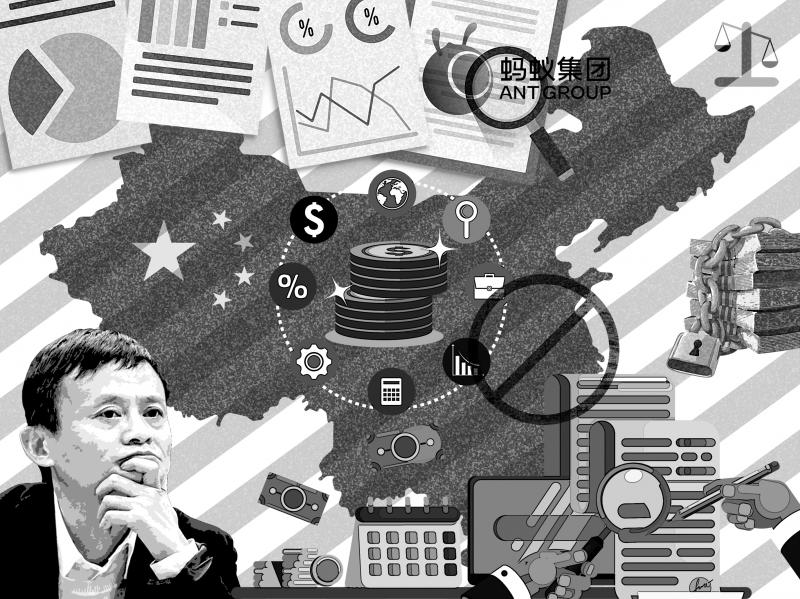

Illustration: Louise Ting

The meeting ended without a discussion of Ant’s initial public offering (IPO), but it was a sign that things might not go as planned.

The subsequent unraveling of the US$35 billion share sale has thrust Ma’s fintech giant into turmoil, offering a stark reminder that even the country’s most celebrated businessman is not immune to the whims of the Chinese Communist Party that has steadily tightened its grip on the world’s second-largest economy under Chinese President Xi Jinping’s (習近平) leadership.

Among the questions that linger as international investors try to make sense of a chaotic 72 hours: Why would China scuttle Ant’s IPO at the last minute after months of meticulous preparation? What does the future hold for one of the country’s most important companies?

Interviews with regulators, bankers and Ant executives offer some answers, although even insiders say that only China’s top leaders can be confident of what happens next. Most of the people who spoke for this story did so on the condition of anonymity to discuss sensitive matters.

Ma’s meeting in Beijing triggered a behind-the-scenes scramble by Ant and its bankers for more clarity from Chinese regulators. While commission officials at the time signaled that they were not aware of any changes to the IPO plans, the regulator’s cryptic social media post later on that day about a “supervisory interview” with Ma set tongues wagging from Hong Kong to New York.

By Tuesday afternoon, the mood had worsened as whispers of a delay began circulating in Shanghai. At around 8pm, the city’s stock exchange called Ant to say that the IPO would be suspended.

When the official statement landed less than an hour later, it cited a “significant change” in the regulatory environment, but offered few additional details on why authorities would scupper the listing two days before shares were expected to start trading.

At a hastily arranged meeting between Ant’s bankers and the commission later that evening, officials pointed to the company’s need for more capital and new licenses to comply with a spate of regulations for financial conglomerates that had begun taking effect on Sunday last week. There was no discussion of how quickly the IPO could be restarted.

An Ant spokesman said that the need for more capital and new licenses was not discussed in the meeting, but declined to provide more details.

One concern among regulators was that the stricter rules might not have been fully disclosed in Ant’s prospectus.

On top of the new financial conglomerate regulations, Beijing on Monday released stringent draft rules for consumer loans that would require Ant to provide at least 30 percent of the funding for loans it underwrites for banks and other financial institutions. Ant currently funds just 2 percent of its loans, with the rest taken up by third parties or packaged as securities.

Several officials said that it was better to stop the listing at the 11th hour than to let it proceed and expose investors to potential losses.

That sentiment was shared by at least one institutional money manager, who said that he had practically begged an Ant executive for an IPO allocation during a meeting at the Mandarin Oriental hotel in Hong Kong. Now that he has a clearer idea of the regulatory risks, he is relieved the share sale was shelved, the manager said.

The commission in a statement on Wednesday said that preventing a “hasty” listing of Ant in a changing regulatory environment was a responsible move for the market and investors.

Still, some China watchers have an alternative theory for why Beijing acted the way it did: It wanted to send a message.

Ma, a former teacher who is widely revered in China, faced an unusual amount of criticism in state media after he slammed the country’s financial rules for stifling innovation at a conference in Shanghai on Oct. 24. His remarks came after Chinese Vice President Wang Qishan (王岐山) — a Xi confidante — called for a balance between innovation and strong regulations to prevent financial risks.

“It appeared that, intentionally or not, Ma was openly defying and criticizing the Chinese government’s approach to financial regulation,” Gavekal China research director Andrew Batson wrote in a report.

The weekend before Ma was summoned to Beijing, China’s Financial Stability and Development Committee led by Chinese Vice Premier Liu He (劉鶴) stressed the need for fintech firms to be regulated.

In one sign that authorities might keep up the pressure on Ant, people familiar with the matter on Wednesday said that regulators plan to discourage banks from using the fintech firm’s online lending platforms.

The directive strikes at the heart of Ant’s commission-based lending model, which generated about 29 billion yuan (US$4.39 billion) of revenue in the first half of this year.

Any suggestion that banks would stop using its platforms is unsubstantiated, Ant said in a response to questions from Bloomberg.

Some investors are also bracing for tougher times at the rest of Ma’s business empire. Shares of Alibaba Group Holding, which owns about one-third of Ant, on Tuesday tumbled more than 8 percent in New York trading for the steepest drop in five years.

The slump cut Ma’s wealth by almost US$3 billion to US$58 billion, dragging him down to No. 2 on the list of richest Chinese behind Tencent Holdings’ Pony Ma (馬化騰).

The IPO debacle has also raised broader concerns about China’s commitment to transparency as it tries to lure international investors.

On Tuesday, confusion over the suspension triggered a flood of calls to Ant’s bankers from baffled money managers.

The sense of whiplash in some cases was stark: Just an hour or two before the suspension was announced, Ant’s investor relations team was still trying to confirm attendance at a post-IPO gala in Hong Kong.

One of the company’s biggest foreign investors predicted that the episode could do lasting damage to confidence in China’s capital markets.

It might also have spillover effects on Hong Kong, whose status as a premier financial hub has already come under question amid increased meddling from Beijing. Nearly one-fifth of the territory’s population had by one estimate signed up to buy Ant shares. Many who had planned on a windfall were instead stuck paying interest expenses on useless margin loans.

“The lack of transparency reminds us that the ‘Chinese way’ remains fraught with issues,” said Fraser Howie, a co-author of the book Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise.

As for Ant itself, it is unlikely that the IPO suspension will deal a fatal blow. The company as of June had 71 billion yuan of cash and equivalents and is one of China’s most systemically important institutions.

The last thing Chinese authorities want is a destabilizing loss of confidence in a business that plays a key role in the nation’s financial plumbing.

The more pertinent risk for Ant is a decline in its breakneck pace of growth and lofty valuation. China’s new regulations might force the company to act more like a traditional lender and less like an asset-light provider of technology services to the financial industry. That will almost certainly mean a lower price-earnings ratio for the stock if it eventually lists.

Also looming is the introduction of digital currency by the Chinese central bank, which threatens to erode Ant’s dominance in payments.

That could have implications for the company’s other businesses as well. Ant’s credit platform, for instance, utilizes its huge trove of payments data to assess the financial strength of borrowers who often lack collateral or formal credit histories.

All of that is bad news for shareholders who propelled Ant’s valuation to US$315 billion — higher than that of JPMorgan Chase & Co. However, it might suit regulators and party leaders who worry that Ma’s creation has grown too big, too fast.

After more than a year of review, the National Security Bureau on Monday said it has completed a sweeping declassification of political archives from the Martial Law period, transferring the full collection to the National Archives Administration under the National Development Council. The move marks another significant step in Taiwan’s long journey toward transitional justice. The newly opened files span the architecture of authoritarian control: internal security and loyalty investigations, intelligence and counterintelligence operations, exit and entry controls, overseas surveillance of Taiwan independence activists, and case materials related to sedition and rebellion charges. For academics of Taiwan’s White Terror era —

The Chinese Communist Party (CCP) has long been expansionist and contemptuous of international law. Under Chinese President Xi Jinping (習近平), the CCP regime has become more despotic, coercive and punitive. As part of its strategy to annex Taiwan, Beijing has sought to erase the island democracy’s international identity by bribing countries to sever diplomatic ties with Taipei. One by one, China has peeled away Taiwan’s remaining diplomatic partners, leaving just 12 countries (mostly small developing states) and the Vatican recognizing Taiwan as a sovereign nation. Taiwan’s formal international space has shrunk dramatically. Yet even as Beijing has scored diplomatic successes, its overreach

On Feb. 7, the New York Times ran a column by Nicholas Kristof (“What if the valedictorians were America’s cool kids?”) that blindly and lavishly praised education in Taiwan and in Asia more broadly. We are used to this kind of Orientalist admiration for what is, at the end of the day, paradoxically very Anglo-centered. They could have praised Europeans for valuing education, too, but one rarely sees an American praising Europe, right? It immediately made me think of something I have observed. If Taiwanese education looks so wonderful through the eyes of the archetypal expat, gazing from an ivory tower, how

After 37 US lawmakers wrote to express concern over legislators’ stalling of critical budgets, Legislative Speaker Han Kuo-yu (韓國瑜) pledged to make the Executive Yuan’s proposed NT$1.25 trillion (US$39.7 billion) special defense budget a top priority for legislative review. On Tuesday, it was finally listed on the legislator’s plenary agenda for Friday next week. The special defense budget was proposed by President William Lai’s (賴清德) administration in November last year to enhance the nation’s defense capabilities against external threats from China. However, the legislature, dominated by the opposition Chinese Nationalist Party (KMT) and Taiwan People’s Party (TPP), repeatedly blocked its review. The