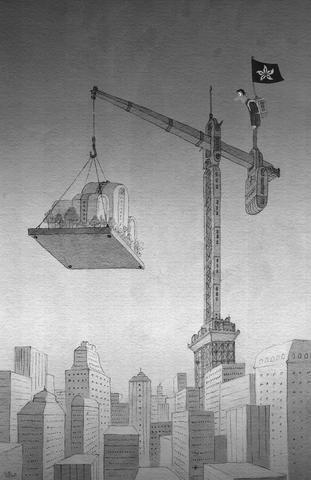

Ten years after its return to Chinese rule, Hong Kong ranks again among the world's most expensive cities to live in after a traumatic rollercoaster ride that has left many home owners still feeling the pain.

Rebecca Leung's tiny 46m2 flat in the busy but grimy North Point area of Hong Kong Island cost the mother of two an exorbitant HK$2 million (US$256,000) at the height of the property boom in 1996.

Today it is worth just 60 percent of that and Leung, 56, can neither keep up the mortgage payments nor afford to sell at such a loss.

She is just one of the city's 6,700 homeowners still heavily in debt as their property's value tumbled when the real estate bubble burst following the 1997-1998 Asian financial crisis.

Then came the dotcom boom and bust, and finally the 2003 outbreak of SARS, shattering consumer confidence as property prices collapsed about 70 percent from their peak.

"I wanted our own home because I thought I wouldn't have to worry about living if I get older because I would still have my flat," Leung said.

"I never imagined to be like this now. For a long time, property prices were rising. I bought it because I saw it as a safe investment and expected the value to go up, not down," she said.

During the mid-1990s boom, property was believed to be a sure-fire bet for a quick and reliable profit in the then British colony, which boasted some of the most expensive houses anywhere in the world.

"A lot of people would buy a property and sell a month later and still could make 10 to 20 percent profit," said Jason Ng (

People often bought several properties, hoping to trade them on quickly, but when the Asian crisis hit, the market collapsed, leaving them saddled with expensive debt on homes whose prices kept on falling, Ng said.

At its worst in 2003, one in five mortgagees was in a negative equity position, a term used to describe people with properties worth less than their mortgages and one virtually unheard of before the financial turmoil.

The impact was felt everywhere, for as the property market goes, so does Hong Kong, with land sales an important revenue source for the government and a key barometer of the territory's financial well-being.

The turning point came in early 2003, although it was initially masked by the SARS outbreak, which traumatized the city and seemed to point to even worse to come.

Instead, helped in no small part by the emergence of China as the world's manufacturing dynamo, money began flowing through Hong Kong again, drawing in bankers and businessmen anxious to get their share of the mainland growth story.

As demand grew, confidence returned, bringing with it some of the speculative exuberance of the mid-1990s to the point where last year a luxury residential site on the world-famous Peak fetched a record per-square-meter price of HK$454,194.

But if the luxury end has done best, it has still not yet fully recovered to pre-1997 levels, with a recent research report by CB Richard Ellis showing average prices still 23 percent below the 1997 high.

Property agent Centaline says Hong Kong's overall housing market plunged from an all-time high of 100 points in July 1997 to a low of 31.34 points in May 2003 and only managed to rise to 55.20 last month.

Wong Leung-sing (黃良昇), associate research director at Centaline, said on fundamentals of supply and demand the market should return to 1997 levels, but buyers have been too hurt by the downturn to take too many risks.

"A lot of people have been scarred by the Asian financial crisis and SARS; it was like a nightmare to them. Hong Kong's fundamentals are very good but people are too worried to buy," Wong said.

Others say Hong Kong's now strong economic recovery, a record-breaking performance on the stock market and plenty of cash should bode well.

"The stock market keeps attracting fund inflows, Hong Kong and China's economic prospects are very good, the number of people in negative equity is getting smaller," Ng said.

For the luxury market, Rick Santos, managing director of CB Richard Ellis, is optimistic, partly because of an influx of mainland Chinese buyers.

"There are a lot of very wealthy individuals here. Some of them are buying their homes with a lot of cash. They belong to the super-wealthy class," he said.

"The economy is growing, employee incomes are on the rise, the stock market is performing well. Only properties have lagged behind, but there's plenty of room for upside, so the future is very good," Wong said.

"I don't know when we will return to the 1997 level. I predict it will be very quick and when it does, it will definitely surpass it," he said.

Speaking at the Copenhagen Democracy Summit on May 13, former president Tsai Ing-wen (蔡英文) said that democracies must remain united and that “Taiwan’s security is essential to regional stability and to defending democratic values amid mounting authoritarianism.” Earlier that day, Tsai had met with a group of Danish parliamentarians led by Danish Parliament Speaker Pia Kjaersgaard, who has visited Taiwan many times, most recently in November last year, when she met with President William Lai (賴清德) at the Presidential Office. Kjaersgaard had told Lai: “I can assure you that ... you can count on us. You can count on our support

Denmark has consistently defended Greenland in light of US President Donald Trump’s interests and has provided unwavering support to Ukraine during its war with Russia. Denmark can be proud of its clear support for peoples’ democratic right to determine their own future. However, this democratic ideal completely falls apart when it comes to Taiwan — and it raises important questions about Denmark’s commitment to supporting democracies. Taiwan lives under daily military threats from China, which seeks to take over Taiwan, by force if necessary — an annexation that only a very small minority in Taiwan supports. Denmark has given China a

Many local news media over the past week have reported on Internet personality Holger Chen’s (陳之漢) first visit to China between Tuesday last week and yesterday, as remarks he made during a live stream have sparked wide discussions and strong criticism across the Taiwan Strait. Chen, better known as Kuan Chang (館長), is a former gang member turned fitness celebrity and businessman. He is known for his live streams, which are full of foul-mouthed and hypermasculine commentary. He had previously spoken out against the Chinese Communist Party (CCP) and criticized Taiwanese who “enjoy the freedom in Taiwan, but want China’s money”

Last month, two major diplomatic events unfolded in Southeast Asia that suggested subtle shifts in the region’s strategic landscape. The 46th ASEAN Summit and the inaugural ASEAN-Gulf-Cooperation Council (GCC)-China Trilateral Summit in Kuala Lumpur coincided with French President Emmanuel Macron’s high-profile visits to Vietnam, Indonesia and Singapore. Together, they highlighted ASEAN’s maturing global posture, deepening regional integration and China’s intensifying efforts to recalibrate its economic diplomacy amid uncertainties posed by the US. The ASEAN summit took place amid rising protectionist policies from the US, notably sweeping tariffs on goods from Cambodia, Laos and Vietnam, with duties as high as 49 percent.