Wistron Corp (緯創) yesterday said it is highly optimistic about its artificial intelligence (AI) server business this year, as widening AI applications boost demand for servers that utilize graphics processing units (GPUs) and application-specific integrated circuits (ASICs).

The company expects last year’s robust growth momentum, with revenue posting triple-digit percentage growth, to carry over into this year, Wistron president Jeff Lin (林建勳) said.

Wistron is “very positive” about revenue growth from AI servers, as it is well-positioned to benefit from its major clients’ rapid expansion, Lin said.

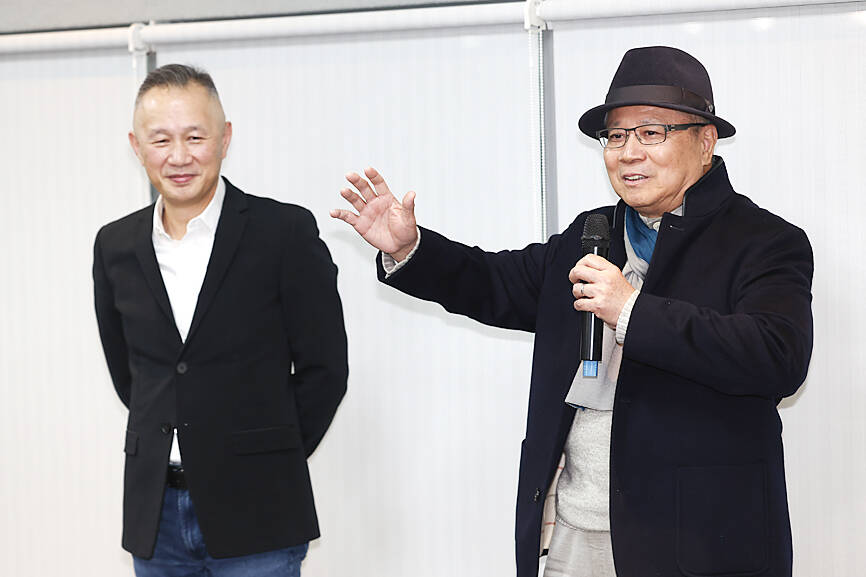

Photo: CNA

The company counts Nvidia Corp, Dell Technologies Inc and Advanced Micro Devices Inc (AMD) as its main AI server clients.

Asked about reports that Nvidia might start selling fully integrated Level 10 Vera Rubin server systems — pre-installed with components such as Vera CPUs, Rubin GPUs, cooling systems and various interfaces — and how it might affect profitability, Lin said that Wistron does not expect gross margin to drop sharply to 3 or 4 percent as it did before as the complexity of assembling AI servers increases.

In terms of capital expenditure, Taiwan would remain the group’s primary investment base, drawing more than half of its planned spending to support customers’ expansion in the nation, he said.

In the US, Wistron’s new Texas plant is expected to enter mass production in the first half of this year, he said.

The newly added Texas facility leverages faster access to power and proximity to the market, focusing on later-stage assembly, testing and delivery to serve North America’s AI server market and improve overall delivery efficiency, he said.

Over the long term, Wistron is considering increasing its US capacity allocation to cope with rising customer demand, he said.

Meanwhile, its networking business is ramping up, with shipments expected to grow 10 times from last year, the company said.

The networking business would be another growth driver, with the company mainly supplying major North American networking companies, whose products are used in cloud service providers’ data centers, Lin said.

As for notebook computers, Wistron was cautious, as tightening memorychip supply and surging prices could push up end-product costs and dampen consumers’ willingness to upgrade, creating uncertainty for overall sales this year, he said.

Nonetheless, the impact would be less severe on Wistron compared with its peers, as it focuses on mid-to-high-end commercial models, which are less price sensitive than entry models, Lin said.

South Korea’s equity benchmark yesterday crossed a new milestone just a month after surpassing the once-unthinkable 5,000 mark as surging global memory demand powers the country’s biggest chipmakers. The KOSPI advanced as much as 2.6 percent to a record 6,123, with Samsung Electronics Co and SK Hynix Inc each gaining more than 2 percent. With the benchmark now up 45 percent this year, South Korea’s stock market capitalization has also moved past France’s, following last month’s overtaking of Germany’s. Long overlooked by foreign funds, despite being undervalued, South Korean stocks have now emerged as clear winners in the global market. The so-called “artificial intelligence

CONFUSION: Taiwan, Japan and other big exporters are cautiously monitoring the situation, while analysts said more Trump responses ate likely after his loss in court US trading partners in Asia started weighing fresh uncertainties yesterday after President Donald Trump vowed to impose a new tariff on imports, hours after the Supreme Court struck down many of the sweeping levies he used to launch a global trade war. The court’s ruling invalidated a number of tariffs that the Trump administration had imposed on Asian export powerhouses from China and South Korea to Japan and Taiwan, the world’s largest chip maker and a key player in tech supply chains. Within hours, Trump said he would impose a new 10 percent duty on US imports from all countries starting on

Chinese artificial intelligence (AI) start-up DeepSeek’s (深度求索) latest AI model, set to be released as soon as next week, was trained on Nvidia Corp’s most advanced AI chip, the Blackwell, a senior official of US President Donald Trump’s administration said on Monday, in what could represent a violation of US export controls. The US believes DeepSeek will remove the technical indicators that might reveal its use of American AI chips, the official said, adding that the Blackwells are likely clustered at its data center in Inner Mongolia, an autonomous region of China. The person declined to say how the US government received

Like many of us who are mindful of our plastic consumption, Beth Gardiner would take her own bags to the supermarket and be annoyed whenever she forgot to do so. Out without her refillable bottle, she would avoid buying bottled water. “Here I am, in my own little life, worrying about that and trying to use less plastic,” she says. Then she read an article in this newspaper, just over eight years ago, and discovered that fossil fuel companies had plowed more than US$180 billion into plastic plants in the US since 2010. “It was a kick in the teeth,” Gardiner