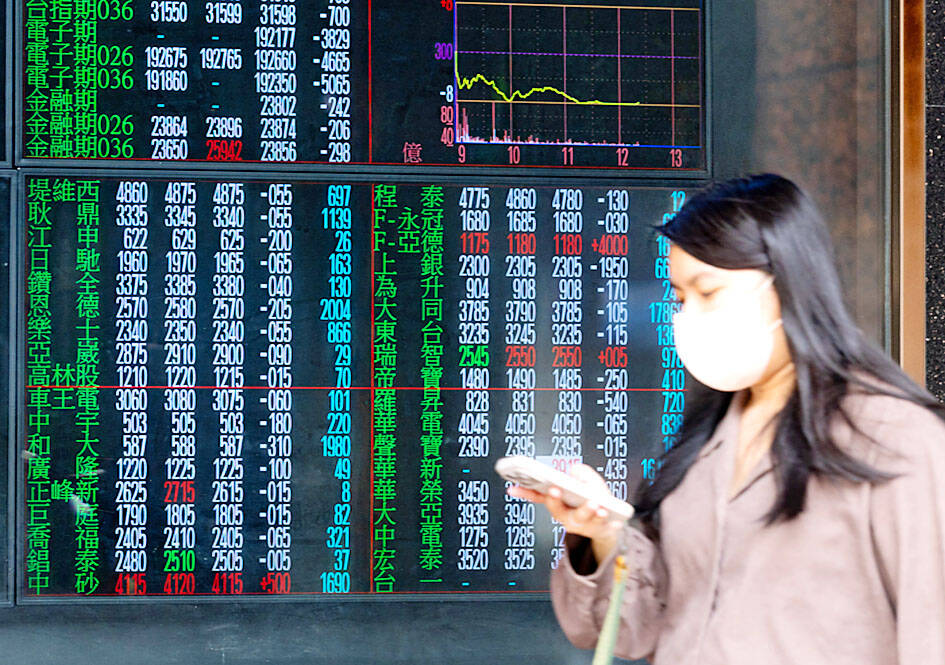

The TAIEX plunged 1.37 percent yesterday with selling sparked by heavy tech losses in the US at the end of last week amid concerns that US Federal Reserve chair nominee Kevin Warsh could adopt a more hawkish monetary stance, dealers said.

The TAIEX ended down 439.72 points to 31,624.03 with turnover of NT$740.40 billion (US$23.4 billion).

“The nomination of Warsh has raised fears that the Fed will downsize its balance sheet by withdrawing funds from the market, which caused not only the stock markets, but also gold and silver prices to plunge,” MasterLink Securities Corp (元富證券) analyst Tom Tang (湯忠謙) said.

Photo: CNA

“Many major local market players simply seized the US tech losses as a cause to pocket their recent significant gains ahead of the Lunar New Year holiday,” Tang said, citing a 0.94 percent fall on the tech-heavy NASDAQ index and a 3.87 percent decline on the Philadelphia Semiconductor Index.

Smartphone IC designer

MediaTek Inc (聯發科) slid 3.12 percent to close at NT$1,705.00, and memory chip suppliers Nanya Technology Corp (南亞科技) and Winbond Electronics Corp (華邦電子) tumbled 10 percent, the maximum daily amount, to end at NT$294.00 and NT$116.00, respectively.

“Fortunately, Taiwan Semiconductor Manufacturing Co (TSMC, 台積電) benefited from late session bargain hunting to recoup part of the TAIEX’s losses,” Tang said.

TSMC, which accounts for more than 40 percent of market value, dropped 0.56 percent to close at NT$1,765.00, off a low of NT$1,745.00.

Elsewhere in the tech sector, artificial intelligence server maker and iPhone assembler Hon Hai Precision Industry Co (鴻海精密) lost 2.72 percent to close at NT$214.50, while cooling solutions provider Asia Vital Components Co (奇鋐科技) bucked the downturn, rising 2.05 percent to end at NT$1,490.00.

In the legacy economy sector, Formosa Plastics Corp (台灣塑膠) lost 6.34 percent to close at NT$44.30, and Nan Ya Plastics Corp (南亞塑膠) fell 6.98 percent to end at NT$70.60. Shihlin Electric & Engineering Corp (士林電機) shed 5.68 percent to close at NT$216.00, and Fortune Electric Co (華城電機) slid 2.89 percent to end at NT$942.00.

Shares in China Steel Corp (中鋼), the largest steel maker in Taiwan, rose 1.69 percent to close at NT$21.10 after it turned a profit in December, and Chun Yuan Steel Industry Co (春源鋼鐵) added 1.62 percent to end at NT$21.90.

In the financial sector, which lost 0.77 percent, Fubon Financial Holding Co (富邦金控) dropped 0.44 percent to close at NT$90.50, and Cathay Financial Holding Co (國泰金控) ended down 1.46 percent at NT$74.50.

“Judging from today’s movement, the TAIEX seemed to have technical support ahead of the 20-day moving average of 31,300 points for now,” Tang said.

Foreign institutional investors sold a net NT$48.12 billion of shares on the main board yesterday, the Taiwan Stock Exchange said.

In Italy’s storied gold-making hubs, jewelers are reworking their designs to trim gold content as they race to blunt the effect of record prices and appeal to shoppers watching their budgets. Gold prices hit a record high on Thursday, surging near US$5,600 an ounce, more than double a year ago as geopolitical concerns and jitters over trade pushed investors toward the safe-haven asset. The rally is putting undue pressure on small artisans as they face mounting demands from customers, including international brands, to produce cheaper items, from signature pieces to wedding rings, according to interviews with four independent jewelers in Italy’s main

Macronix International Co (旺宏), the world’s biggest NOR flash memory supplier, yesterday said it would spend NT$22 billion (US$699.1 million) on capacity expansion this year to increase its production of mid-to-low-density memory chips as the world’s major memorychip suppliers are phasing out the market. The company said its planned capital expenditures are about 11 times higher than the NT$1.8 billion it spent on new facilities and equipment last year. A majority of this year’s outlay would be allocated to step up capacity of multi-level cell (MLC) NAND flash memory chips, which are used in embedded multimedia cards (eMMC), a managed

Japanese Prime Minister Sanae Takaichi has talked up the benefits of a weaker yen in a campaign speech, adopting a tone at odds with her finance ministry, which has refused to rule out any options to counter excessive foreign exchange volatility. Takaichi later softened her stance, saying she did not have a preference for the yen’s direction. “People say the weak yen is bad right now, but for export industries, it’s a major opportunity,” Takaichi said on Saturday at a rally for Liberal Democratic Party candidate Daishiro Yamagiwa in Kanagawa Prefecture ahead of a snap election on Sunday. “Whether it’s selling food or

In the wake of strong global demand for AI applications, Taiwan’s export-oriented economy accelerated with the composite index of economic indicators flashing the first “red” light in December for one year, indicating the economy is in booming mode, the National Development Council (NDC) said yesterday. Moreover, the index of leading indicators, which gauges the potential state of the economy over the next six months, also moved higher in December amid growing optimism over the outlook, the NDC said. In December, the index of economic indicators rose one point from a month earlier to 38, at the lower end of the “red” light.