The world’s largest tech firms show no signs of easing up on artificial intelligence (AI) spending, a record wave that’s propelling hardware providers like Samsung Electronics Co and SK Hynix Inc. That is even as doubts persist about the staying power of AI demand to justify all that capital.

Meta Platforms Inc on Wednesday revealed ambitions to spend as much as US$135 billion this year — one of the biggest planned outlays of the business sphere. Its suppliers have responded in kind: Yesterday, SK Hynix said it plans a “considerable increase” in capital expenditure, and Samsung said it is ratcheting up spending on its memory production capacity.

Meta, Microsoft and fellow hyperscalers such as Amazon.com Inc and Alphabet Inc, are driving a wave of global spending on chips, servers and computers that’s firing up hardware suppliers around the world, particularly in Asia. A procession of industry linchpins’ results this week further underscored how voracious the appetite for AI hardware has grown — and how that’s likely to extend well into this year.

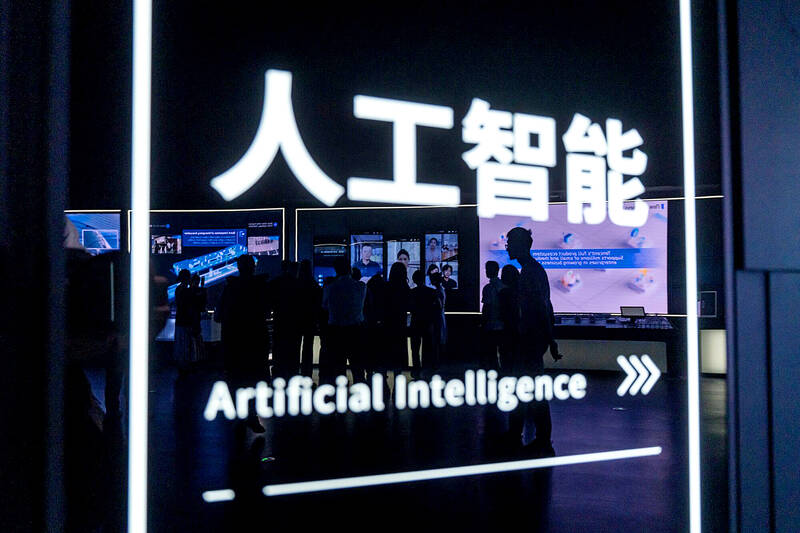

Photo: Qilai Shen, Bloomberg

Ratcheting spending by hyperscalers reflects growing use cases for AI, CLSA Securities Korea Ltd research head Sanjeev Rana said, adding that “the companies are spending real money on real stuff.”

“We are in unchartered territory in terms of valuations, share prices, the demand cycle,” he said. “Everything is unprecedented.”

At the same time, that enormous demand is worsening a global chip demand-supply imbalance that threatens to disrupt industries from smartphones and electronics to car-making.

While the appetite for Nvidia and Advanced Micro Devices Inc accelerators needed to develop and operate AI has long outstripped supply, investors are growing increasingly concerned about a similar deficit in more basic memory.

Memory supply cannot keep pace with demand, SK Hynix’s DRAM marketing head Park Joon-deok said on a conference call yesterday. “Most customers are struggling to secure memory volumes and are persistently demanding increased supply.”

The availability of semiconductors will be a big bottleneck to growth for companies including Tesla Inc, and may necessitate building a Tesla TeraFab — a factory that can make logic and memory chips and provide packaging, chief executive officer Elon Musk said in a recent podcast with X Prize Foundation founder Peter Diamandis.

“We’re going to hit a chip wall if we don’t do the fab,” Musk said. “We’ve got two choices: hit the chip wall or make a fab.”

Tesla will spend US$20 billion this year on pursuits including AI, self-driving vehicles and robotics and plow another US$2 billion into Musk’s xAI start-up.

Memory manufacturers are reallocating production lines toward lucrative high-bandwidth memory (HBM) to satisfy the needs of AI data centers. Because HBM requires about three times the wafer capacity of standard DRAM for the same amount of memory, this shift has reduced supply for the consumer electronics industry. The resulting shortage is threatening double-digit price hikes for PC makers and smaller electronics companies.

Even while companies are spending hundreds of billions of dollars on data centers, concerns about the strength of end-demand for AI persist, however. Microsoft’s capital expenditure grew a larger-than-anticipated 66 percent in the quarter, but its Azure cloud-computing unit posted a 38 percent revenue gain — one percentage point slower than the prior three months.

On the other hand, Meta chief Mark Zuckerberg talked about “a major AI acceleration” that’s been brewing within the tech industry for over a year. “I expect our first models will be good, but more importantly, we’ll show the rapid trajectory that we’re on,” he said on Wednesday’s earnings call.

In Asia, attention is on the race for leadership in next-generation HBM4, which is set to be integrated with Nvidia’s upcoming flagship Rubin processors. Samsung plans to start shipments of its next-generation HBM4 next month — a key step in its bid to catch up with SK Hynix in the lucrative segment. Samsung is close to obtaining certification from Nvidia for the latest version of its AI memory chip.

NEW IDENTITY: Known for its software, India has expanded into hardware, with its semiconductor industry growing from US$38bn in 2023 to US$45bn to US$50bn India on Saturday inaugurated its first semiconductor assembly and test facility, a milestone in the government’s push to reduce dependence on foreign chipmakers and stake a claim in a sector dominated by China. Indian Prime Minister Narendra Modi opened US firm Micron Technology Inc’s semiconductor assembly, test and packaging unit in his home state of Gujarat, hailing the “dawn of a new era” for India’s technology ambitions. “When young Indians look back in the future, they will see this decade as the turning point in our tech future,” Modi told the event, which was broadcast on his YouTube channel. The plant would convert

‘SEISMIC SHIFT’: The researcher forecast there would be about 1.1 billion mobile shipments this year, down from 1.26 billion the prior year and erasing years of gains The global smartphone market is expected to contract 12.9 percent this year due to the unprecedented memorychip shortage, marking “a crisis like no other,” researcher International Data Corp (IDC) said. The new forecast, a dramatic revision down from earlier estimates, gives the latest accounting of the ongoing memory crunch that is affecting every corner of the electronics industry. The demand for advanced memory to power artificial intelligence (AI) tasks has drained global supply until well into next year and jeopardizes the business model of many smartphone makers. IDC forecast about 1.1 billion mobile shipments this year, down from 1.26 billion the prior

People stand in a Pokemon store in Tokyo on Thursday. One of the world highest-grossing franchises is celebrated its 30th anniversary yesterday.

Zimbabwe’s ban on raw lithium exports is forcing Chinese miners to rethink their strategy, speeding up plans to process the metal locally instead of shipping it to China’s vast rechargeable battery industry. The country is Africa’s largest lithium producer and has one of the world’s largest reserves, according to the US Geological Survey (USGS). Zimbabwe already banned the export of lithium ore in 2022 and last year announced it would halt exports of lithium concentrates from January next year. However, on Wednesday it imposed the ban with immediate effect, leaving unclear what the lithium mining sector would do in the